Insights

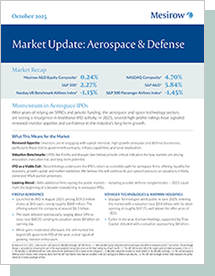

October 2025 Market Update: Aerospace & Defense

Share this article

MOMENTUM IN AEROSPACE IPOs

After years of relying on SPACs and private funding, the aerospace and space technology sectors are seeing a resurgence in traditional IPO activity. In 2025, several high-profile listings have signaled renewed investor appetite and confidence in the industry’s long-term growth.

WHAT THIS MEANS FOR THE MARKET

Renewed Appetite | Investors are re-engaging with capital-intensive, high-growth aerospace and defense businesses, particularly those tied to government contracts, military capabilities, and lunar exploration.

Valuation Benchmarks | IPOs like Firefly and Voyager provide critical indicators for how markets are pricing innovation, execution risk, and long-term potential.

IPO as a Viable Exit | Recent listings underscore the IPO’s return as a credible path for aerospace firms, offering liquidity for investors, growth capital, and market validation. We believe this will continue to put upward pressure on valuations in hotly contested M&A auction processes.

Looking Ahead | With additional firms eyeing the public markets – including possible defense conglomerates – 2025 could mark the beginning of a broader reawakening in aerospace IPOs.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters