Risk Management Overlays: Active

Mesirow Currency Management provides investors a customized solution to manage unrewarded currency risk in their international portfolios.

For institutional investors

As an independent currency specialist, Mesirow Currency Management (MCM) has been delivering innovative, customized currency solutions to institutional clients globally since 1990.1 Being a private, employee owned firm, Mesirow is free from many conflicts of interest associated with bank-affiliated organizations or publicly held firms and is fully aligned with the interests of its clients.

Active risk overlay

Dynamic active hedging has been a custom solution offered to our institutional clients since 1990.1 Our diverse, quantitative model suite operates over various market regimes and across multiple time horizons.

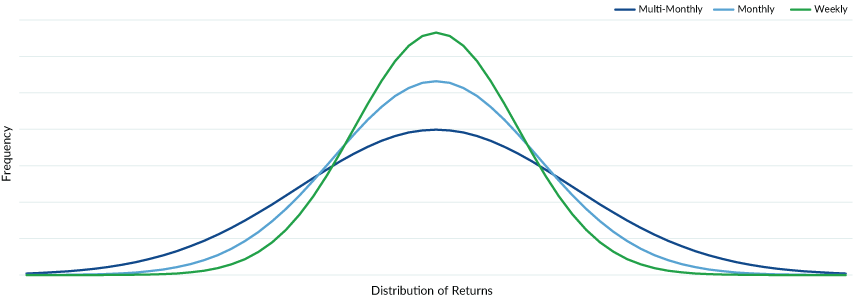

Currency movements are driven by the impact of information as it enters the market over various time horizons (i.e. weekly, monthly, multi-monthly). Our adaptive process consumes data on a daily basis and, along with risk oversight, measures the effect of various market drivers over short and long-term timeframes.

Distribution of currency returns over various timeframes

The above is for illustrative purposes only.

Why consider?

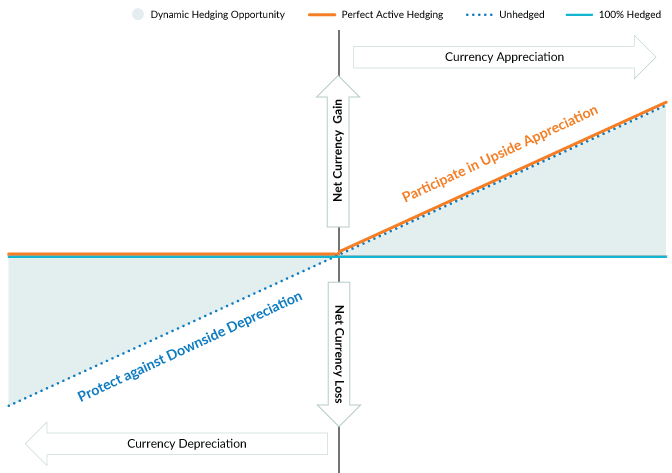

Currency markets demonstrate meaningful volatility in a portfolio and provide opportunities for currency managers to add value through active trading. MCM specializes in single currency and multi-currency portfolios and begins by managing currency risk already present in a client portfolio. Our systematic process responds to changing market environments and adjusts positions accordingly to reduce portfolio volatility and capitalize on directional opportunities associated with currency price movements.

Source: Mesirow. Past performance is not necessarily indicative of future results; actual outcomes may materially differ.

Strategic partnership

Strategic partnership

As a pure agent, our business is aligned with clients’ interests to form long-term strategic partnerships. Rather than focusing on providing standardized products, MCM develops custom solutions through our deep experience with global institutional clients.

Manage client's existing currency risk while potentially adding value in gains and limiting losses

Target return* | 100–150 basis points p.a. expressed through active adjustment's to client's hedge ratio

Risk* | 2–4% tracking error (typical mandate)

Time horizon | Realize target returns over 3-to 5-year investment horizon

Exposure | Each client’s currency exposure is unique in terms of currency, size, frequency of changes in the underlying investment, and operational constraints. Each area is taken into consideration and a structure is implemented to maximize hedge program efficiency.

Methodology | Varies from client to client based on their portfolio, MCM builds the operational framework to be the most accurate and efficient and to accommodate the client's needs.

Reporting | Customized reporting packages are produced to ensure clients receive the most comprehensive information available to evaluate the program’s performance and ensure complete transparency.

Experience | Our trading team averages 20+ years experience and is fully staffed on a 24-hour basis throughout the global trading day.

Systems | MCM's core proprietary software and market leading external systems allow us to serve as agent for our client base across a broad roster of global counterparty institutions.

Counterparties | Competitive counterparty selection process, rigorous attention to all aspects of transaction pricing, and transparent execution reporting. This best-in-class approach ensures execution effectiveness that incorporates a bid/offer spread and time stamp approach and translates directly into transparent value for our clients.

An effective program will expertly balance operational mandate requirements with a thoughtful, strategic approach to achieve a client’s specific risk management objectives. MCM has built the necessary IT and Systems infrastructure to properly manage the most complex currency management mandates, and we continue to develop and invest significant resources to ensure it remains best in class.

Explore other risk management overlays

1. Track record for Currency Risk Management Overlay strategies prior to May 2004, the date that the Currency Risk Management team joined Mesirow, occurred at prior firms.

* The MSCI EAFE Index is a stock market index that is designed to measure the equity market performance of developed markets outside of the U.S. & Canada. It is maintained by MSCI Inc., a provider of investment decision support tools; the EAFE acronym stands for Europe, Australasia and Far East. The MSCI EAFE 100% Hedged to USD Index represents a close estimation of the performance that can be achieved by hedging the currency exposures of its parent index, the MSCI EAFE Index, to the USD, the "home" currency for the hedged index. The index is 100% hedged to the USD by selling each foreign currency forward at the one-month Forward weight. The parent index is composed of large and mid cap stocks across 21 Developed Markets (DM) countries* and its local performance is calculated in 13 different currencies, including the Euro.

** Actual returns may materially differ from the target returns. Actual tracking error or volatility may materially differ from the targets set forth herein. Risks and offering terms vary materially by product. Nothing contained herein constitutes an offer to sell interest in any Mesirow investment vehicle. Please refer to the disclaimer page here.