Inflation, interest rates and your pocketbook

Share this article

At the onset of the pandemic a few years ago, the US Government and the Federal Reserve took aggressive action to support the US economy as it went into a self-imposed shutdown. Congress passed the Cares Act which provided the public with stimulus checks, and the federal funds rate was lowered to nearly zero. The goal of these policies was to flood the economy with dollars to fight off instability and unemployment until the virus could be contained.

Over three years later, we are experiencing the inflationary effects of those stimulus programs. The Russian invasion of Ukraine further jolted inflation as the commodity and oil markets spiked and supply chain disruptions worsened. Today, inflation continues at the highest rate since the early 80’s and the Federal Reserve is taking action to combat it. This article discusses how such an environment could affect your personal finances.

The impact of rising inflation

Inflation is a measure of the rate of increase of prices for goods and services in an economy, which has popularly been measured by the Consumer Price Index “CPI.” In any growing economy, there is a natural and healthy level of inflation. The primary effect of increased levels of inflation to consumers is an erosion of purchasing power, with the value of a dollar being worth less than before. Savings, wages, and fixed income streams are all devalued, which can lead consumers to move up scheduled expenses to get ahead of upcoming price increases. This adds fuel to the inflation cycle, progressively ratcheting it up to unhealthy levels.

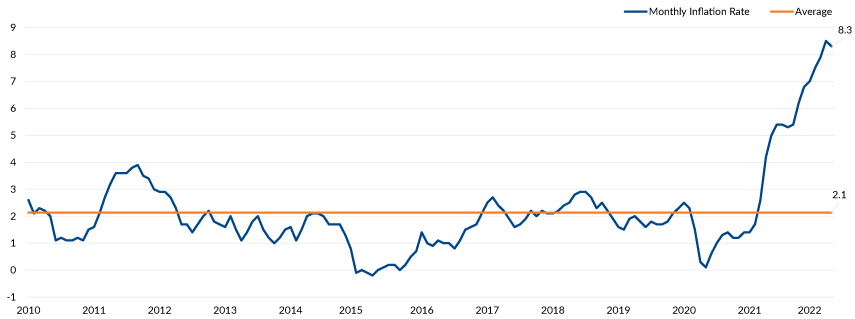

Since 1913, when the Government started tracking inflation, the US has averaged 3.10% growth a year through 2020.¹ However, there have been several periods when inflation has deviated from this average, such as the late 1970s to early 1980s when inflation reached 14.5%.¹ In 2022, we saw an unprecedent level of inflation as the economy fully reopened. Recently, the Labor Department reported retail inflation for April 2023 of 8.3% year-over-year.² While some argue that rising interest rates may cause inflation to peak, April’s rate was well above the year-over-year average of 2.1% recorded since 2010.³ The chart below highlights the increase in the rate of inflation since January 1, 2010.

Inflation Since 2010

Between 2010 and 2022, the average rate of inflation hovered at 2.1%, while there was variance between 0 and 4%; however, between 2021 and 2022, it rose dramatically to approximately 8.3%.

Between 2010 and 2022, the average rate of inflation hovered at 2.1%, while there was variance between 0 and 4%; however, between 2021 and 2022, it rose dramatically to approximately 8.3%.

Source: bls.gov

While investing during uncertain times can be unsettling for investors, it is important to keep a long-term view and understand that market volatility can create attractive buying opportunities. If investing in equities, it is key to invest in high quality businesses with competitive advantages and strong pricing power that will perform well over the long term. If investors are concerned about inflation eroding their purchasing power, they should consider investing in Treasury Inflation-Protected Securities (TIPS) or Series I-Bonds, a Treasury protected investment which has a yield tied to inflation. As of November 2023, I-Bonds had an annual yield of 5.27%.4

To keep inflation in check, the Federal Reserve has historically relied on a policy of increasing borrowing rates to help cool down levels of spending. Inflation will be an important metric to follow, as further step-downs in inflation may ease the Fed’s pressure to raise interest rates at an accelerated pace.

The impact of rising interest rates

The Federal Reserve increased interest rates for their first time since 2018 in March 2022 and kept raising it throughout the year, in 2023 the year-end rate was 5.25-5.5%.”

When the Federal Reserve increases rates, the most notable effect takes place in lending markets. Adjustable-rate loans such as credit cards, Adjustable Rate Mortgages, and Home Equity Lines of Credit will be subject to increasing rates, and thus increased monthly payments for the borrower. Existing fixed rate loans will be sheltered from increasing rates, but future loans would be subject to higher carrying costs, potentially providing an impetus to apply for a loan sooner than planned.

The flip side to increased borrowing costs is an increase in bank savings rates. Currently, savings accounts pay next to nothing on your cash holdings. If interest rates continue to increase, banks will begin paying more to keep your funds in an account. Money market accounts, High Yield savings, and Certificates of Deposit will all likely provide higher returns than in the recent past. This added incentive may increase your willingness to keep money in cash reserve or an increased allocation to fixed income investments.

Be prepared for what’s next

These are just a few of the aftershocks that would be produced by persistent inflation and by the Federal Reserve’s subsequent actions to counter it. It’s important to note that all economies have myriad elements and unknowns that can alter its trajectory. Attempting to time or predict moves in interest rates cannot be done with any level of certainty.

We believe the best way to prepare for inflation and or rising interest rates is by consulting your Mesirow advisor and reviewing your long-term goals and financial plan. Your advisor will be able to help guide you through decisions relating to refinancing, funding loan payoffs, utilizing savings accounts and more as it pertains to your unique situation.

Published February 2026

1. www.inflationdata.com | 2. Department of Labor – 5/11/2022 | 3. Bloomberg | 4. treasurydirect.gov

Connect with an advisor

Mesirow does not provide legal or tax advice. Past performance is not indicative of future results. The views expressed above are as of the date given, may change as market or other conditions change, and may differ from views express by other Mesirow associates. This is not a solicitation to buy or sell the securities mentioned. Do not use this information as the sole basis for investment decisions, it is not intended as advice designed to meet the particular needs of an individual investor. Information herein has been obtained from sources which Mesirow believes to be reliable, we do not guarantee its accuracy and such information may be incomplete and/or condensed. All opinions and estimates included herein are subject to change without notice. This communication may contain privileged and/or confidential information. It is intended solely for the use of the addressee. If you are not the intended recipient, you are strictly prohibited from disclosing, copying, distributing or using any of the information. If you receive this communication in error, please contact the sender immediately and destroy the material in its entirety, whether electronic or hard copy. This material is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.

Mesirow refers to Mesirow Financial Holdings, Inc. and its divisions, subsidiaries and affiliates. The Mesirow name and logo are registered service marks of Mesirow Financial Holdings, Inc. ©2026, Mesirow Financial Holdings, Inc. All rights reserved. Any opinions expressed are subject to change without notice. Past performance is not indicative of future results. Advisory Fees are described in Mesirow Financial Investment Management, Inc.’s Form ADV Part 2A. Advisory services offered through Mesirow Financial Investment Management, Inc. an SEC registered investment advisor. Securities offered by Mesirow Financial, Inc. member FINRA and SIPC.