Insights

An armed war and a currency battle

Share this article

September 12, 2023 | By Mesirow Currency Management

Russia confronts the US dollar with so-so results.

We’ve written about the US dollar dominance in global commerce and finance. Many nations chafe under that global supremacy, and countries such as China and Russia want to diminish the power of the US dollar. The Ukraine – Russia conflict, however, has illustrated the difficulties trading when the US currency is unavailable because of economic sanctions. Without the dollar, Russia has found it challenging to deal with other countries interested in its energy products. We describe the currency issues facing Russia and what it’s doing to solve the vexing dollar problem.

Two-front war and the ruble

Russia is fighting a two-front war. The first is the armed conflict against Ukraine. That venture is faring poorly: Sources estimate its troops, under attack in a Ukraine counteroffensive, have lost nearly 300,000 killed or wounded from February 2022 to August 2023.

The second front is an economic one. Russia is battling a series of sanctions levied by a US-led coalition in response to the Ukraine invasion. The coalition capped the price of Russian crude oil; blocked Russian banks from using SWIFT, the US-managed global payment system; and froze Russian currency reserves. Russia has had some success on this second front, but currency issues are stifling advancement. That’s because Russia must substitute other currencies for the off-limits US dollar, and getting around the US dollar’s dominance in global commerce is not easy.

The world was almost unanimous in its condemnation of the war, and the initial economic reaction was reflected in the collapse in the Russian ruble against the dollar (Figure 1). President Biden scorned the Russian currency: “As a result of these unprecedented sanctions, the ruble almost is immediately reduced to rubble.” But world opinion quickly lost its solidarity as nations evaluated the conflict from their self-interest, and the currency quickly recovered and even rose to a peak of over 53 rubles per dollar (indicating a weak dollar and strong ruble) before steadily declining to over 91 rubles per dollar (strong dollar, weak ruble) at the end of July 2023 (Figure 1).

FIGURE 1: US DOLLAR IN TERMS OF RUSSIAN RUBLES (JANUARY 2019–AUGUST 2023)

Inverted scale to show movement in the ruble

Source: Bloomberg

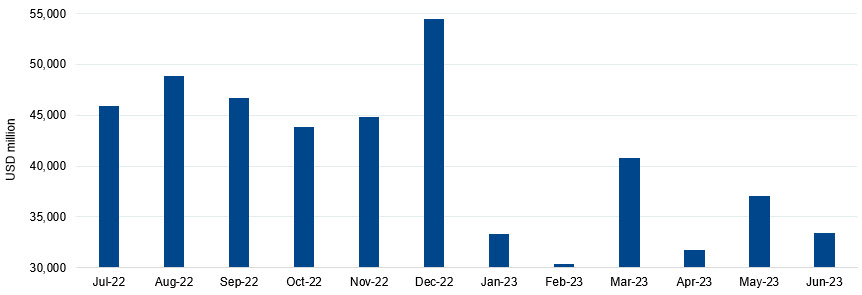

Matters worsened in the next month as the Russian currency closed lower at over 100 rubles to the dollar on August 14th. The central bank scrambled, hiking interest rates by 3.5 percent to 12 percent to support the currency. The interest rate increase made little difference to the exchange rate which closed at about 96 at August’s end. Instead, the currency took the brunt of the deterioration in the Russian trade balance with lower energy demand and prices resulting in reduced exports (Figure 2). Meanwhile, war requirements have increased the need for imports forcing Russia to buy foreign currencies and sell rubles. The current account surplus, a measure of how much more foreign currency the nation receives from exports than it spends on imports, fell 86% in the first part of the year.

FIGURE 2: RUSSIAN EXPORTS IN USD MILLION (JULY 2022–JUNE 2023)

Source: Central Bank of Russia

End run around the US dollar

Some of the nations that abstained from the initial condemnation of the invasion and that did not participate in the sanctions began to trade with Russia, supplying electronics, machinery and other products and buying Russian energy products. China and India have supported Russia with energy purchases in currencies other than US dollars. Mostly that’s been Chinese yuan for about $60.3 billion in oil imports. Trading with the Chinese has resulted in an increase of Russian imports denominated in Chinese yuan from 4 percent to 23 percent in 2022, according to the Russian central bank. The downturn in the Chinese economy in 2023, however, has reduced that nation’s need for Russian energy.

While trading with China has evaded the sanctions to some degree, trading with India has been troublesome because India has insisted on paying for Russian energy in Indian rupees. The Russian energy companies are unable to convert rupees to another useful currency because of the sanctions. Spending rupees is difficult because India only has a two percent share of global exports. In other words, no one needs — or wants — rupees. As a result, India and Russia have discontinued negotiations about settling trade in rupees. That’s a blow to India which hoped to continue to purchase Russian energy at sanction-capped prices.

Trading in a third currency such as the United Arab Emirates dirham might solve the rupee problem. Russia and India have reportedly used the UAE dirham as a go-between currency. Russia sells oil to India invoiced in UAE dirham. It is not clear, however, why sellers of dirham would want to buy rupees that are difficult to trade or spend. UAE also buys low-priced Russian oil for internal consumption and sells higher-priced Mid East oil on the global market for a profit. The UAE imported 60 million barrels of Russian oil in 2022, triple the amount in 2021.

Future: central bank digital currency

Russia has also sought to elude the omnipresent US dollar through the issuance of a central bank digital currency, a digital form of a government-issued currency. Russia had intended to launch a CBDC pilot program in April 2023, but that program was delayed while awaiting legislation authorizing the digital currency; President Putin signed that bill on July 24. The long-range hope is that CBDCs can be used in cross-border transactions that could make it easier for Russia and its partners to trade without using the US dollar.

Hey – things aren’t so bad

While Russia finds the sanctions and export situation challenging, the nation’s economy is coping. In early July, Prime Minister Mikhail Mishustin reported that gross domestic product for 2023 may exceed 2 percent. The International Monetary Fund expects the Russian economy to grow 1.5 percent this year.

If Russia is successful in neutralizing the US-led sanctions, other nations may be encouraged to develop similar sanction-avoiding capabilities in case they too run afoul of US policy.

Explore

USD and the BRICS threat

Sanctions on Russia lead to a call for a new currency to compete with the USD. Is a common currency likely?

T+1 securities settlement cycle

Same-day security settlement is moving closer to reality. Is the FX market ready?

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters