Insights

The US hedging advantage

Share this article

Potential to increase return while reducing risk by simply hedging currencies

For US investors, the management of currency risk in their portfolios has historically been an afterthought for a variety of reasons and assumptions, chief among them: zero expected return, portfolio diversification, and low materiality in the portfolio. We will touch upon each of these views, discussing their validity, evolution, and relevancy within the current market environment.

Zero expected return

Assumption – Currencies have zero expected return, so currency management is unnecessary as it will wash out in the end.

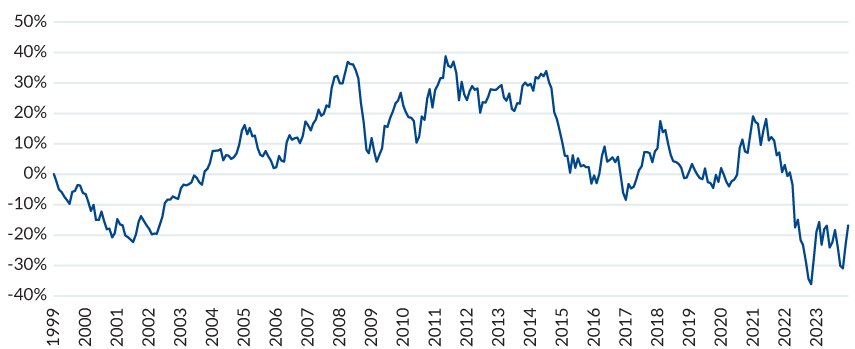

Historically, developed market currencies have not added or detracted meaningful return in multi-decade time horizons. Since the introduction of the Euro in 1999, EAFE currencies have gone full cycle, crossing the 0% return line again in early 2022 (Figure 1).

However, the impact over shorter time horizons is relevant as both plans and managers are often judged over periods as short as one to five years. Even with longer time horizons of ten years or more, volatile currency swings up to 50% have occurred, episodically adding or detracting significant value to the total equity portfolio.

FIGURE 1: EAFE CURRENCY RETURN

Source: Bloomberg, MSCI, Mesirow. Performance from January 1999 – December 2023. Past performance is not necessarily indicative of future results. Actual results may materially differ.

The information contained herein is intended for institutional clients, Qualified Eligible Persons, Eligible Contract Participants, or the equivalent classification in the recipient’s jurisdiction, and is for informational purposes only. Nothing contained herein constitutes an offer to sell an interest in any Mesirow Financial investment vehicle. It should not be assumed that any trading strategy incorporated herein will be profitable or will equal past performance. Please see the disclaimer at the end of the materials for important additional information.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters