What to expect “financially” when you’re expecting

Share this article

Having a baby is one of the most exhilarating and awe-inspiring moments in most people’s lives, truly a time of profound emotion and personal joy. However, that joy also comes with additional financial complexities that can be dealt with by planning ahead. Below are some planning tips to maintain financial stability for the expecting family.

Health insurance coverage

The most immediate expenses to address are the Medical costs associated with pregnancy. Even with existing health care coverage, these expenses can add up to quite a large out-of-pocket sum. Having a child in 2024 differs by state, but ranges between $6,000 to over $13,000. 1 With the addition of regular insurance premiums and co-pays for prenatal check-ups, the total cost can be unexpectedly high. Prior to giving birth, check with your insurance provider to understand your coverage and what costs you can expect to pay for.

Create a “baby budget”

Once you understand the budget for medical, you should begin to look ahead and plan for the one-time and ongoing costs with your baby. Getting a grasp on what these expenses look like before your child arrives will help to ease this transition from your existing budget. Below are just a few of the important considerations to make.

Maternity / Paternity Leave

Check with your Human Resources department to get an explanation of the amount of time you’re entitled to and if you’ll be receiving pay. Understanding these benefits for expecting parents will not only help with scheduling but also help prepare for any short-term loss of income.

Childcare

After you’ve exhausted your maternity / paternity leave, what happens next? Will one parent leave their job to stay home with the baby? Will you both continue working? If so, will you hire a nanny or use daycare?

A recent survey conducted by YouGov showed US families spend an average of $8,355 per year on childcare.2 Of course, these expenses vary drastically state to state and between daycare and a nanny. Expecting parents should plan early and begin shopping around to determine their upcoming costs. One way to offset some childcare costs is through the use of a Dependent Care Flexible Spending Account. Typically offered as an employee benefit, these plans allow you to set aside $5,000 annually per employee in pre-tax dollars to be used for various qualified expenses, including childcare. This will likely be your largest ongoing expense for the first several years, so every bit of savings count

Nursery, diapers, and more

Your budget should be sure to account for both one-time big-ticket items such as a crib, stroller and a car seat, as well as ongoing costs like diapers, formula, clothing and more diapers. If you’re anticipating a baby shower, a good practice is to create a “must-have” list which could help to ensure some of your essentials are paid for.

College Savings Plan

Finally, consider establishing a 529 college savings plan with additional funds. This is a tax-advantaged investment account that allows for parents, family members, and friends to make contributions up to $18,000 per person per year for the benefit of a child. A 529 plan allows for federal tax-deferred growth, tax-free withdrawals on qualified expenses and in some instances, state tax deductions on your contributions. An additional benefit of 529 plans is that beginning in 2024, any unused funds in the plan can be converted into a Roth 401k, subject to contribution limits.3

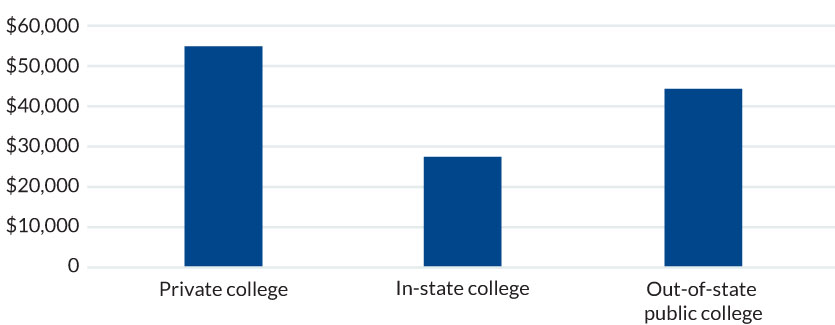

Average cost of attendance

Source: College Board. Trends in College Pricing and Student Aid, 2020

There will be no shortage of expenses once your child arrives, so you’ll want to take advantage of available tax breaks and create and understand your “baby budget” as early as possible while also keeping in mind the need for flexibility.

Aside from the additional costs you face upon your child’s birth, there are several other important non-expense related items to consider that will protect you and your baby.

Create a Will

While it isn’t pleasant to think about, tragedies can occur to one or even both parents. Ensuring that your child is protected in the event of an untimely death starts with having the proper legal documents in place. At the basic level, you’ll want to create a will that designates a legal guardian for your child. Doing so will guarantee your child will be cared for as per your wishes and avoid leaving such an important decision to the mercy of the courts.

Life Insurance

Purchasing life insurance can help provide resources for your child in the event of the passing of one or both parents. When deciding how much insurance to buy, factors to consider include the loss of your income for 18-20 years, covering outstanding debts such as a mortgage, and the cost of college tuition, just to name a few.

Disability Insurance

If an illness or injury prevents you from working for long enough, your company may stop paying your income. Obtaining long-term disability coverage, either through work benefits or on the open market, can help to cover up to 60% of your income in such an occurrence. This type of protection is especially important as the increased expenses associated with your child are often essential and cannot be reduced.

Expecting the arrival of your first child is an exciting time for you and those closest to you. It can also welcome undesired stress both emotionally and financially. However, with some diligence and thoughtful planning with your Mesirow Wealth Advisor, your anxieties can be eased so you can focus on what’s important to you.

Published January 2026

1. https://www.foxnews.com/lifestyle/how-much-money-costs-have-baby-2024-report

2. https://www.bankrate.com/finance/credit-cards/summer-childcare-survey/

3. https://www.forbes.com/sites/andrewrosen/2023/02/16/the-secure-act-20-and-your-529-plan/?sh=6217252b6a8b

Connect with an advisor

Mesirow does not provide legal or tax advice. Past performance is not indicative of future results. The views expressed above are as of the date given, may change as market or other conditions change, and may differ from views express by other Mesirow associates. This is not a solicitation to buy or sell the securities mentioned. Do not use this information as the sole basis for investment decisions, it is not intended as advice designed to meet the particular needs of an individual investor. Information herein has been obtained from sources which Mesirow believes to be reliable, we do not guarantee its accuracy and such information may be incomplete and/or condensed. All opinions and estimates included herein are subject to change without notice. This communication may contain privileged and/or confidential information. It is intended solely for the use of the addressee. If you are not the intended recipient, you are strictly prohibited from disclosing, copying, distributing or using any of the information. If you receive this communication in error, please contact the sender immediately and destroy the material in its entirety, whether electronic or hard copy. This material is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.

Mesirow refers to Mesirow Financial Holdings, Inc. and its divisions, subsidiaries and affiliates. The Mesirow name and logo are registered service marks of Mesirow Financial Holdings, Inc. ©2026, Mesirow Financial Holdings, Inc. All rights reserved. Any opinions expressed are subject to change without notice. Past performance is not indicative of future results. Advisory Fees are described in Mesirow Financial Investment Management, Inc.’s Form ADV Part 2A. Advisory services offered through Mesirow Financial Investment Management, Inc. an SEC registered investment advisor. Securities offered by Mesirow Financial, Inc. member FINRA and SIPC.