Insights

Cryptocurrencies make room for tokenization

Share this article

January 23, 2024 | By Mesirow Currency Management

Distributed ledger technology: Will your medical records and driver’s license be tokens soon?

Reports of fraud, theft, mismanagement and incompetence continue to roil the cryptocurrency industry. That high-profile turbulence may be obscuring interest in digital ledger technology, the rules and infrastructure needed to create and trade digital assets including cryptocurrencies.

A beneficiary of this infrastructure interest are tokens, digital representations of assets. Some industry observers believe tokenization, the process of creating tokens, is poised to increase dramatically by 2030, but technology issues, a lack of protocols and public uncertainty might make those lofty levels difficult to achieve.

Potential of tokenization

Some market observers are wildly enthusiastic about the tokenization potential. Citi predicts that tokenization will reach $4 trillion in value by 2030, powered by over 2 billion people world-wide using $5 trillion in central bank digital currencies. A CBDC is a digital representation of a currency issued by a nation’s central bank.

There will, however, be problems reaching this tokenization potential if CBDCs are an essential component. Eleven nations have launched CBDCs and 21 countries are in pilot programs. But in nations that have issued CBDCs, citizens are cool to the new currency, uncertain about its usefulness and more comfortable with familiar payment methods such as credit cards and smart phone apps.

Some CBDC terms

Tokens represent ownership or value in something, often a unique creative work or a financial security like a bond or stock. But information, such as a person’s medical record or government ID, can be tokenized. And tokens can be divisible: an asset can have many owners much like shareholders in a company.

Tokens can be interchangeable, the same as dollar bills: one dollar can be swapped with any other dollar. In cryptocurrencies, one bitcoin is equivalent to any other bitcoin. But tokens can be unique, a one-of-a-kind digital asset. These are called non-fungible tokens and are often used to tokenize art and music. An NFT isn’t interchangeable because it has specific attributes and distinct values that sets it apart from other tokens. The uniqueness and indivisibility of NFTs are highly useful in creative industries where provenance, which describes the origination of the asset and its history of ownership, are critical components of the token’s value.

Tokens are created using distributed ledger technology, the infrastructure and protocols that simultaneously access, validate and update records. Distributed ledger technology works on a computer network spread across multiple entities and nodes. Each node in a distributed ledger processes and verifies every item to create a consensus of information across the network, thereby confirming transactions to be true and accurate.

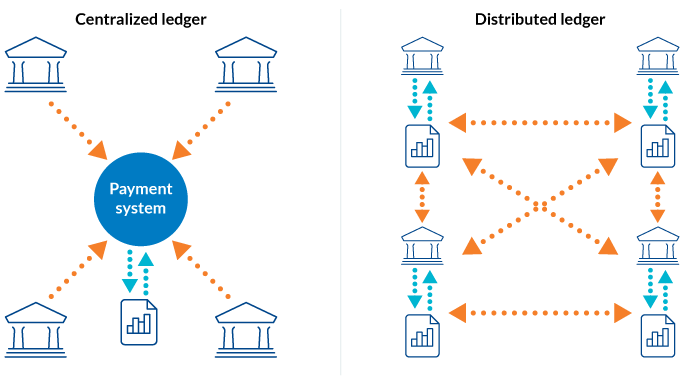

FIGURE 1: CENTRALIZED LEDGER VS. DISTRIBUTED LEDGER

Figure 1 shows two types of ledgers. The first type is a centralised ledger image showing four bank icons on the perimeter pointing towards a box in the center of them that reads 'payment system'. The payment system is in charge of handling the ledger. The second type of ledger is a distributed ledger and this image shows four bank icons on the perimeter all sharing ledger information with each other. This is conveyed with arrows.

Source: Bank for International Settlements

Distributed ledgers aren’t new, and they’re commonly used. In a stock transaction, the buyer documents the transaction in a ledger (typically a database), recording the trade date, settlement date, share description, price and other information. The seller records similar data from its point of view and stores the information in its system. To ensure accuracy so that the securities and cash are exchanged without incident, the two parties often load their transactions to another ledger, a central trade matching platform. That platform compares each party's data and confirms the transaction. The benefit of distributed ledger technology is its ability to reduce the time necessary to post the transaction and to minimize errors in reconciliation of the data across the nodes of the computer network. Distributed ledger technology ensures that every other entity, like regulators, exchange officials and the public have the current, accurate and trusted version of the transaction.

Token examples

Without getting too technical, some common tokens are cryptocurrencies like bitcoin and stablecoins like USD Coin, but tokens can also represent ownership of creative works. An Andy Warhol Marilyn print can be priced upwards of $200 million, out of reach for most Warhol admirers. That's where an entity like Freeport, a company that provides fractional ownership of art pieces by selling reasonably priced tokens, or shares, can help. For $3,900 you can buy 50 shares of Warhol’s Double Mickey (Figure 2).

FIGURE 2: MICKEY MOUSE GETS TOKENIZED

Figure 2 depicts Double Mickey Mouse by Andy Warhol. It is a screen print from 1981, portraying a duplicated image of the famous cartoon character.

Source: Andy Warhol's, Double Mickey, (1981). Courtesy of Freeport.

Financial assets are prime candidates for tokenization. Broadridge, a financial technology infrastructure company, provides a distributed ledger platform that handles $1 trillion of tokenized repurchase agreements monthly. Broadridge’s DLR system manages the agreement and execution and settlement of the transaction on a single, private distributed ledger.

Commodities are targets for tokenization too. In early November 2023, HSBC tokenized its London gold holdings (one token equals 0.001 troy ounce or about $2 per token), trading the fractional gold with other institutional investors on its Evolve platform and using a distributed ledger to record the transactions. While HSBC is a newcomer to gold tokenization, cryptocurrencies, another form of tokenization, dominate the gold token market with about $970 million in capitalization.

Benefits of tokenization

Tokenization can improve liquidity by increasing the number of buyers and sellers, thereby reducing price volatility.

An expanded marketplace means that a broader portion of the population can participate in ownership of wealth. Few people can buy a physical Warhol, but many people have the resources to buy a small digital fraction of the artist’s work.

Distributed ledgers are transparent and secure. Users can follow the trail of immutable transactions to determine ownership history. That immutability and the details of those transactions help to reduce fraud.

Distributed ledgers make it easier to tokenize and trade tokens. Because the distributed ledgers aren’t maintained by a central party with business hours that are inconvenient to non-local customers, transactions and their recording can be done around the clock by users throughout the world. Fewer intermediaries – no brokers or banks – and cost-efficient technology mean operating costs and the time to complete transactions can be minimized.

Tokens and distributed ledgers can improve record keeping and regulatory compliance. Some tokens can be programmed to comply with anti-money laundering and know-your-customer regulations. Tokens can help meet requirements in the European Union’s General Data Protection Regulation, the Health Insurance Portability and Accountability Act in the United States (only the patient, with a private key, can access health information stored on a distributed ledger) or Securities and Exchange Commission rules. Distributed ledgers can improve recordkeeping with automated validation, with timestamped, encrypted transactions recorded in an immutable ledger.

Smart contracts can be programmed for some tokens. A smart contract performs a certain action when an event occurs, an if-then logic. Ownership of a property could be automatically transferred upon receipt of the last mortgage payment.

Problems with tokens

There are dozens of token and non-fungible token marketplaces. However, it is often difficult or impossible to trade tokens unless they’re on a specific distributed ledger. That’s because some token creators want to influence the price of tokens that they issue.

Trading on a secondary distributed ledger outside of the issuer’s control makes that difficult, and interoperability, communications between distributed ledgers, is often poor or non-existent. Limiting trading to specific distributed ledgers means competition can be nonexistent, resulting in high costs.

Distributed ledgers lack scalability; they struggle to record transactions promptly when volumes increase. That slow processing time is reflected in high distributed ledger transaction costs. Tokenization and distributed ledgers involve cryptography, but that doesn’t mean that these systems can’t be hacked to defraud users or investors. More work is needed to improve security and address potential vulnerabilities.

Regulation is an unknown, and the uncertainty slows development and raises costs. It also alters the global competitive balance. Some nations are far ahead in the race to issue central bank digital currencies and to create protocols and governance standards. Geopolitical and technological analysts worry that some high-tech nations, including the United States, are lagging in the development of CBDCs and distributed ledger technology, hindering the industry’s lofty goals and putting the US and other allies at a competitive disadvantage.

If Citi is right, trillions of dollars' worth of tokens will soon be created or maintained on distributed ledgers, with few people realizing that distributed ledgers are running in the background.

There’s a lot to do to get that to happen by 2030.

Explore more currency insights

The future for hedged share class investors: Futures overlays

Grappling with the coming (T+1) security settlement cycle

Central Bank Digital Currencies

What do CBDCs mean for the US dollar as the world’s major reserve currency?

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters