Insights

FX Perspectives

Share this article

As 2020 advances amid the coronavirus epidemic, the financial market reactions have reflected the magnitude of concern felt by the world on a global scale, with currency risk weighing heavily on international investors. Since our previous paper in late February, risky assets have continued to be under pressure, with peak-to-trough drops of -34% in both the S&P 500 and MSCI World thus far this year. The safe-haven qualities of US dollar have attracted investors, particularly during the episodes of equity weakness, as periods of risk-off have dominated the marketplace.

We have updated the timeline below (Figure 1) through early April, tracking the Dollar Spot Index with corresponding events related to the coronavirus. While US dollar has appreciated overall during this period of uncertainty as both a safe-haven and funding currency, the volatile nature of currencies has been evident during these turbulent times.

Three periods of outsized appreciation have been shaded, with US dollar strength of +3.61%, +8.35%, and +2.36%, respectively. The periods of weakness, spurred initially by proposed US interest rate cuts and fears over stifled US growth followed by a strong reversal in the equity markets, punctuate the intra-period volatility experienced over the first quarter.

FIGURE 1: Dollar Spot Index - Coronavirus Timeline

Source: Bloomberg, The New York Times (https://www.nytimes.com/2020/02/13/world/coronavirus-timeline.html). Past results are not necessarily indicative of future results. Actual results may materially differ from those shown above. Please refer to the disclaimer page for important additional information.

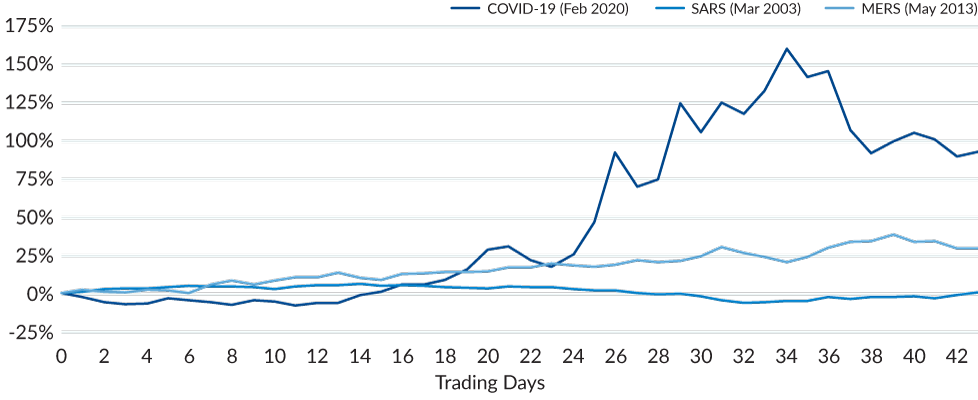

When we last looked in late February, we noted the surge in FX volatility from elevated uncertainty. When comparing COVID-19 to the other coronavirus variants, SARS and MERS, a common increase in FX volatility over a month’s period during the early days of each outbreak was evident.

Updating over the next month, the JPM Global FX Volatility Index during COVID-19 has exploded beyond the 25% increase we saw before, peaking at a 160% increase from the start of February (Figure 2), dwarfing the moves in SARS and MERS over an analogous number of trading days.

The higher magnitude and growth of currency volatility during COVID-19 can be attributed to its infection rate and cross-country contamination, making this more of a global event than either SARS or MERS. COVID-19 infected more than one million people in three months; SARS infected just over eight thousand in eight months; MERS required a year to infect 108 people. COVID-19 has affected 209 countries and territories, while both SARS and MERS were highly concentrated in particular regions, with 87% of SARS concentrated in China and Hong Kong, and all cases of MERS linked to the Arabian Peninsula. COVID-19’s global reach and evolutionary uncertainty threatens to keep currency volatility elevated and to pressure equity markets during this risk-on/risk-off dichotomy, until a more stable situation is reached across the globe.

Mesirow Currency Management continues to recommend having a currency risk management policy in effect at all times to mitigate currency risk and to control for downside protection in falling currency markets. Without such a policy in place, important and sizable investments in international markets are exposed to unforeseen high volatility periods such as the one we are experiencing with the coronavirus. Please stay safe during these uncertain times.

FIGURE 2: JPM Global FX Volatility Index - Virus Comparison

Source: Bloomberg. Past results are not necessarily indicative of future results. Actual results may materially differ from those shown above. Please refer to the disclaimer page for important additional information.

For educational and informational purposes only. Mesirow Financial Currency Management (“MFCM”) is a division of Mesirow Financial Investment Management, Inc. (“MFIM”), an SEC-registered investment advisor. The information contained herein is intended for institutional clients and Qualified Eligible Persons only and is for informational purposes only. MFCM provides discretionary investment management services to managed accounts held on behalf of qualified investors only and not to funds. MFCM will not act as agent or intermediary in respect of the execution of a discretionary investment management agreement. Nothing contained herein constitutes an offer to sell an interest in any Mesirow investment vehicle. It should not be assumed that any trading strategy incorporated herein will be profitable or will equal past performance.

Sources:

World Economic Forum - https://www.weforum.org/agenda/2020/02/comparing-outbreaks-coronavirus-mers-sars-health-epidemic

The New York Times - https://www.nytimes.com/2020/02/13/world/coronavirus-timeline

https://www.worldometers.info/coronavirus/

https://www.cdc.gov/about/history/sars/timeline.htm

https://www.npr.org/sections/goatsandsoda/2020/01/22/798277557/how-does-wuhan-coronavirus-compare-to-mers-sars-and-the-common-cold

https://www.cdc.gov/coronavirus/mers/us.html

Mesirow Currency Management (“MCM”) is a division of Mesirow Financial Investment Management, Inc. (“MFIM”) a SEC registered investment advisor. The information contained herein is intended for institutional clients, Qualified Eligible Persons and Eligible Contract Participants and is for informational purposes only. This information has been obtained from sources believed to be reliable but is not necessarily complete and its accuracy cannot be guaranteed. Any opinions expressed are subject to change without notice. It should not be assumed that any recommendations incorporated herein will be profitable or will equal past performance. Mesirow does not render tax or legal advice. Nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy an interest in any Mesirow investment vehicle(s). Any offer can only be made through the appropriate Offering Memorandum. The Memorandum contains important information concerning risk factors and other material aspects of the investment and should be read carefully before an investment decision is made.

This communication may contain privileged and/or confidential information. It is intended solely for the use of the addressee. If this information was received in error, you are strictly prohibited from disclosing, copying, distributing or using any of this information and are requested to contact the sender immediately and destroy the material in its entirety, whether electronic or hardcopy.

Certain strategies discussed throughout the document are based on proprietary models of MCM’s or its affiliates. No representation is being made that any account will or is likely to achieve profits or losses similar to those referenced.

Performance pertaining to the Currency Risk Management Overlay strategies is stated gross of fees. Performance pertaining to the Currency Alpha and Macro strategies may be stated gross of fees or net of fees. Performance information that is provided net of fees reflects the deduction of implied management and performance fees. Performance information that is provided gross of fees does not reflect the deduction of advisory fees. Client returns will be reduced by such fees and other expenses that may be incurred in the management of the account. Simulated model performance information and results do not reflect actual trading or asset or fund advisory management and the results may not reflect the impact that material economic and market factors may have had, and can reflect the benefit of hindsight, on MCM’s decision-making if MCM were actually managing client’s money in the same manner. Performance referenced herein for Currency Risk Management Overlay strategies prior to May 2004, the date that the Currency Risk Management team joined Mesirow, occurred at prior firms. Performance referenced herein for Currency Alpha and Macro strategies prior to October 1, 2018, the date that the Currency Alpha and Macro Strategies team joined Mesirow, occurred at prior firms. Any chart, graph, or formula should not be used by itself to make any trading or investment decision. Any currency selections referenced herein have been included to illustrate the market impact of certain currencies over specific time frames. The inclusion of these is not designed to convey that any past specific currency management decision by MCM would have been profitable to any person. It should not be assumed that currency market movements in the future will repeat such patterns and/or be profitable or reflect the currency movements illustrated above.

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that a strategy’s returns or volatility will be similar to the indices. The strategy is compared to the indices because they are widely used performance benchmarks.

Mesirow refers to Mesirow Financial Holdings, Inc. and its divisions, subsidiaries and affiliates. The Mesirow name and logo are registered service marks of Mesirow Financial Holdings, Inc., © 2020, Mesirow Financial Holdings, Inc. All rights reserved. Investment management services provided through Mesirow Financial Investment Management, Inc., a SEC registered investment advisor, a CFTC registered commodity trading advisor and member of the NFA, or Mesirow Financial International UK, Ltd. (“MFIUK”), authorized and regulated by the FCA, depending on the jurisdiction.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters