Insights

ESG risk factors

Share this article

Over the past decade, ‘socially responsible’ investing has become a key objective of pension funds globally. Environmental, social and governance (ESG) risk ratings have enabled investors to incorporate ‘non-tangible’ information about a company, such as their environmental and employee welfare policies, into their investment decisions.

ESG and the currency markets:

Traditionally, ESG ratings have only been published at a corporate-level. However, ESG ratings at a country-by- country level are now available. In this article we take a preliminary look at whether this data could be useful in predicting the path of a country’s currency. First, let’s conjecture how a country’s standing in terms of ESG matters could potentially impact the price of its currency: 1. Countries that have healthy, productive and stable workforces are more likely to have a societal framework conducive to a flourishing economy versus countries whose workforce is the opposite. A corollary to this are countries with higher ESG scores may be more competitive (and have stronger currencies) longer term than countries with lower ESG scores. 2. Countries with good environmental standards and/or stable governance in terms of financial, judicial and political systems, are often classified by investors as lower risk than countries with the contrary. Therefore, countries that score higher on ESG factors may attract more investment and have stronger currencies than those countries who score poorly.

ESG and currency: Research so far

As country-level ESG factors are relatively new, there is limited research of the use of ESG country factors in the currency markets. However, in 2019 a paper by Baker, Alves and Morey (2020) found evidence supporting the hypothesis that the currencies of countries with high ESG country-ratings performed significantly better than the currencies of countries with low ESG country-ratings.

Is there a link between a country’s ESG rating and its currency?

Creating an ESG currency basket:

Like Baker et al (2020), we used the MSCI ESG Government ratings but concentrated our efforts on the developed currencies of: AUD, CAD, CHF, EUR, GBP, JPY, NZD. We created a systematic strategy which, on an individual country basis, creates a buy signal for that country’s currency if the most recent ESG value has increased the previous year and a sell signal if its most recent ESG value has decreased since the prior year. We effectively tested the hypothesis that a country that has an increasing (decreasing) ESG country-value will, over the following year, see an appreciation (depreciation) in its exchange rate.

The period under study is January 2009 to December 2019. All trades are versus the US Dollar; the returns of the strategy are calculated individually on each of the seven currencies (against the USD) and then equally-weighted to create the basket return.

Figure 1: Hypothetical performance of an esG currency Basket and a multi-strategy Currency Factor portfolio.

|

|

Multi-Strategy Currency Factor |

||

|

|

ESG Strategy Currency Basket |

Original Weights |

Weights adjusted to include allocation to the ESG Basket |

|

Annualised Return |

1.90% |

2.52% |

2.37% |

|

Annualised Standard Deviation |

5.59% |

2.85% |

2.77% |

|

Return/Risk |

0.34 |

0.89 |

0.85 |

|

Maxdown |

-8.52% |

-4.15% |

-3.18% |

|

Best month |

7.01% |

3.68% |

3.74% |

|

Worst month |

-5.50% |

-1.54% |

-2.49% |

The results of this analysis can be seen in the second column of Figure 1. Over the period in question, the ESG currency strategy basket achieved a positive annualized return of 1.90%. The progression of the net asset value of the strategy can be seen in Figure 2.

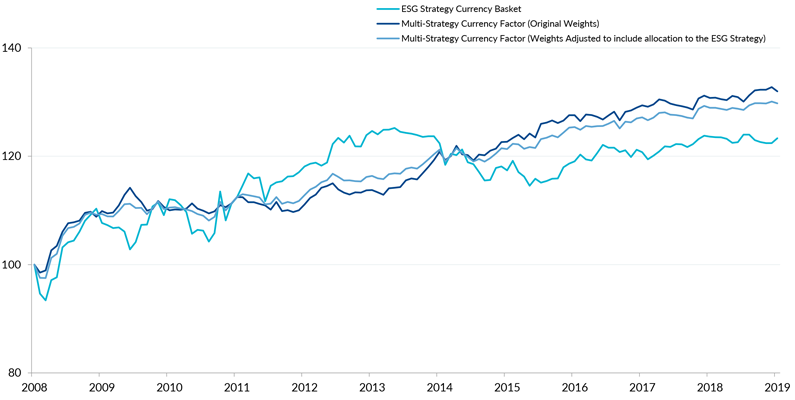

Figure 2: Hypothetical Net Asset Value of an ESG Currency Basket and a Multi-Strategy Currency Factor Portfolio.

The signal in an ESG currency strategy emanates from a source which is very different to the most popular currency trading styles of carry, value and trend. As such, adding an ESG strategy to a multistrategy currency portfolio may result in diversification benefits.

Using the single style currency factors from Middleton (2019) namely carry, value and momentum, we calculated the correlation coefficients with the ESG currency basket over the period in question. It was not unexpected to see that the correlation between the ESG strategy was low at 0.19 and 0.25 with the carry and value factors respectively, and negative with respect to the momentum factor at -0.23.

In Middleton (2019) the three styles of carry, value and momentum were equally-weighted to produce a multi-strategy factor and the performance of this can be seen in column 3 of Figure 1 with the progression of the net asset value shown in Figure 2. Figure 1. Hypothetical performance of an ESG currency Basket and a multi-strategy currency Factor portfolio.

To assess whether adding the ESG strategy would have a beneficial effect on diversification, the multistrategy was reweighted to 25% on carry, value and momentum and the additional 25% allocated to the ESG strategy. The results of this can be seen in the fourth column of Figure 1 and also in the net asset value chart in Figure 2.

Overall, adding the ESG strategy did little to change the overall performance of the multi-strategy currency factor portfolio with the return to risk of the original weighting being roughly in line with that of the re-weighted one, 0.89 versus 0.85. However, the maximum drawdown of the re-weighted multistrategy did decrease by approximately a quarter to -3.18%.

In addition, Figure 2 shows that the value-add of including an allocation to the ESG strategy varied: between 2009 to 2012 it detracted performance versus the original multi-strategy factor, through 2011 to 2014 it enhanced performance but has detracted performance since. This suggests that if an allocation to an ESG currency basket could be varied strategically within an already diversified currency strategy portfolio, it may prove beneficial to overall returns.

Traditionally it has been difficult for investors to include ESG information into their currency investment approaches. This has changed over recent times though with the advent of country-wide ESG ratings.

Whilst an ESG strategy currency basket may not produce enough return-to-risk characteristics to warrant an investment in insolation, it may have diversification benefits.

In the case of ESG applied to traditional asset classes, it is unusual for an investor to demand a strategy that is entirely ESG-orientated. Instead, the importance is more about integrating ESG considerations into the overall investment process.

There is no reason to believe investors in currency would think any differently and we have seen how an ESG currency basket exhibits low or negative correlation with the mainstream currency strategies of carry, value and trend. This suggests, therefore, that a framework to incorporate an ESG currency strategy into an already diversified currency portfolio could be of interest to investors and therefore an interesting area for future research.

The ESG data contained herein is the property of MSCI ESG Research LLC (ESG). ESG, its affiliates and information providers make no warranties with respect to any such data. The ESG data contained herein is used under license and may not be further used, distributed or disseminated without the express written consent of ESG.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters