Emerging Markets Currency Alpha Strategy

For institutional investors

As an independent currency specialist, Mesirow Currency Management has been delivering innovative, customized currency solutions to institutional clients globally since 1990.1 Being a private, employee owned firm, Mesirow is free from many conflicts of interest associated with bank-affiliated organizations or publicly held firms and is fully aligned with the interests of its clients.

Emerging MARKETS CURRENCY ALPHA STRATEGY2

- Strategy commenced trading February 2008

- Low or negative correlation to equities, bonds, and other alternative investments

- Systematic (Technical, Fundamental) and Discretionary (Market Information) investment style

- Region - Emerging Markets

performance data | January 2026 (%)

| MTD | YTD | 3-Year | 5-Year | Since inception | |

| Gross of Fees | 5.73 | 5.73 | 7.13 | -0.17 | 5.92 |

| Net of Fees | 5.66 | 5.66 | 6.33 | -0.91 | 4.52 |

| Source: Mesirow | Please see PDF below for more performance statistics. | |||||

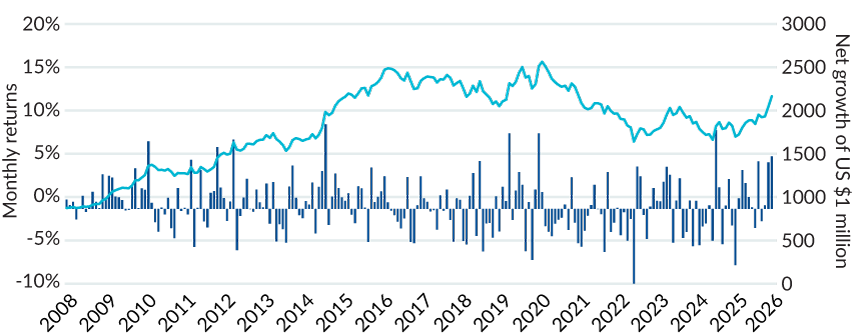

net monthly and cumulative performance

Source: Mesirow

The information contained herein is for professional investors, institutional clients, Eligible Contract Participants and Qualified Eligible Persons, or the equivalent classification in the recipient’s jurisdiction, only and is for informational purposes only. Performance of the Extended Markets Currency Alpha Strategy prior to October 1, 2018 was attained at The Cambridge Strategy, an unaffiliated investment manager. On October 1, 2018, a MFIM affiliate completed the purchase of a significant portion of TCS’ assets, including TCS’ intellectual property and hired a majority of TCS employees. Past performance is not an indication of future results. Actual results may be materially different from the results achieved historically. Please refer to the disclaimer at the end of these materials for important additional information. | 1. Track record for Currency Risk Management Overlay strategies prior to May 2004, the date that the Currency Risk Management team joined Mesirow, occurred at prior firms. Track record for Currency Alpha and Macro strategies prior to October 1, 2018, the date that the Currency Alpha and Macro Strategies team joined Mesirow, occurred at prior firms. | 2. Performance of the Emerging Markets Currency Alpha Strategy prior to October 1, 2018, was attained at The Cambridge Strategy (TCS), an unaffiliated investment manager. On October 1, 2018, a MFIM affiliate completed the purchase of a significant portion of TCS’ assets, including TCS’ intellectual property and hired a majority of TCS employees. Past performance is not an indication of future results. Actual results may be materially different from the results achieved historically. | Notes on performance: The Emerging Markets Currency Alpha Strategy commenced trading in February 2008 as a carve-out from an institutional account. From February 2008 through December 2010 performance is based on an equal-weighted composite of all accounts invested in the Emerging Markets Currency Alpha Strategy; from January 2011 performance is based on the asset weighted performance of all accounts invested in that strategy. Fees are based on a client’s volatility level, which can be customized to their preference. Net returns are calculated using implied management fees of 0.75% per annum and performance fees of 10% per annum, which are the highest fee level based on the highest volatility level. Performance fees are accrued daily, paid quarterly and a high water mark is employed. Performance is in USD and all returns and statistics are based on monthly returns. The composite includes all fee paying accounts, including both commingled and managed accounts. Currency trading may involve instruments that have volatile prices, are illiquid or create economic leverage. Emerging markets securities involve risks such as currency fluctuation and political and economic instability that could result in additional volatility. Unhedged short sales expose the strategy to additional liability. | Past performance is not an indication of future results. Actual results may be materially different from the results achieved historically. | Nothing herein is meant to be taken as a recommendation to buy or sell a particular asset or invest in a particular strategy.