Insights

Argentina’s $40 billion lifeline

Share this article

November 16, 2025

Bailout or bet—can US dollars stabilize a collapsing peso?

When we explored speculative currency attacks, Argentina was already teetering on the edge of financial instability. Facing a collapsing peso, persistent inflation, and dwindling reserves, Argentina has secured temporary access to a $20 billion swap line, a politically charged lifeline from the US Treasury.

The move echoes past efforts to stave off devaluation, but history offers sobering lessons: currency defenses without deep reform rarely hold. As markets digest the implications and voters reflect on the October 26 elections, the question looms—will this infusion of dollars be the foundation of future prosperity, or merely delay the inevitable?

Milei’s economic reforms

The Argentine crisis is rooted in waning confidence in President Javier Milei and his economic reforms. Elected as an anarcho-capitalist in 2023 promising to subdue inflation, cut spending and shrink government, Milei still grapples with monthly inflation of two percent. His dismissal of thousands of public employees and subsidy cuts have triggered rising unemployment and widespread protests.

The president suffered a severe blow when the opposition center-left Peronist coalition trounced Milei’s party in Buenos Aires provincial elections in early September. Despite that crushing defeat, Milei and his supporters won an unexpectedly high percentage of the October 26 national vote, securing enough seats to shield his legislation agenda from vetoes and bolster his mandate for reform.

Peso under pressure

Milei’s domestic problems are compounded by currency issues. Argentinians, wary of the peso’s declining purchasing power, increasingly hold dollars. Currency traders exploit Argentina's dual exchange rate system – buying dollars at the official rate and selling them on unofficial exchange markets for a profit of 8 to 10 percent or more. This arbitrage trade drains central bank reserves, widens the gap between official and unofficial rates and signals expectations of further depreciation.

Source: Getty Images

Argentina’s currency swap

The weakening peso forces Argentina to sell precious dollars to support the currency. But insufficient US dollars handcuff efforts to prop up the Argentine peso and repay foreign debt that includes an enormous $40+ billion obligation to the International Monetary Fund.

In response, the US Treasury approved a $20 billion swap line sourced from the Exchange Stabilization Fund. Access to the Fund (controlled by the Treasury to influence the US dollar’s value and to provide financial aid to countries), will allow Argentina to buy pesos in open-market transactions. The swap line, announced shortly before the midterms, was viewed as a vote of confidence in Milei’s reforms.

The aid angered US farmers who complained that US tax dollars would help Argentine farmers. The situation worsened when Argentina suspended grain export taxes in late September, triggering a stampede of agricultural exports that competed with US farm products. Six billion dollars flooded into the country that Argentine exporters converted to pesos, forcing the central bank to spend precious dollars to sop up excess pesos.

Unfazed by the criticism, the US doubled down on its Argentine support, arranging another $20 billion in private funding. Conflicting comments from President Trump and Treasury Secretary Scott Bessent about the possible withdrawal of financial support should Milei lose the mid-term elections added to uncertainty and confusion swirling in the country and international markets. Milei’s strong showing in the midterm elections should reassure markets of ongoing US backing.

Is this a US bailout?

Critics of the US aid say that the US will squander its $40 billion investment; they point to many examples of unrepaid loans and currency devaluations in Argentina’s history. The US government disagrees; it presents the economic lifeline as a bet that will result in a currency trading profit.

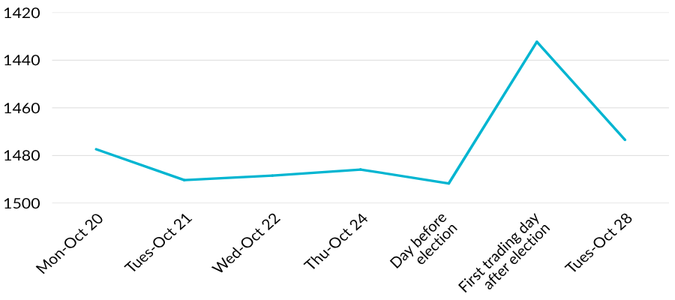

Maybe. The peso surged over nine percent on the Monday after the midterm elections (October 27, 2025). The gain steadily eroded during the next day as euphoria over the election subsided, replaced by the realization that Argentina has much to do to shore up its economy. Since the election to mid-November, the peso has traded in a range between 1400 and 1500 pesos to the dollar.

FIGURE 1: US DOLLAR IN TERMS OF ARGENTINE PESO (Inverted scale)

Source: Bloomberg | Note: Election was on Sunday, October 26, a non-trading day.

US–China–Argentina love triangle

US assistance isn’t without self-interest. Besides an uncertain currency trading profit, the US intends its financial assistant to counter China’s influence in Argentina. The Asian superpower has invested heavily in Argentine infrastructure, energy and agriculture and extended its own swap line. That assistance gives China financial and political leverage with a major South American country.

Argentina’s president, Javier Milei, with the President of the People’s Republic of China, Xi Jinping in November 2024. Source: Wikimedia Commons

The US is desperate to ensure it has access to Argentina’s ’s vast reserves of lithium and more modest quantities of rare earth minerals, essential for defense, technology and industry. The US is keen to strengthen cooperation on those critical minerals. That desire led to a 2024 memorandum of understanding that promotes trade and investment in critical mineral exploration, mining and processing.

Currency Defenses: Lessons from History

Argentina’s peso meets several conditions associated with speculative attacks.

TABLE 1: CONDITIONS THAT INCREASE RISK OF A SPECULATIVE CURRENCY ATTACK

| Condition | Comments | Risk raised? |

| Fixed or semi-fixed exchange rate | The peso exchange rate is a managed float with central bank intervention. | Yes |

| Weak macroeconomic fundamentals | Stubborn inflation, low central bank reserves, moderate unemployment (7.6% June 2025), weak ruling political party that suffers from corruption and voter austerity fatigue. | Yes |

| Limited credibility of monetary authorities | History of devaluations. | Yes |

| Catalyst | Despite assurances, US promises of support could be withdrawn; failure to finalize free trade agreement with US; escalating global trade conflict. | Yes |

If Argentina experiences an attack, recent currency defenses suggest there’s little hope for the peso:

1992 UK Black Wednesday: Bank of England’s failed defense of the pound against George Soros and other speculators.

1997 Asian Financial Crisis: Thailand’s baht collapse despite central bank intervention.

2012 European Central Bank “Whatever It Takes” moment: Mario Draghi’s verbal defense of the euro — a rare success.

Argentina’s own history: repeated IMF bailouts (23 since 1958, IMF’s largest debtor), peso devaluations, and failed peg regimes. A grim history faces the US’s $40 billion bet that this time will be different.

Is $40 billion enough?

In the short-term, US support buys time for reforms. Long-term, a failed currency defense might cause Argentinians voters to abandon economic austerity and turn to Peronist promises of subsidies and jobs.

While $40 billion sounds formidable for defending the currency, it may not be enough. Determined speculators could relentlessly sell pesos, forcing Argentina’s central bank to exhaust its dollar reserves in defense of the currency. At what point does the US say ‘enough’? $40 billion? $80 billion? President Trump and Secretary Bessent have staked their credibility on a positive outcome – an outcome that, given Argentina’s history, is highly uncertain.

The House wins

Without deep reforms to tame inflation and spur growth, the peso will remain under pressure. Complicating matters is fallout from the US–China economic rivalry: erratic U.S. tariff policies disrupt Argentine exports, while both superpowers vie for influence through aid and access to Argentina’s mineral wealth. The US is betting it can overcome decades of Argentine currency history, while China wagers its economic support will secure strategic leverage. But in this high-stakes game the likely outcome is that the house – currency speculators – will probably win.

Explore more currency insights

Soros, stablecoins, and the new currency wars

What yesterday’s currency crisis reveals about tomorrow's digital collapse

Managing risk with FX futures

Hedging and speculation with currency futures - understanding the basics

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters