COVID-19, Economy and FX: Past, Present and Future

Analyzing pandemic economic effects and foreign exchange rate movements

Mesirow Currency Management (“MCM”) offers an extensive analysis of the economic impact of the COVID-19 pandemic and its effect on several currencies. They then explain a predictive model that utilizes COVID-19 indicators to generate FX trading signals in their recent insight “COVID-19, Economy and FX: Past, Present and Future.”

Different country, different pandemic lockdown policies

As each country had different pandemic lockdown policies, different underlying economies, different population distributions, and varying levels of vaccination rates, it is expected that the divergence among economies will feed through to movements in foreign exchange rates.

The goal of MCM's research is to 1) understand the effect of the COVID-19 pandemic on different types of economies 2) understand the correlation between COVID-19 statistics and FX markets and 3) create a predictive model based on a COVID-19 infection rate signal in order to opportunistically predict currency depreciations.

Economic effects of COVID-19

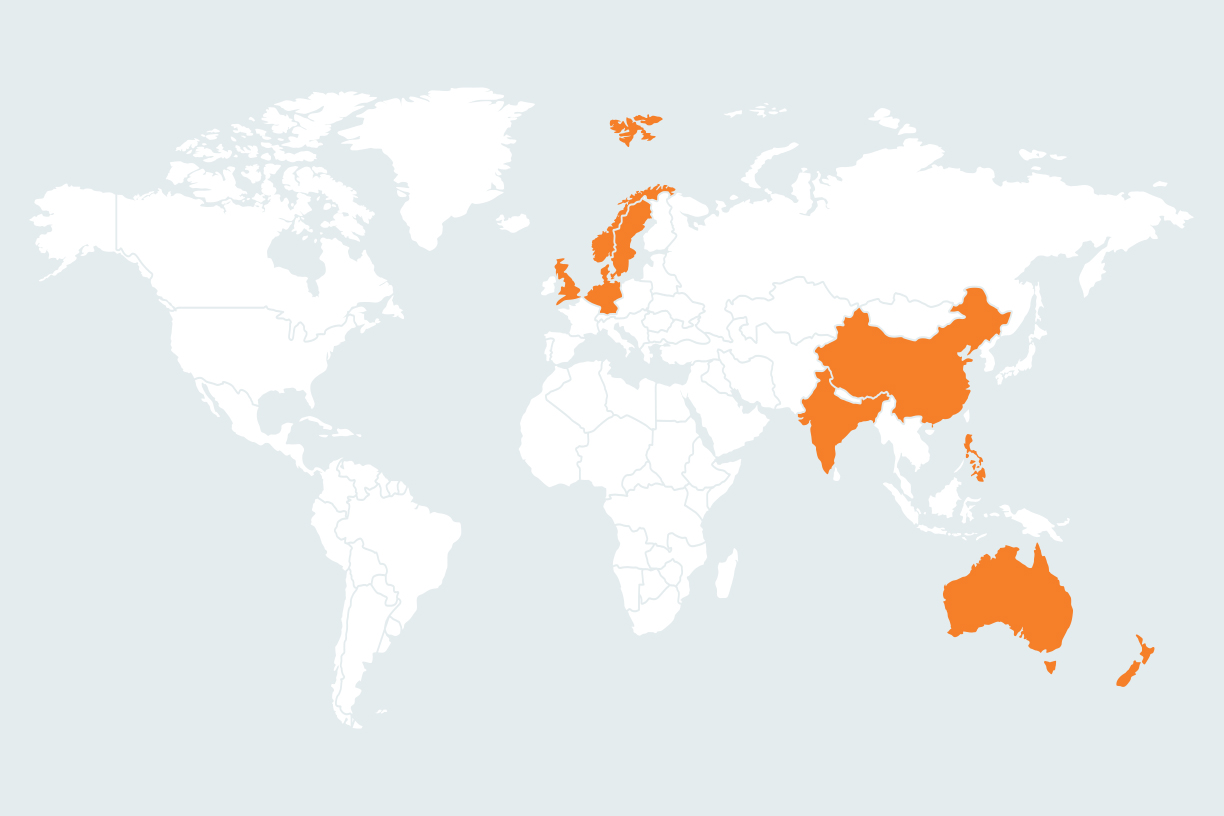

The countries selected for the first portion of the study were as follows: United Kingdom, Germany, Norway, Philippines, India, China, Australia, New Zealand, and Sweden. These countries were selected based on COVID lockdown strategies and underlying economies (services oriented vs. manufacturing oriented, export vs. import economies, etc.).

COVID-19 specific data (infections, deaths, vaccinations) was obtained from Our World in Data. Economic data for each country was obtained from Bloomberg and from the Organisation for Economic Co-operation and Development (OECD).

