Insights

Carry strategies

Share this article

Why having an adaptable carry strategy is important in a time of risk aversion

Although carry is a popular trading strategy in the currency markets, one of its downfalls is that it tends to rely on markets being ‘risk seeking’, and it is widely acknowledged and witnessed empirically that the strategy suffers in periods of risk aversion or ‘risk off’. In the main, this is because the source from which it extracts its signal, i.e. interest rates, is not able to adjust quickly enough (or at all) to reflect the changes in the market environment, resulting in carry strategies possibly continuing to hold positions that are loss leading for a considerable amount of time.

March 2020

Triggered by the continuing spread of COVID-19 and fears of a global recession, investors scrambled to safe-haven assets in March as equity markets fell and bond yields rose.

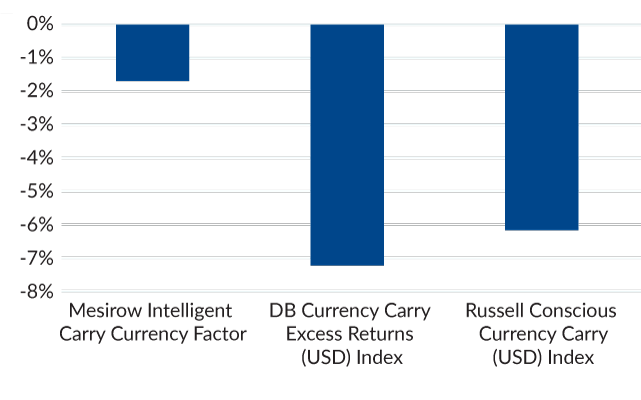

To demonstrate the detrimental effect on carry strategy performance, Figure 1 illustrates the returns for March 2020 for two publicly available carry strategies – the Deutsche Bank (DB) Currency Carry Index and the Russell Conscious Currency Carry Index. Both indices experienced losses that were more than -7% and -6%, respectively.

This poses the question of whether there is anything that can be done within the carry strategy itself to limit losses in these periods. One such thing is to build a carry strategy which incorporates a risk indicator which then deleverages positions during a period of risk aversion. This is exactly what is built into the trading framework of the Mesirow Intelligent Carry Currency Factor.

Figure 1 shows the beneficial impact of this in the month of March, whilst performance was negative at -1.7%, losses were less than a third of those suffered by the equivalent DB and Russell carry factors.

Figure 1: Comparing Carry Strategy Returns – March 2020

Source: MCM. Performance for the Mesirow Intelligent Carry Currency Factor represents simulated trading using backfilled data and does not represent trading on behalf of an actual client. These returns are generated with the benefit of hindsight. Returns stated are gross of fees. Past performance is not necessarily indicative of future results. Actual results may materially differ from those shown above. Please refer to the disclaimer page at the end of this presentation for important additional information.

What is a risk indicator?

It is common for investors in equity and bond markets to examine indicators such as VIX or TED spreads to gauge risk sentiment and adjust their investment decisions accordingly, and there is no reason why an indicator for risk could not be used within a currency strategy as well.

While individual indicators of risk are useful, our intention was to use a risk indicator within the carry factor that encapsulates risk sentiment across many different asset markets. In addition, it’s important for transparency reasons that we also use a risk indicator that is publicly available.

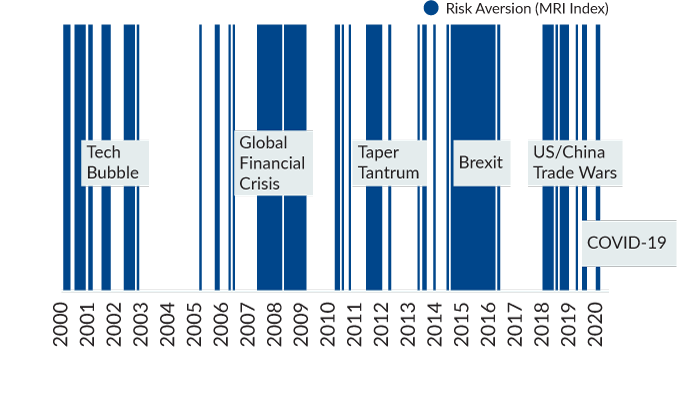

The Citi Macro Risk Index (MRI) consists of several proxies for market risk such as FX volatility, the TED spread and the VIX and can be used systematically to indicate which ‘state’ the market is in currently. The index is constructed with upper and lower bonds of 0 and 1 and the MRI methodology deems a value higher than 0.5 as indicative of a risk-averse state and lower than 0.5 as indicative of a risk seeking state.

The shaded areas in Figure 2 show an empirical representation of periods of risk aversion, as indicated by the MRI. Here we see times of crisis spanning from the ‘tech bubble’ to the US recession in 2001, the Great Financial Crisis (GFC) of 2007/08, the ‘taper tantrum’ of 2012 and more recently the uncertainty over Brexit and the US/China Trade wars in 2018/19. In addition, Figure 2 shows that the MRI also signaled risk aversion for the month of March 2020.

Figure 2: Citi Macro Risk Index (MRI) Periods of Risk Aversion

Source: Bloomberg. Actual results may materially differ from those shown above. Please refer to the disclaimer page at the end of this presentation for important additional information.

The Mesirow Intelligent Carry Currency Factor

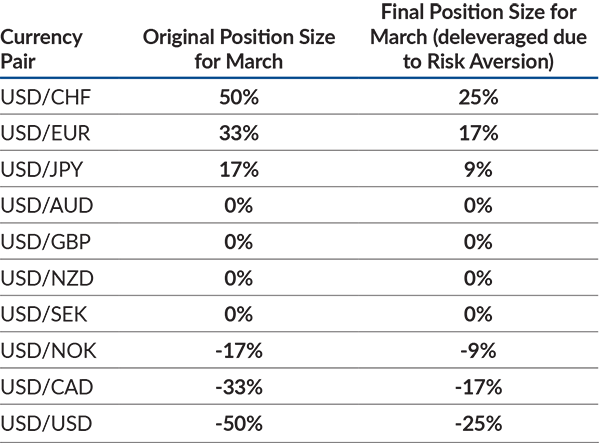

The signals for the Mesirow Intelligent Carry Currency Factor strategy are generated systematically on the last day of each month. A rank-based weighting system is used to allocate trade-weights to the top 3 and bottom 3 currencies in our permissible universe of G10 currencies versus the US Dollar. If the level of MRI on the last day of the month indicates a risk seeking environment, then the trade weights remain unchanged. If, however, the MRI level indicates risk aversion, the trade weights are, instead, deleveraged by half.

To demonstrate this clearly, the second column of Figure 3 shows the initial rank-based trading weights calculated at the end of February 2020 to be implemented in March 2020. The next step looks at the value of the MRI as at the end of February which indicated a risk averse state. As such, the initial trading weights were deleveraged by half as can be seen in the third column of Figure 3.

Figure 3: Adjustment to Carry Trade Positions due to MRI Indicating Risk Aversion – March 2020

Source: MCM and Bloomberg. Position adjustment for Mach due to the MRI indicating a risk averse state at the end of February 2020. Performance for the Mesirow Intelligent Carry Currency Factor represents simulated trading using backfilled data and does not represent trading on behalf of an actual client. These returns are generated with the benefit of hindsight. Returns stated are gross of fees. Past performance is not necessarily indicative of future results. Actual results may materially differ from those shown above. Please refer to the disclaimer page at the end of this presentation for important additional information.

Impact

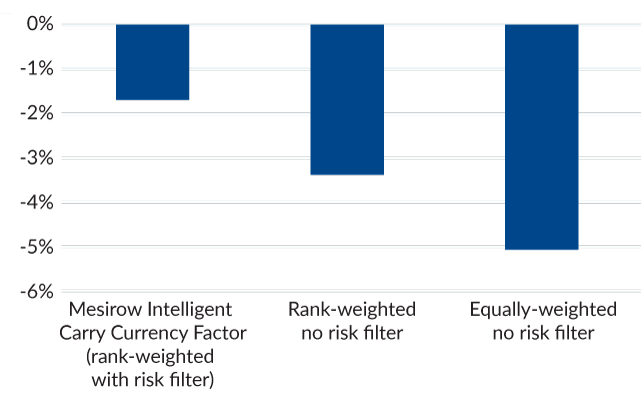

So what impact did the Risk Filter have on performance? The first bar in Figure 4 presents the March 2020 performance of Mesirow’s strategy (-1.7%), which incorporates the risk filter into the trade weights. The second bar shows what the performance would have been (-3.4%) if the carry strategy had not contained the risk filter and the positions had not been deleveraged by half. This illustrates that by incorporating the risk filter as a second stage in the strategy, it added 1.7% of value in March 2020 versus a ‘naïve’ carry strategy.

Something else to note though is the impact on performance in March due to a rank-base weighting system, used within the Mesirow Carry Factor, versus an equal-weighting system that is used in the majority of other investable carry factors.

In an equal-weighting system, the currencies that are ranked top 3 and bottom 3 would all receive a trade weight that is equal, i.e. long or short 33%. An assumption within this type of methodology is that the magnitude of a signal’s information coefficient is equal regardless of where the currency appeared in the ranking, i.e. the strength or conviction of signal from a currency ranked 1 is indifferent to a currency ranked 3.

It could be argued that an equal-weighting approach discards some of the information and benefit offered by a rank-based structure. As such, our weighting system differs significantly from the weighting methodology used by other currency factors because it places a higher buy (sell) trade weight on the currency pair that ranked 1 (10) than ranked 2 (9) than ranked 3 (8). An example of the resulting rank-based weights for March 2020 can be seen in column 2 of Figure 3.

To assess the benefit of using our rank-based approach, we recalculated the carry factor returns for the month of March but assuming an equally-weighted trade weight had been applied instead. The results can be seen in the third bar of Figure 4 and show that the losses for the month would have been in excess of -5%.

Figure 4 demonstrates quite clearly that by having a rank-based weighting system, in addition to incorporating a risk filter, Mesirow’s strategy added 3.4% of value in March 2020 versus an equally-weighted naïve carry strategy.

Figure 4: Performance of the Carry Factor Under Different Iterations

Source: MCM. Performance for the Mesirow Intelligent Carry Currency Factor represents simulated trading using backfilled data and does not represent trading on behalf of an actual client. These returns are generated with the benefit of hindsight. Returns stated are gross of fees. Past performance is not necessarily indicative of future results. Actual results may materially differ from those shown above. Please refer to the disclaimer page at the end of this presentation for important additional information.

Long-term performance

Using a rank-based weighting system with a risk filter was successful in limiting downside in March 2020, but would it be beneficial over the longer term?

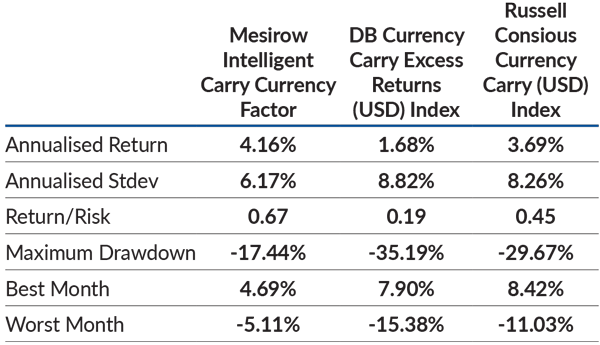

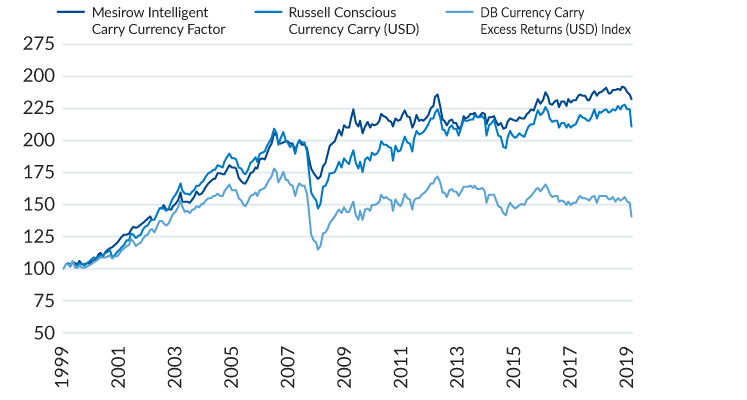

Figure 5 shows the annualised returns of the Mesirow Intelligent Carry Currency Factor alongside the performance statistics of the DB and Russell equivalent carry factors from December 1999 to March 2020.

The beneficial impact of the risk filter, and its ability to deleverage position size in times of risk aversion, is clear when comparing the annualised standard deviation and maximum drawdown statistics of the Mesirow Intelligent Carry Currency Factor with the equivalent statistics of the DB and Russell carry factors.

The impact of the risk filter on drawdown can also be seen clearly in Figure 6 and shows the net asset values of each of the factor strategies. The Mesirow Intelligent Carry Currency Factor had less pronounced and deep drawdowns, in periods such as the GFC, than the DB and Russell carry strategies.

Figure 5: Carry Factor Annualised Performance (December 1999 – March 2020)

Figure 6: Carry Factor Net Asset Values (December 1999 – March 2020)

Source: MCM & Bloomberg. Performance for the Mesirow Intelligent Carry Currency Factor represents simulated trading using backfilled data and does not represent trading on behalf of an actual client. These returns are generated with the benefit of hindsight. Returns stated are gross of fees. Past performance is not necessarily indicative of future results. Actual results may materially differ from those shown above. Please refer to the disclaimer page at the end of this presentation for important additional information.

Middleton, A., “Accessing Currency Returns Through Intelligent Currency Factors”, The Journal of Investment Consulting, Volume 19, Number 1, pp 30-42, 2019.

Mesirow Currency Management (“MCM”) is a division of Mesirow Financial Investment Management, Inc. (“MFIM”) a SEC registered investment advisor. The information contained herein is intended for institutional clients, Qualified Eligible Persons and Eligible Contract Participants and is for informational purposes only. This information has been obtained from sources believed to be reliable but is not necessarily complete and its accuracy cannot be guaranteed. Any opinions expressed are subject to change without notice. It should not be assumed that any recommendations incorporated herein will be profitable or will equal past performance. Mesirow does not render tax or legal advice. Nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy an interest in any Mesirow investment vehicle(s). Any offer can only be made through the appropriate Offering Memorandum. The Memorandum contains important information concerning risk factors and other material aspects of the investment and should be read carefully before an investment decision is made.

Currency strategies are only suitable and appropriate for sophisticated investors that are able to lose all of their capital investment.

This communication may contain privileged and/or confidential information. It is intended solely for the use of the addressee. If this information was received in error, you are strictly prohibited from disclosing, copying, distributing or using any of this information and are requested to contact the sender immediately and destroy the material in its entirety, whether electronic or hardcopy.

Certain strategies discussed throughout the document are based on proprietary models of MCM’s or its affiliates. No representation is being made that any account will or is likely to achieve profits or losses similar to those referenced.

Performance pertaining to the Currency Risk Management Overlay strategies is stated gross of fees. Performance pertaining to the Currency Alpha and Macro strategies may be stated gross of fees or net of fees. Performance information that is provided net of fees reflects the deduction of implied management and performance fees. Performance information that is provided gross of fees does not reflect the deduction of advisory fees. Client returns will be reduced by such fees and other expenses that may be incurred in the management of the account. Simulated model performance information and results do not reflect actual trading or asset or fund advisory management and the results may not reflect the impact that material economic and market factors may have had, and can reflect the benefit of hindsight, on MCM’s decision-making if MCM were actually managing client’s money in the same manner. Performance referenced herein for Currency Risk Management Overlay strategies prior to May 2004, the date that the Currency Risk Management team joined Mesirow, occurred at prior firms. Performance referenced herein for Currency Alpha and Macro strategies prior to October 1, 2018, the date that the Currency Alpha and Macro Strategies team joined Mesirow, occurred at prior firms. Any chart, graph, or formula should not be used by itself to make any trading or investment decision. Any currency selections referenced herein have been included to illustrate the market impact of certain currencies over specific time frames. The inclusion of these is not designed to convey that any past specific currency management decision by MCM would have been profitable to any person. It should not be assumed that currency market movements in the future will repeat such patterns and/or be profitable or reflect the currency movements illustrated above.

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that a strategy’s returns or volatility will be similar to the indices. The strategy is compared to the indices because they are widely used performance benchmarks.

Citi Macro Risk Indices measure risk aversion based on prices of financial assets that are typically sensitive to risk. The long-term MRI measures the level of risk aversion while the short-term index measures changes.

Mesirow refers to Mesirow Financial Holdings, Inc. and its divisions, subsidiaries and affiliates. The Mesirow name and logo are registered service marks of Mesirow Financial Holdings, Inc., © 2020, Mesirow Financial Holdings, Inc. All rights reserved. Investment management services provided through Mesirow Financial Investment Management, Inc., a SEC registered investment advisor, a CFTC registered commodity trading advisor and member of the NFA, or Mesirow Financial International UK, Ltd. (“MFIUK”), authorized and regulated by the FCA, depending on the jurisdiction.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters