Insights

2021 Year-End Sector Report: Packaging Perspectives

Share this article

2021 Year-end review

The packaging sector experienced very strong transaction volumes in 2021, with Mesirow completing 18 transactions, a new record, following eight transactions last year. Key M&A

drivers were robust demand aided by pandemic tailwinds, strong valuations and an abundance of capital among strategic and financial buyers. Packaging companies will continue to experience elevated M&A activity in 2022, especially as consumer e-commerce behaviors and demand for sustainable packaging drive further values within the sector, and as strategic and financial buyers leverage their capital access to pursue accretive acquisitions.

Share price performance and public market valuations

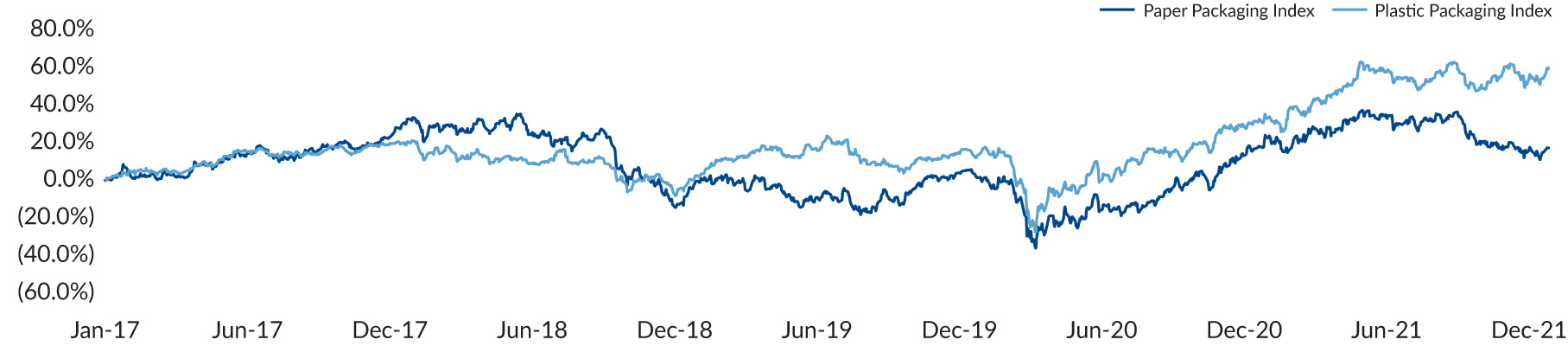

Over the past year, the share prices of packaging companies have increased despite COVID-19 effects, supply chain disruptions and significant inflationary (raw material, labor, etc.) pressures. Share prices for plastic packaging companies ended up 22% for the year, while those for paper packaging companies remained flat. The past five-year share price performance for plastic packaging companies and paper packaging companies have been up 60% and 17%, respectively (Chart 1), both underperforming the overall market (S&P 500 Index up 111%).

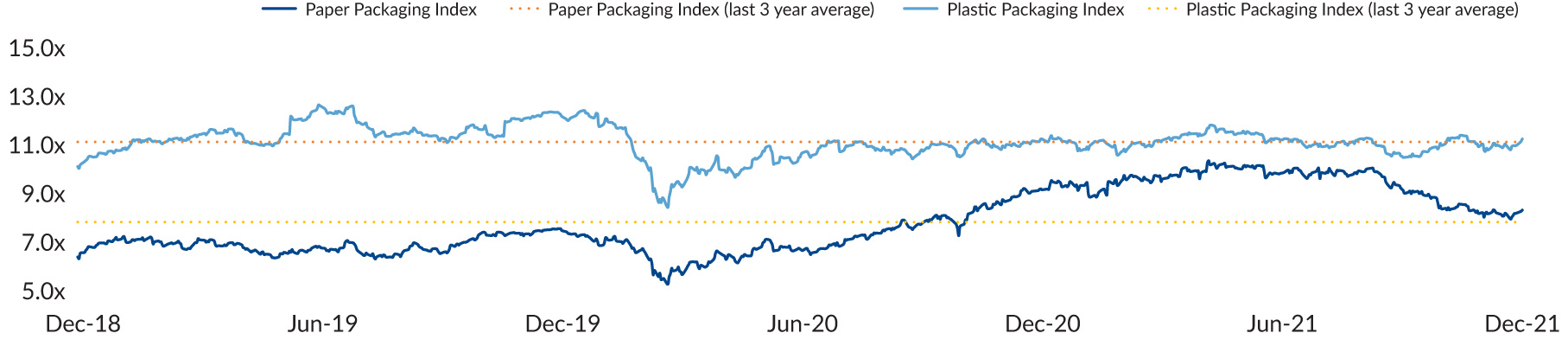

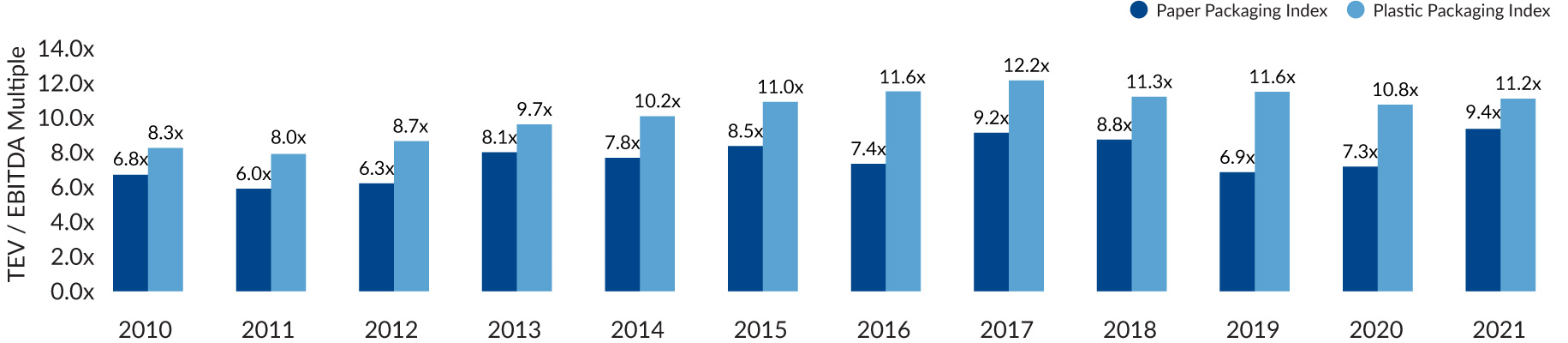

Public market valuations for both plastic and paper packaging companies also increased in 2021 from last year. Plastic packaging companies’ valuations at the end of the year were at 11.3x EV / EBITDA, slightly above their three-year average of 11.2x, while paper packaging companies’ valuations were at 8.4x EV / EBITDA versus their three-year average of 7.9x (Charts 2 and 3).

CHART 1: SHARE PRICE PERFORMANCE – PACKAGING INDICES1

Source: S&P Capital IQ as of December 31, 2021. Past performance is not indicative of future results. Please see below for important information.

CHART 2: PUBLIC PACKAGING COMPANY PERIOD END TEV / EBITDA MULTIPLES1

Source: S&P Capital IQ as of December 31, 2021. Past performance is not indicative of future results. Please see below for important information.

Source: S&P Capital IQ as of December 31, 2021. Past performance is not indicative of future results. Please see below for important information.

CHART 3: PUBLIC PACKAGING COMPANY ANNUAL AVERAGE TEV / EBITDA MULTIPLES1

Source: S&P Capital IQ as of December 31, 2021. Note: Average TEV / EBITDA multiples as of December 31 for 2010–2021. Please see below for important information.

Source: S&P Capital IQ as of December 31, 2021. Note: Average TEV / EBITDA multiples as of December 31 for 2010–2021. Please see below for important information.

1. Paper Packaging Index: BillerudKorsnäs AB (BILL:OME); DS Smith Plc (SMDS-LON); International Paper Company (IP-US); Mayr-Melnhof Karton AG (MMK-WBO); Mondi plc (MNDI-LON); Smurfit Kappa Group plc (SKG-LON); Stora Enso Oyj (STERV-HEL); UPM-Kymmene Oyj (UPM-HEL); WestRock Company (WRK-US).

Plastic Packaging Index: Amcor PLC (AMCR-US), Aptargroup, Inc. (ATR-US), Avery Dennison Corporation (AVY-US), Berry Global Group Inc (BERY-US), CCL Industries Inc. Class B (CCL.B-CA), Sealed Air Corporation (SEE-US), Silgan Holdings Inc. (SLGN-US).

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters