Insights

Nothing lasts forever

Share this article

Is the US dollar an exception?

“If something cannot go on forever, it will stop.”1 The certainty of that quote made it famous, and its applicability is almost universal, dynasties included. The Roman Empire seemed perpetual to its enemies, but that rule ended after about 500 years. The loss of Tom Brady, some fans say, has doomed the long championship run of the New England Patriots. But is the saying true for the US dollar as the world's major reserve currency?

We talked about the rise of the dollar to post-World War II supremacy and about Bretton Woods, the peacetime structure of global commerce and finance. Bretton Woods centered on the United States converting US dollars to gold at $35 per ounce and other nations keeping their currencies at a fixed exchange rate solely with the dollar. The US’s focus on domestic issues at the expense of managing an international financial system resulted in a short-lived dynasty when Bretton Woods collapsed in the early 1970s.

Many economists at the time heralded the failure of Bretton Woods as the US dollar’s swan song, comparing the dollar’s likely future to sterling’s demise as the main international currency. “For someone who spent the 1960s in England, wrote British historian Emma Rothschild in 1978, the decline of the dollar is like coming home. Memories of an English girlhood: life in a continuing currency crisis.”2

But the US dollar continued to be the largest holding of central banks, international commerce was still invoiced in dollars, and commodity quotes remained in USD. The dollar reigned, although changes in American economic policies and fluctuations of dollar exchange rates following the end of Bretton Woods caused severe hardship for some emerging market nations. Those countries, particularly Asian nations and chiefly China, learned by harsh experience that holding massive quantities of US dollars was key to riding out global economic storms.

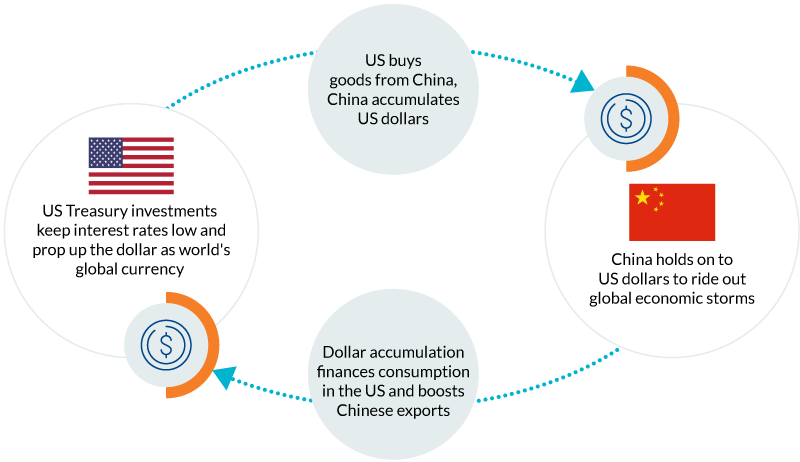

A pattern appeared: The US bought goods from these Asian countries who accumulated dollars, leading to an overvalued dollar and highly competitive currencies that boosted emerging market exports. That dollar accumulation helped reduce interest rates, financed deficit consumption by the US, and propped up the dollar as the world’s global currency. This economic structure is often referred to as Bretton Woods II.3

Bretton Woods II

Source: Mesirow Currency Management

Each global economic crisis threatened Bretton Wood II’s survival. Those crises and competition for reserve status were expected to result in a tri-reserve currency arrangement involving the dollar, euro, and renminbi. But the euro was plagued with debt crises and the renminbi has been hobbled by capital controls, investor concerns about transparency, and uncertainty about the government’s role in the currency market.4 Neither currency gained the critical mass to rival the dollar.

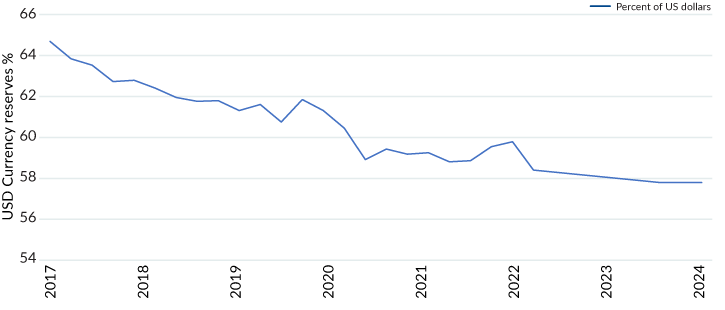

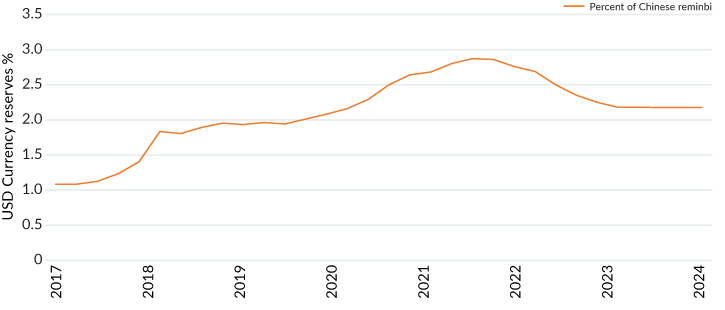

The Ukraine – Russia war is a new challenge to US dollar hegemony. The freezing of Russian assets (including currency reserves) was the end to Bretton Woods II, claimed Credit Suisse interest rates strategist Zoltan Pozsar, and the start of Bretton Woods III. Pozsar believed only the Chinese had the capability to supply financing to bridge the gap between Russian prices for energy (constrained by Western sanctions and price caps) and prices of energy provided by other suppliers. That unique role would offer an avenue for the Chinese to propel the renminbi into a dominant currency role. But the chaotic economic situation at the start of the war in February 2022 eased, and the currency reserve data through 2024 show the war has not been a world-altering event for the Chinese currency. The renminbi has been unable to take advantage of the US dollar's slow decline, staying below three percent of reserve currency holdings.

CHART 1: Currency composition of official foreign exchange reserves - USD (2017 – 2024)

Source: International Monetary Fund Currency Composition of Official Foreign Exchange Reserves

CHART 2: Currency composition of official foreign exchange reserves - RMB (2017 – 2024)

Source: International Monetary Fund Currency Composition of Official Foreign Exchange Reserves

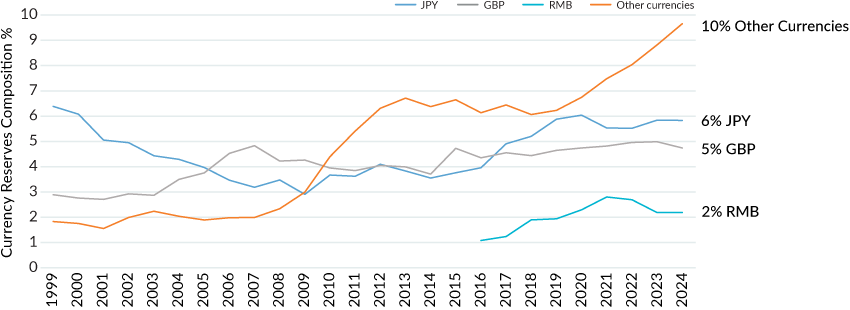

Some economists say the dollar is under stealthy threat from a multi-currency group including the South Korean won, Swedish krona, and other lesser-traded currencies. From 1999 to the end of 2024, dollar holdings as reserve currency declined by about thirteen percentage points (71.0 to 57.8 percent) while holdings of these other currencies increased from 1.83 percent to 9.64 percent. These currencies may continue to increase in reserve currency holdings at the dollar's expense.

CHART 3: CURRENCY COMPOSITION OF OFFICIAL FOREIGN EXCHANGE RESERVES (1999 – 2024)

Source: International Monetary Fund Currency Composition of Official Foreign Exchange Reserves

If not an individual currency or group of them, what else might dethrone the dollar? Digital currencies are a possibility. Central banks are scrambling to provide their citizens, and perhaps those of other nations, with a central bank digital currency. Three nations (Nigeria, The Bahamas, and Jamaica) have launched a central bank digital currency, and every G20 country is exploring a central bank digital currency. Of those G20 countries, thirteen are in the pilot stage including Brazil, Japan, Australia, and Turkey. It’s uncertain whether a first mover in central bank digital currencies will have significant advantages over late comers or how these digital currencies might affect reserve currency holdings.

Finally, a grim possibility for change in reserve currency leadership: The US dollar came to dominance because of war, and war could cause the United States to lose its currency supremacy. Wars don’t last forever, but the consequences of armed conflict can change the world.

Explore

US dollar: Currency dynasty

Is the USD's position as the world's reserve currency safe, or is its decline inevitable?

The central bank digital currency threat

Nations are rushing to launch CBDCs. Will the US be a leader or a laggard in the digital currency race?

1. Herbert Stein, Senior Fellow at American Enterprise Institute. https://www.cepweb.org/if-something-cannot-go-on-forever-it-will-stop/# | 2. Rothschild, Emma. “Pounds Then, Dollars Now.”, New York Times, 19 March 1978. https://www.nytimes.com/1978/03/19/archives/pounds-then-dollars-now-foreign-affairs.html | 3. The Economist. What comes after Bretton Woods II? https://www.economist.com/finance-and-economics/2019/08/15/what-comes-after-bretton-woods-ii | 4. https://crsreports.congress.gov/product/pdf/IF/IF11707# | 5. https://www.imf.org/en/Blogs/Articles/2022/06/01/blog-dollar-dominance-and-the-rise-of-nontraditional-reserve-currencies | 6. https://www.atlanticcouncil.org/cbdctracker/

Originally published March 2023, updated May 2025 | The information contained herein is for professional investors, institutional clients, Eligible Contract Participants and Qualified Eligible Persons, or the equivalent classification in the recipient’s jurisdiction, only and is for informational purposes only. Past performance is not an indication of future results. Actual results may be materially different from the results achieved historically.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters