Insights

P3 innovation

Share this article

Mesirow acted as the exclusive underwriter of Health Services Facility Lease Revenue Bonds for The University of Illinois Hospital and Clinics in a Public-Private Partnership. The Series 2020 Project consists of financing for the design and construction of a 200,000 sf outpatient surgery and specialty clinic facility. Delivery of the facilities by the private sector provides more immediate liquidity compared to traditional public financing.

The UIC Surgery Center LLC

The University operates independent of the Hospital and therefore, pledges a portion of its revenue for principal patient care services to secure the repayment of the Hospital’s debt.

Project delivery mechanism

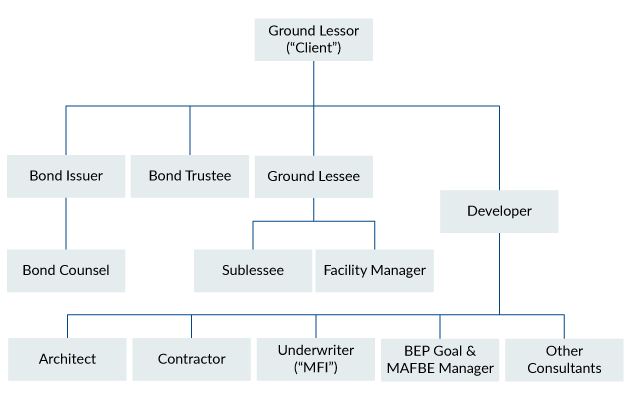

A pinnacle part of the unique “P3” structure is the mitigation of risk for taxpayers. Through a delivery process like the one seen in Chart 1, the credit risk is essentially placed onto, and spread out amongst the Private Sector party/parties. This is beneficial for multiple reasons- most importantly, a public entity can fund capital projects without being burdened with the entirety of the financial responsibility. A Public-Private Partnership allows public institutions like UIC to create Private-Sector-quality facilities, whether it’s a simple renovation or a brand new surgery center, a P3 structure expands the horizons of any municipality.

Chart 1: Delivery process

Source: UIH Series 2020 Ratings Presentation.

Executive Financing

-

Issuance Size: $145,050,000*

-

Structure: Fully Amortizing, Long Term, Tax Exempt,

-

Fixed Rate

-

Latest Maturity: October 1, 2055 (end of lease term)

-

Source of Payments: Lease Payments

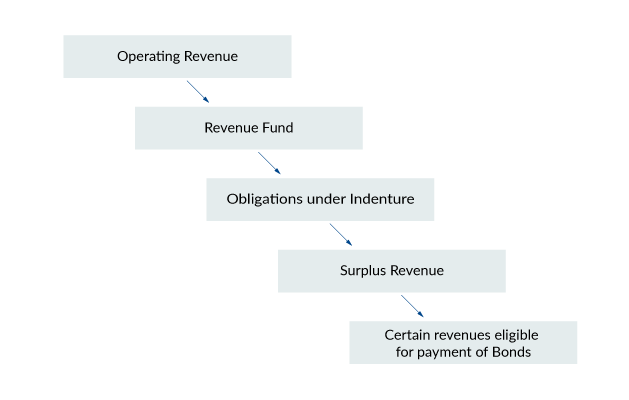

Chart 2: Flow of funds

How Does the Model Work?

The private partners are primarily responsible for:

-

Underwriter: Mesirow Financial (Lead)

-

Construction Management: Pepper Construction

-

Development: Ankura

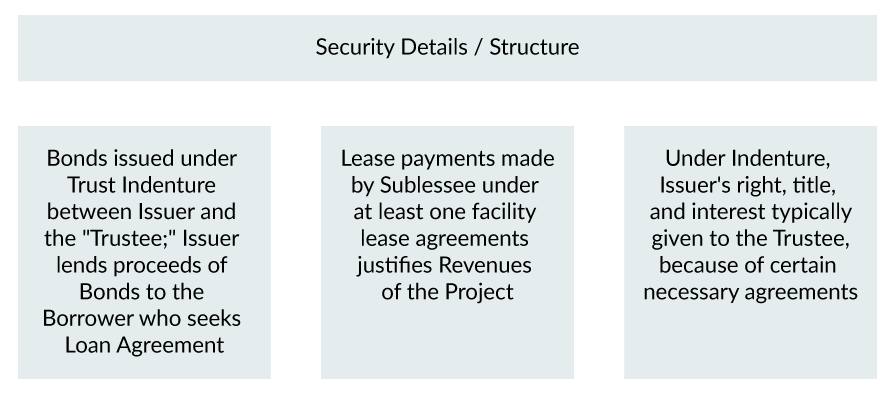

Chart 3: Security structure

Considerations for the Healthcare Industry

-

Healthcare systems face growing demands for increased capacity and service

-

Health facilities will need to become more integrated at addressing needs across the spectrum of medical issues

-

Public-Private partnerships are evolving to meet these changes

-

Previously, public finance was focused on replacing hospital infrastructure

-

Delegating designing, building, financing, maintaining, and operating public health assets to private parties allows authorities to access the capital to finance major projects, while placing the delivery risk on the private sector

*Final par amount is subject to change.

Mesirow Financial refers to Mesirow Financial Holdings, Inc. and its divisions, subsidiaries and affiliates. The Mesirow Financial name and logo are registered service marks of Mesirow Financial Holdings, Inc.,

Mesirow Financial does not provide legal or tax advice. Securities offered by Mesirow Financial, Inc. member FINRA, SIPC. Some information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. Any opinions expressed are subject to change without notice. It should not be assumed that any historical market performance information discussed herein will equal such future performance. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters