Risk Management Overlay: Passive

Mesirow Currency Management provides investors a customized solution to manage unrewarded currency risk in their international portfolios.

For institutional investors

As an independent currency specialist, Mesirow Currency Management (MCM) has been delivering innovative, customized currency solutions to institutional clients globally since 1990.1 Being a private, employee owned firm, Mesirow is free from many conflicts of interest associated with bank-affiliated organizations or publicly held firms and is fully aligned with the interests of its clients.

Passive risk overlay

International portfolio assets are subject to currency fluctuations. Passive currency hedging is an effective way of reducing or eliminating volatility created by the currency exposures of a portfolio's underlying assets.

MSCI World – currency contribution during rising and falling currency environments

| MSCI World1 | Equity contribution | Currency contribution | ||

| Mar 2002–Jul 2011 | 35.66% | 7.96% | 25.65% | |

| Aug 2011–Sep 2022 | 82.12% | 113.98% | -14.89% | |

|

Source: Mesirow, Bloomberg, MSCI. Past performance is not necessarily indicative of future results; actual outcomes may materially differ. |

||||

Why consider?

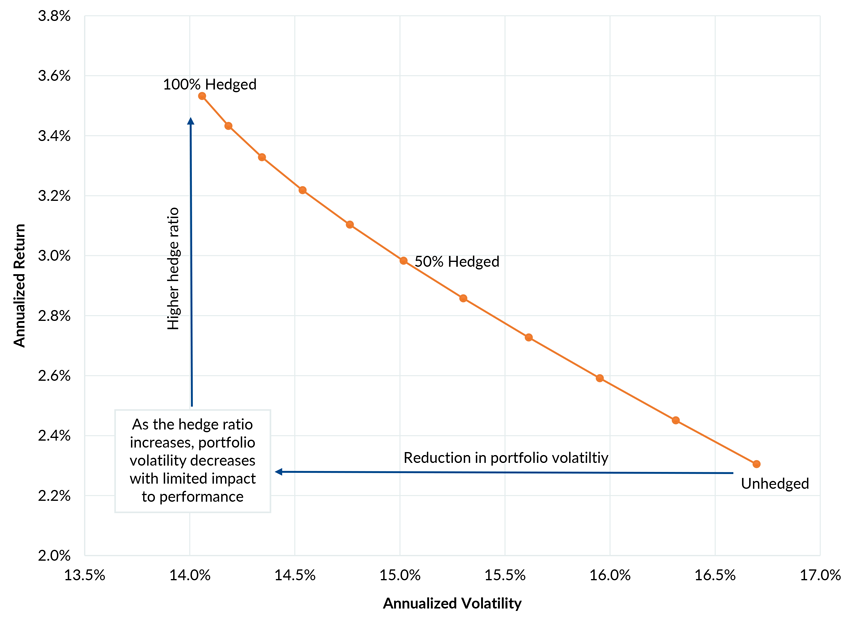

Unhedged currency exposures generally introduce additional portfolio volatility and have no expected return, resulting in uncompensated risk. Hedging out currency risk can help investors improve portfolio efficiency and reduce this uncompensated risk.

Source: Mesirow, Bloomberg, MSCI2. Past performance is not necessarily indicative of future results; actual outcomes may materially differ.

Strategic partnership

Strategic partnership

As a pure agent, our business is aligned with clients’ interests to form long-term strategic partnerships. Rather than focusing on providing standardized products, MCM develops custom solutions through our deep experience with global institutional clients.

Reduce or eliminate risk while ensuring best execution and effective cash flow management

Target return* | Passively remove currency risk; no return target

Risk* | Minimize tracking error while maximizing trading efficiency

Time horizon | Static, long-term hedge

Exposure | Each client’s currency exposure is unique in terms of currency, size, frequency of changes in the underlying investment, and operational constraints. Each area is taken into consideration and a structure is implemented to maximize hedge program efficiency.

Methodology | Varies from client to client based on their portfolio, MCM builds the operational framework to be the most accurate and efficient and to accommodate the client's needs.

Reporting | Customized reporting packages are produced to ensure clients receive the most comprehensive information available to evaluate the program’s performance and ensure complete transparency.

Experience | Our trading team averages 20+ years experience and is fully staffed on a 24-hour basis throughout the global trading day.

Systems | MCM's core proprietary software and market leading external systems allow us to serve as agent for our client base across a broad roster of global counterparty institutions.

Counterparties | Competitive counterparty selection process, rigorous attention to all aspects of transaction pricing, and transparent execution reporting. This best-in-class approach ensures execution effectiveness that incorporates a bid/offer spread and time stamp approach and translates directly into transparent value for our clients.

An effective program will expertly balance operational mandate requirements with a thoughtful, strategic approach to achieve a client’s specific risk management objectives. MCM has built the necessary IT and Systems infrastructure to properly manage the most complex currency management mandates, and we continue to develop and invest significant resources to ensure it remains best in class.

Explore other risk management overlays

1. Track record for Currency Risk Management Overlay strategies prior to May 2004, the date that the Currency Risk Management team joined Mesirow, occurred at prior firms. Track record for Currency Alpha and Macro strategies prior to October 1, 2018, the date that the Currency Alpha and Macro Strategies team joined Mesirow, occurred at prior firms.

2. The MSCI EAFE Index is a stock market index that is designed to measure the equity market performance of developed markets outside of the U.S. & Canada. It is maintained by MSCI Inc., a provider of investment decision support tools; the EAFE acronym stands for Europe, Australasia and Far East. The MSCI EAFE 100% Hedged to USD Index represents a close estimation of the performance that can be achieved by hedging the currency exposures of its parent index, the MSCI EAFE Index, to the USD, the "home" currency for the hedged index. The index is 100% hedged to the USD by selling each foreign currency forward at the one-month Forward weight. The parent index is composed of large and mid cap stocks across 21 Developed Markets (DM) countries* and its local performance is calculated in 13 different currencies, including the Euro.

*Actual returns may materially differ from the target returns. Actual tracking error or volatility may materially differ from the targets set forth herein. Risks and offering terms vary materially by product. Nothing contained herein constitutes an offer to sell interest in any Mesirow investment vehicle. Please refer to the disclaimer page here.