Outsourced trading

For institutional investors

Execution: Fiduciary FX

Independent low-cost 24-hour agency trading that can result in significant savings for investors.

Fiduciary foreign exchange (FidFX) is an enhancement of the agency approach for trading foreign exchange to settle international trades, to convert foreign income such as dividends, and to hedge currency risk. Mesirow Currency Management (MCM) designs a custom high or low-touch trading program, manages regulatory reporting and trade settlements, and provides independent third-party transaction analysis for visibility and transparency.

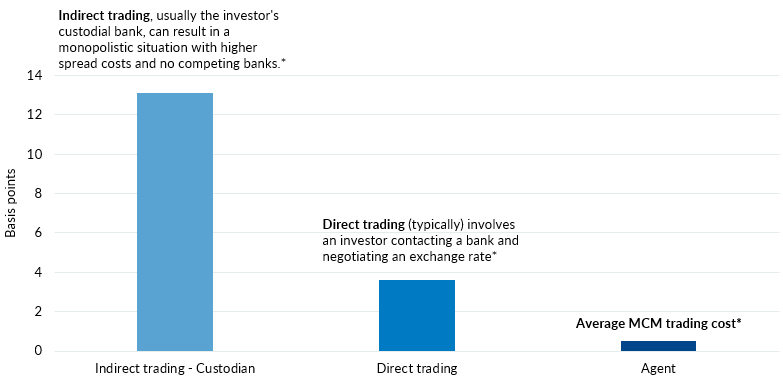

Average trade cost

*MCM analyses of trades executed from 10.1.17 to 10.31.19 on behalf of institutional investors evaluating the Fiduciary FX program. Source for agency costs: Virtu analysis of MCM trading from 2018 to 2019. The above is for illustrative purposes only.

Why consider?

When opting for a fiduciary to handle assets, asset owners can have assurance that the service provider is obligated by ethical and legal responsibilities to prioritize the asset owners' interests over their own.

MCM's Fiduciary FX solution minimizes transaction costs and market risk and provides competitive low-cost trading with transparent fees and results. MCM manages the account setup process and our proprietary technology limits integration requirements. FidFX offers clients access to 24-hour trading capability covered by professionals with an average of over 20 years of trading experience.

Fiduciary FX process

1.

Client sends orders to Mesirow in a format that works best for them, Swift, FTP, FIX or email

2.

Mesirow matches offsetting orders and competes trades with over 20 banks to find the best price possible

3.

Mesirow manages all settlement details with the client’s custodian then returns trade details to the client for STP processing

4.

Mesirow provides clients with an independent transaction cost analysis of all trades

Strategic partnership

Strategic partnership

As a pure agent, our business is aligned with clients’ interests to form long-term strategic partnerships. Rather than focusing on providing standardized products, MCM develops custom solutions through our deep experience with global institutional clients.