Intelligent Multi-Strategy Currency Factor

For institutional investors

As an independent currency specialist, Mesirow Currency Management has been delivering innovative, customized currency solutions to institutional clients globally since 1990.1 Being a private, employee owned firm, Mesirow is free from many conflicts of interest associated with bank-affiliated organizations or publicly held firms and is fully aligned with the interests of its clients.

intelligent multi-strategy currency factor

- Strategy commenced trading January 2000

- Based on well established economic theories for trading currencies

- Investment style: Multi-strategy, Systematic, Monthly Trading

- Region: G10

monthly performance data (%)

(Hypothetical Returns, January 2000 – November 2020 | Live Returns, December 2020 – January 2026)

| MTD | YTD | 5-Year (pa)* | Since January 2000 (pa)* | |

| Gross of Fees | -0.41 | -0.41 | -0.03 | 3.11 |

| Net of Fees | -0.42 | -0.42 | -0.23 | 2.91 |

| Source: Mesirow | *Annualized numbers | Please see PDF below for more performance statistics. | ||||

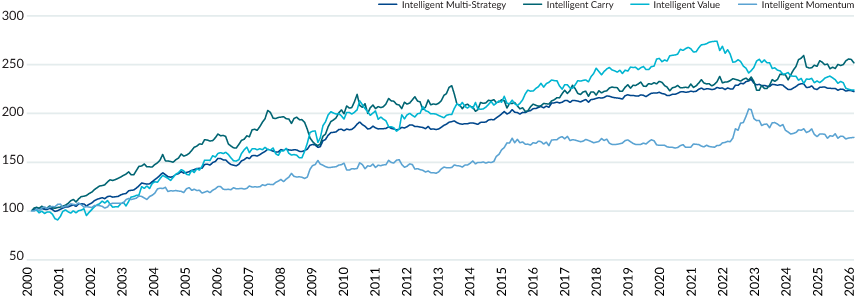

NET ASSET VALUE: GROSS PERFORMANCE OF THE INTELLIGENT MULTI-STRATEGY CURRENCY FACTOR AND THE SUB-COMPONENTS

(Hypothetical Returns, January 2000 – November 2020 |

Live Returns, December 2020 – January 2026)

Source: Mesirow

Source: MCM and Bloomberg. Mesirow Intelligent Currency Factors returns are generated with the benefit of hindsight. Performance prior to December 2020 for the Mesirow Intelligent Currency Factors represents simulated trading using backfilled data and does not represent trading of an actual client account. Past performance is not necessarily indicative of future results. Actual results may materially differ from those shown throughout this presentation. Please refer to the disclaimer page at the end of this paper for important additional information. Net returns are calculated using an implied fee of 0.5% pa. | The information contained herein is intended for institutional clients, Qualified Eligible Persons, Eligible Contract Participants, or the equivalent classification in the recipient’s jurisdiction, and is for informational purposes only. Nothing contained herein constitutes an offer to sell an interest in any Mesirow investment vehicle. It should not be assumed that any trading strategy incorporated herein will be profitable or will equal past performance. | 1. Track record for Currency Risk Management Overlay strategies prior to May 2004, the date that the Currency Risk Management team joined Mesirow, occurred at prior firms. Track record for Currency Alpha and Macro strategies prior to October 1, 2018, the date that the Currency Alpha and Macro Strategies team joined Mesirow, occurred at prior firms. | Past performance is not an indication of future results. Actual results may be materially different from the results achieved historically. | Nothing herein is meant to be taken as a recommendation to buy or sell a particular asset or invest in a particular strategy.