UK | A services oriented economy. The U.K. experienced the largest single quarterly real GDP decline of all the countries in the study. Given that services accounted for 79.6% of the U.K.’s GDP in 2020 and lockdowns directly impacted services-oriented businesses, this drop in real GDP is no surprise.

GDP

| 19.4% decline in 2Q20 | |

| 17.6% rebound during 3Q20 |

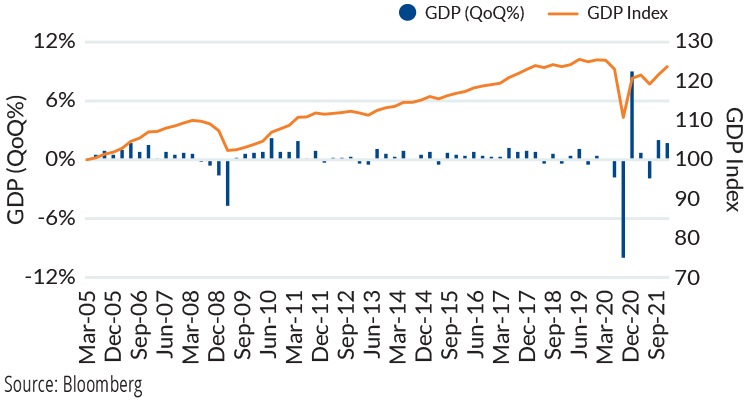

Germany | A manufacturing and export oriented economy. Given the sensitivity to the COVID-19 cycles and lockdown policies, Germany’s quarterly GDP has not recovered to its pre-pandemic levels. Similarly, Germany’s unemployment rate reached a peak of 6.4% in 2Q20 and has been steadily declining since.

The largest components of Germany's real GDP are industrial production (excluding construction), manufacturing, public administration and defense, and wholesale/retail trade and food services.

GDP

| 10.0% decline in 2Q20 | |

| 9.0% rebound in 3Q20 |

Germany's Real GDP (March 2005 – September 2021)

Philippines | An emerging economy. An example of a manufacturing and export oriented emerging economy, the Philippines was more sensitive to lockdowns relative to the other countries in this study. Exports fell by 24.4% in 2Q20, driven by the lockdowns and decreases in imports from its top trade partners, such as the U.S., Japan and China.

GDP

| 21.3% decrease in exports of goods | |

| 27.7% decrease in exports of services |

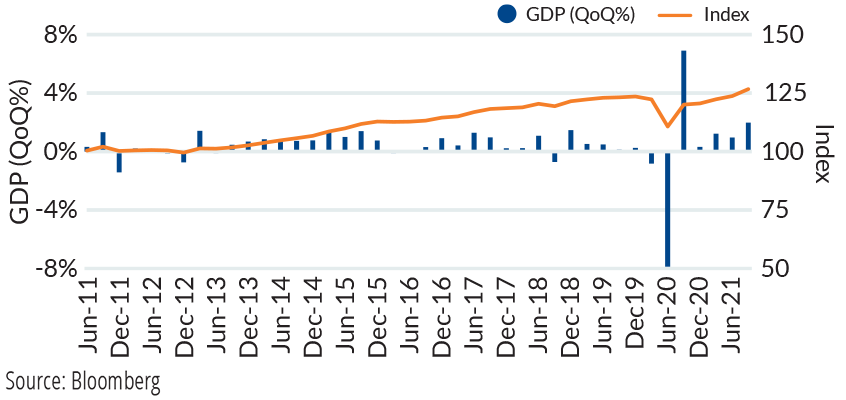

Sweden | Lockdown resistance. Sweden presents an interesting case study of a country that resisted lockdowns in response to the initial waves of COVID-19. Sweden’s quarterly GDP fell by 8 % in 2Q20 and has been recovering since. Driving the loss in GDP included losses in wholesale retail and trade/accommodation and food services, industrial production, manufacturing and professional/scientific and support services.

Sweden's Real GDP (June 2011 – September 2021)

Norway | An oil-based economy. Norway presents an interesting case study of how an oil-oriented economy performed during the pandemic.

GDP

| 4.7% fall in 2Q20, but has been recovering since |

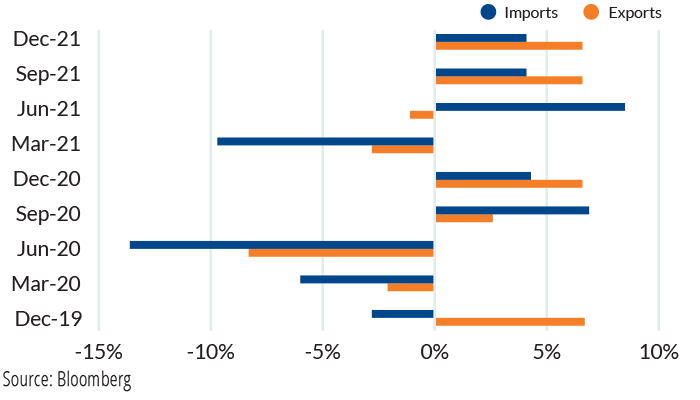

Norway exports & imports (December 2019 – December 2021)

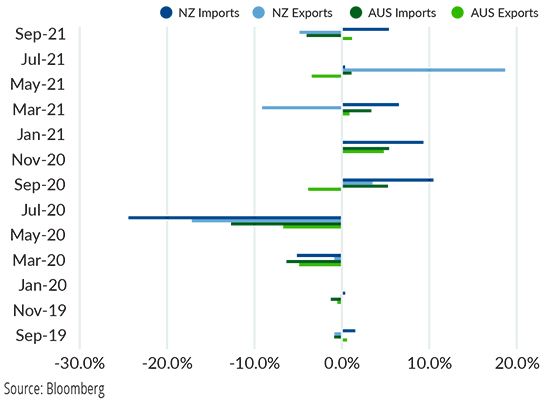

Australia and New Zealand | Strict quarantine and closure policy. Both Australia and New Zealand have similar services-oriented economies, with services driving 75% of Australia’s GDP and 74% of New Zealand’s GDP.

Both countries diverge from others in our current study because of their extensive approach to curb COVID-19 infections through border closures, strict quarantine policies, contact tracing, and lockdowns. Both countries experienced sharp decreases to their exports and imports in 2020 and have struggled to recover to pre-pandemic levels.

Australia and New Zealand Imports & Exports (September 2019 – September 2021)

COVID-19 and FX

Given COVID-19’s level of disruption to everyday economic activity, it is anticipated that there should be a link between COVID-19 variables (infection rates, death rates, excess mortality) and foreign exchange rates. The study looked at the relationship between the level of infections, deaths, and excess mortality on exchange rates for 28 currency pairs.

Assuming the USD as the base currency, it was anticipated that the level of COVID-19 infections, deaths and excess mortality would be negatively correlated to the exchange rate. In other words, each acceleration in COVID-19 infections within each cycle in country n would correspond to a depreciation in that country’s currency.

Predictive model

Considering the economic data and our analysis, the following hypothesis, which constitutes the basis of the predictive model design, was established:

-

There is a negative correlation between a country’s COVID indicators and its currency strength.

-

If this assumption is true, a predictive mechanism applied to a country’s COVID indicators can be used to generate signals to short its currency against the USD as soon as the COVID situation is about to worsen.

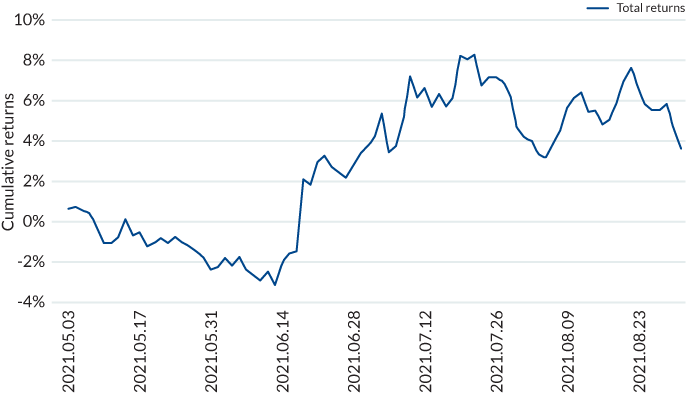

Over a portfolio of 28 currency pairs, the model applied a simple linear regression to the number of daily new COVID-19 cases in each country to, mainly, short the currencies against the USD. After optimizing the model’s hyper-parameters over the validation data, the model resulted in 3.35% positive returns over the out-of-sample period.

SIMULATED Monthly returns during the out-of-sample period (May 2021 – August 2021)

| May 2021 | June 2021 | July 2021 | August 2021 | Total out-of-sample returns |

| -2.40% | 5.95% | 0.41% | -0.61% | 3.35% |

Cumulative total returns over the out-of-sample period (May 2021 – August 2021)

Source: Mesirow

One of the challenges of writing a paper during a pandemic is that the situation is constantly evolving. The analysis presented in MCM's paper provides a framework for how a new wave of infections will affect countries. Download the full paper below.

The information contained herein is for professional investors, institutional clients, Eligible Contract Participants and Qualified Eligible Persons, or the equivalent classification in the recipient’s jurisdiction, only and is for informational purposes only. Past performance is not an indication of future results. Actual results may be materially different from the results achieved historically.