Insights

Managing currency risk means managing change

Share this article

There are few topics in currency risk management that are more polarizing than the most basic question: should currency risk be hedged? Much less controversy exists about the need to hedge emerging market currencies. Many analysts and investors believe that hedging emerging market currencies is unnecessary. They offer various reasons: currency return is zero over the long term; the cost of carry is too high; currency trading costs are expensive; and collateralization of some currency positions encumbers cash or securities that could be used for other investment purposes.

This article examines the management of currency risk associated with an emerging market international equity portfolio from the perspective of a U.S. dollar-based investor. Using the MSCI Emerging Markets Index1 to represent exposure to emerging market equities, we examine the impact currencies had on that portfolio during the period January 2001 to May 2020.

Analysis

Currency markets are dynamic. This dynamism is reflected in changes in currency rates which, in general, adjust slowly. However, in periods of heightened asset market volatility or when geopolitical events occur, currency moves can be abrupt and significant and may take investors by surprise.

Some institutions apply a hedging strategy to manage this currency risk. Whether the investor decides to leave the portfolio unhedged (0% hedge ratio), completely hedged (100% hedge ratio), or chooses a hedge ratio in between, the selected static hedge is not likely to be the optimal hedge ratio in all market conditions.

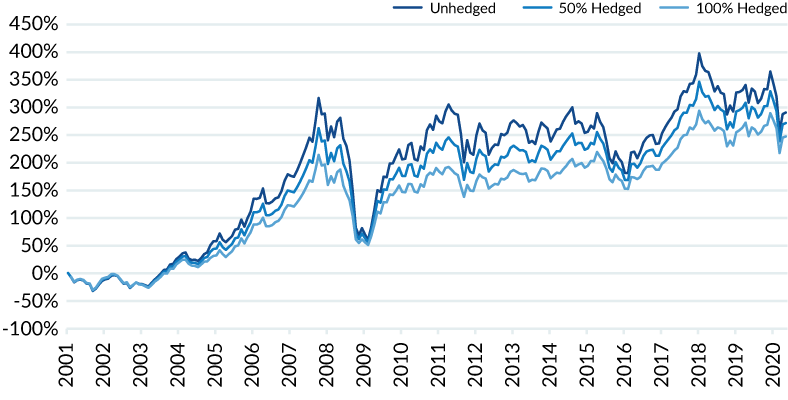

To demonstrate this dynamic, Figure 1 presents the cumulative returns of the MSCI EM Index since January 2001. The dark blue line is an unhedged portfolio. The grey and light blue lines are a 50% hedged and a 100% hedged portfolio, respectively. It is apparent that the unhedged portfolio outperforms the hedged portfolios under normal environments. During times of stress, however, the unhedged portfolio tends underperform the hedged portfolios. This is evident in 2008 and 2009 during the Global Financial Crisis and again during the Greek Credit Crisis and the COVID-19 pandemic.

Figure 1: CUMULATIVE RETURNS ON AN EM PORTFOLIO WITH DIFFERENT HEDGE RATIOS

Source: Bloomberg and MCM. Past performance is not necessarily indicative of future results; actual outcomes may differ.

Many investors face the dilemma of when to initiate a currency hedge. They are concerned that they will implement the hedge just as the value of foreign currencies has bottomed and begun increasing. Choosing a different time to implement the hedge could result in another (perhaps undesirable) outcome. It is this uncertainty – how well the hedge will perform from a return perspective – that can result in indecision and inaction.

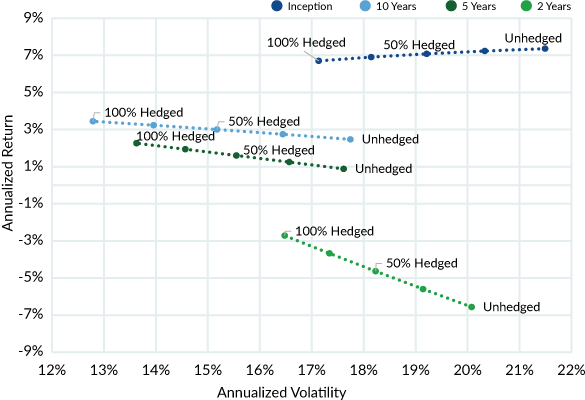

Figure 2 presents the efficient frontiers for various hedge ratios and shows clearly how the choice of hedge ratio and period (various times between January 2001 and May 2020) results in remarkably different combinations of risk and return.

Figure 2: EFFICIENT FRONTIERS FOR HEDGING MSCI EM INDEX

Source: Bloomberg and MCM. Past performance is not necessarily indicative of future results; actual outcomes may differ. This graph does not illustrate actual client experience or results.

Figure 2 illustrates how different hedging levels impact performance and volatility. In all periods evaluated, the 100% hedged portfolio had the highest information ratio. However, over the entire 19-year period, the unhedged portfolio had the highest annualized return of 7.36% compared to the 6.70% annualized return of the hedged portfolio. For the additional 66bps of annualized return on an unhedged portfolio, an investor would have incurred higher annualized volatility of 4.36%.

Based on the risk and return profiles over these different periods, it may be prudent for investors to consider some degree of hedging program on their emerging market portfolio to minimize portfolio volatility and reduce drawdowns especially during times of market stress.

Objections to Hedging Emerging Market Currencies

Investment professionals often cite hedging philosophy, the cost of carry, transaction costs, and collateralization requirements as reasons not to hedge emerging market currencies. The next section of this article considers each of these points.

Philosophy – To hedge or not to hedge, that’s really the question

An argument for not hedging emerging market currency risk is the view that, over the long-term, the impact on the portfolio of leaving currencies unhedged is negligible as the expected return from currency exposure is zero. Because many investors consider themselves long-term investors in the underlying international assets (e.g. bonds or equities), they often adopt a similar philosophy to currencies and believe they can ignore currencies’ short-term volatility.

The long-term view syndrome can be a symptom of the fear of getting things wrong. However, having the wrong hedging policy may not only contribute to underperformance of the underlying portfolio, but may also mean not participating in favorable currency moves. Hedging strategy requires careful consideration including the willingness to adjust the strategy when conditions change.

Cost of carry

If a US investor is exposed to fluctuations in the dollar resulting from an investment in a Brazilian security, the investor could sell Brazilian reals and buy U.S. dollars to eliminate some or most of the imbedded currency risk. The quoted forward rate will differ from the spot rate, and the difference between the quoted rate as a percentage of the spot rate is called “carry”. Carry can be either positive or negative for the passive hedger and is based on two factors: interest rate differential and cross-currency basis.

When quoting a forward, the currency with the higher interest rate is priced at a discount to the currency with the lower interest rate in a no-arbitrage pricing relationship known as covered interest rate parity (CIP). Investors in countries with relatively low interest rates (such as the United States) that hedge currency risk of countries with higher interest rates (Brazil) will sell Brazilian reals at a discount and incur a carry cost at the inception of the hedge. Carry is a realized cost and the wider the interest rate differential the more material this cost can be to portfolio performance. When covered interest parity does not hold, the difference between CIP and market rates is cross-currency basis.

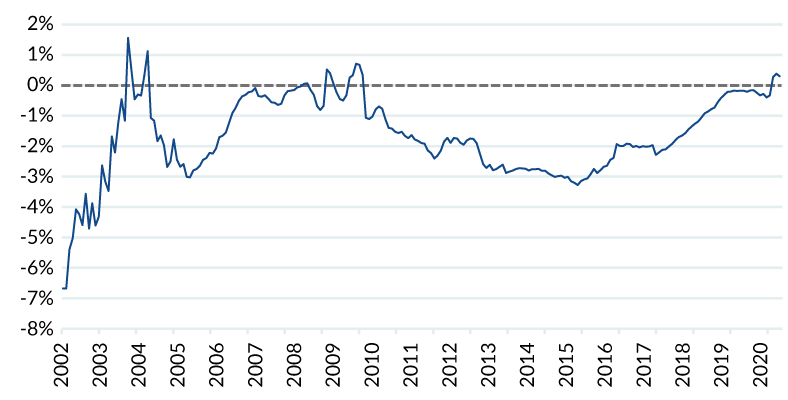

In Figure 3, we illustrate the rolling 12-month cost of carry that would have resulted from hedging an emerging market portfolio back to the U.S. dollar. For most of the period, an investor would have incurred a cost to hedge emerging market currencies except during periods of heightened stress such as the GFC and the COVID-19 pandemic. During periods when the structural cost is lower, hedging can be an appealing strategy.

Figure 3: EM HEDGING COSTS (U.S. INVESTOR)

Source: Bloomberg and MCM. From periods in 2003, 2004, 2008/9 (GFC) and 2020, hedging resulted in a carry gain for U.S. investors. Most other periods resulted in a carry cost. Past performance is not necessarily indicative of future results; actual outcomes may differ. This graph does not illustrate actual client experience or results.

Transaction costs

Based on volumes through May 2020, Mesirow Currency Management (MCM) estimates it will trade approximately $550 billion in 2020 on behalf of its global client base. This includes about $4.1 billion for hedging emerging market currency exposures. Based on currency market spreads as of June 2020, we estimated transaction costs for trading currencies in the MSCI Emerging Markets Index and presented those costs in Table 1.

Table 1 contains two estimated cost columns. The first column presents year 1 transaction costs that include the initiation of the hedge, rebalancing the hedge monthly, and rolling the forwards quarterly. The second column shows subsequent year estimated transaction costs which involve monthly rebalancing and quarterly rolling. It is clear from Table 1 that the initial launch and annual estimated transaction costs are not excessive: aggregate costs over a two-year period are only about 19.5 basis points.

Table 1: ESTIMATED TRANSACTION COSTS FOR EMERGING MARKET HEDGE

Source: MSCI Emerging Markets Index and ITG. Past performance is not necessarily indicative of future results; actual outcomes may differ. This table does not illustrate actual client experience or results.

Collateralization

A consideration for managing emerging market currencies has been the global regulatory requirement to collateralize non-deliverable forwards. An NDF is a cash-settled forward contact in which the gain or loss on settlement date is paid in a deliverable currency such as the US dollar. Because of legal, operational or other restrictions, some emerging market currencies cannot be freely exchanged (traded). In these instances, investors can hedge a currency exposure using NDF contracts. Table 2 presents those currencies in the MSCI Emerging Markets Index that are traded using NDFs and their index weights.

Due to regulatory requirements, NDFs require collateral. Collateral management can reduce counterparty risk, however, posting collateral can tie-up funds or securities that could be used for other investments. Additionally, managing collateral can be administratively burdensome. For these reasons, some investors choose to avoid currency trading or risk management situations requiring collateral. In other words, these investors avoid hedging emerging market currency risk.

The weights for some non-deliverable currencies in the MSCI Emerging Markets Index (such as Chilean peso and Colombian peso) requiring collateral are small, significantly less than 2%. One solution for addressing the disadvantages of collateral management, at least for these small exposures, is to leave those low-weight currencies unhedged.

For other currencies, the weights are significant enough to require attention. Currently, while investors must post variation margin for NDFs, most counterparties do not demand initial margin, lessening the investor’s collateral burden. Offsetting the disadvantages of collateralization is the benefit from the reduction in counterparty risk which is a key risk to manage in over-the-counter currency transactions.

Table 2: MSCI Emerging Markets Index – Currencies Requiring NDFs

Source: MSCI Emerging Markets Index as of 31 May 2020. Past performance is not necessarily indicative of future results; actual outcomes may differ. This table does not illustrate actual client experience or results.

Conclusion

If there is anything constant about the currency market, it is change. Exchange rates are in endless flux, and investors interested in managing currency risk need to match that change with appropriate currency risk management strategies. Hedging policies employing a static hedge ratio will address today’s market conditions but may result in suboptimal outcomes if the policy is not revised to reflect adjustments in exchange rates.

MCM’s analysis demonstrated that the optimal hedging strategies changed during the last 19 years for the MSCI Emerging Markets Index. Analysis over different periods showed that a fully hedged position was the optimal solution based on information ratio results. During normal market environments, however, an unhedged portfolio may have performed better.

Some traditional reasons for not hedging are no longer valid. Transaction costs are not overly significant, and the inconvenience of collateralizing currency positions is offset with a reduction in counterparty risk. In addition, the current cost of carry is not as significant compared to the magnitude of recent annual values.

The main barrier to currency hedging is overcoming the uncertainty that accompanies the investment decision: is the domestic currency near its peak or its nadir? If a hedge is implemented, what is the optimal hedge ratio?

This final concern may be best addressed by applying active currency risk program (dynamic hedging). Active currency programs use systematic and discretionary inputs to decide when to hedge foreign currency exposures and at what hedge ratio. An active hedging program can reduce the risk that the initiation of the hedge is taken at an inopportune time and it can assist with reacting promptly when market conditions indicate that a hedge ratio adjustment is appropriate.

1. The MSCI Emerging Markets Index consists of 23 economies including Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey and the United Arab Emirates. The MSCI is a float-adjusted market capitalization index.

Mesirow Financial Currency Management (“MFCM”) is a division of Mesirow Financial Investment Management, Inc. (“MFIM”) a SEC registered investment advisor. The information contained herein is intended for institutional clients, Qualified Eligible Persons and Eligible Contract Participants and is for informational purposes only. This information has been obtained from sources believed to be reliable but is not necessarily complete and its accuracy cannot be guaranteed. Any opinions expressed are subject to change without notice. It should not be assumed that any recommendations incorporated herein will be profitable or will equal past performance. Mesirow Financial does not render tax or legal advice. Nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy an interest in any Mesirow Financial investment vehicle(s). Any offer can only be made through the appropriate Offering Memorandum. The Memorandum contains important information concerning risk factors and other material aspects of the investment and should be read carefully before an investment decision is made.

Brunei Investors: These materials are intended for distribution only to specific classes of investors as specified under the Securities Markets Order, 2013 and the regulations thereunder (“Order”) and must not, therefore, be delivered to, or relied on by, a retail client. The Autoriti Monetari Brunei Darussalam (“Authority”) is not responsible for reviewing or verifying any presentation materials, or prospectus or other documents in connection with this investment strategy. The Authority has not approved these materials or any other associated documents nor taken any steps to verify the information set out in these materials and has no responsibility for it. Prospective investors in any investment strategy discussed should conduct their own due diligence.

Japanese Investors: Mesirow Financial Currency Management provides discretionary investment management services to managed accounts held on behalf of qualified investors only. MFCM will not act as agent or intermediary in respect of the execution of a discretionary investment management agreement. Please note that this presentation is intended for educational purposes and solely for the addressee and may not be distributed.

Hong Kong Investors: The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the contents of this document. You should obtain independent professional advice prior to considering or making any investment. The investment is not authorized under Section 104 of the Securities and Futures Ordinance of Hong Kong by the Securities and Futures Commission of Hong Kong. Accordingly, the distribution of this Presentation Material and discretionary management services in Hong Kong are restricted. This Presentation Material is only for the use of the addressee and may not be distributed, circulated or issued to any other person or entity.

South Korean Investors: Upon attaining a client, Mesirow Financial Investment Management, Inc. (“MFIM”) will apply for the appropriate licenses and retain the services of a local licensed intermediary (a Korean financial investment company). In the interim, MFIM will rely on and sub-delegate to Mesirow Advanced Strategies, Inc. (“MAS”).

Singapore Investors: Mesirow Financial Currency Management provides discretionary investment management services to managed accounts held on behalf of qualified investors only. MFCM will not act as agent or intermediary in respect of the execution of a discretionary investment management agreement. Please note that this presentation is intended for educational purposes and solely for the addressee and may not be distributed.

This communication may contain privileged and/or confidential information. It is intended solely for the use of the addressee. If this information was received in error, you are strictly prohibited from disclosing, copying, distributing or using any of this information and are requested to contact the sender immediately and destroy the material in its entirety, whether electronic or hardcopy.

Certain strategies discussed throughout the document are based on proprietary models of MFCM’s or its affiliates. No representation is being made that any account will or is likely to achieve profits or losses similar to those referenced.

Performance pertaining to the Currency Risk Management Overlay strategies is stated gross of fees. Performance pertaining to the Currency Alpha and Macro strategies may be stated gross of fees or net of fees. Performance information that is provided net of fees reflects the deduction of implied management and performance fees. Performance information that is provided gross of fees does not reflect the deduction of advisory fees. Client returns will be reduced by such fees and other expenses that may be incurred in the management of the account. Simulated model performance information and results do not reflect actual trading or asset or fund advisory management and the results may not reflect the impact that material economic and market factors may have had, and can reflect the benefit of hindsight, on MFCM’s decision-making if MFCM were actually managing client’s money in the same manner. Performance referenced herein for Currency Risk Management Overlay strategies prior to May 2004, the date that the Currency Risk Management team joined Mesirow Financial, occurred at prior firms. Performance referenced herein for Currency Alpha and Macro strategies prior to October 1, 2018, the date that the Currency Alpha and Macro Strategies team joined Mesirow Financial, occurred at prior firms. Any chart, graph, or formula should not be used by itself to make any trading or investment decision. Any currency selections referenced herein have been included to illustrate the market impact of certain currencies over specific time frames. The inclusion of these is not designed to convey that any past specific currency management decision by MFCM would have been profitable to any person. It should not be assumed that currency market movements in the future will repeat such patterns and/or be profitable or reflect the currency movements illustrated above.

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that a strategy’s returns or volatility will be similar to the indices. The strategy is compared to the indices because they are widely used performance benchmarks.

Mesirow Financial refers to Mesirow Financial Holdings, Inc. and its divisions, subsidiaries and affiliates. The Mesirow Financial name and logo are registered service marks of Mesirow Financial Holdings, Inc., © 2020, Mesirow Financial Holdings, Inc. All rights reserved. Investment management services provided through Mesirow Financial Investment Management, Inc., a SEC registered investment advisor, a CFTC registered commodity trading advisor and member of the NFA, or Mesirow Financial International UK, Ltd. (“MFIUK”), authorized and regulated by the FCA, depending on the jurisdiction.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters