Four reasons to start investing your HSA assets

Share this article

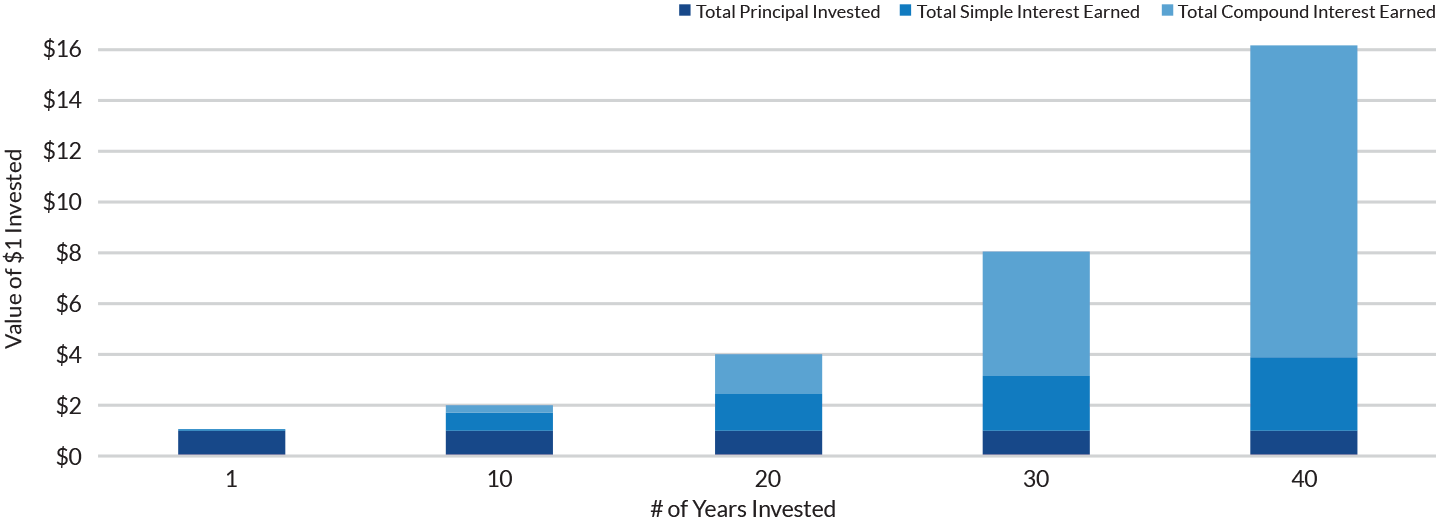

If you can afford to cover your family’s health care costs out-of-pocket (without spending your Health Savings Account (“HSA”), consider investing those HSA assets instead! The tax-free growth in these assets can accumulate significantly over time to help fund health care costs in retirement, freeing your retirement assets up to help fund your retirement goals.

Not everyone has access to an HSA, but if you do, there are opportunities to potentially integrate these accounts into your overall financial plan. HSA accounts are only available for individuals and families covered by a high-deductible health plan (“HDHP”). Since HDHPs have higher out-of-pocket deductibles than traditional coverage, individuals and families must be comfortable with paying “first dollar” expenses out of pocket up to the maximum deductible.

Here are four reasons to stop spending and start investing your HSA assets:

Take advantage of federal triple tax benefits

- Annual contributions of $8,550 per family (2025)¹ are made with pre-tax dollars

- Tax-deferred growth

- Tax-free withdrawals for health care expenses

Pay for medical expenses, past and present

HSA accounts allow you to withdraw these assets to reimburse yourself for health care expenses, both past and present.

- If you have retained detailed documentation of all medical expenses since your HSA was opened, and you paid for these expenses out of pocket, you can repay yourself from the HSA later, even if those expenses were from 10 or 20 years ago. It is crucial that you keep detailed documentation of medical expenses and payment sources to substantiate these eventual reimbursements.

- This retirement strategy will allow you to generate income tax-free in retirement, which has the added benefit of helping to avoid income-related Medicare surcharges.

As an example, consider someone who incurred an average of $7,000 a year in medical expenses over the 15 years she held an HSA account, but paid all of the medical expenses with other money (did not use the HSA funds at all and kept them invested). If she documented these expenses, she can withdraw $105,000 from the HSA at a later date as a tax-free reimbursement. In addition, this $105K of distributions will not count as income in calculations for Medicare premiums (nor for many other tax calculations).

Know that you will have “enough” for health care expenses, without having to spend your retirement assets

Health care costs will likely be one of the largest expenses individuals face in retirement, and they continue to rise unpredictably. On average individuals pay $295,000² in health care expenses during their retirement, not including long term care. These expenses are a combination of prescription drug out-of-pocket costs, premium payments associated with Medicare Part B and D, and Medicare cost-saving provisions.

Invest your HSA assets as part of your overall portfolio

Your wealth advisor can help you invest these assets into a diversified portfolio of mutual funds or exchange traded funds (ETFs), which integrate into your overall financial plan to support your lifetime goals.

Source: Mesirow

Health care is commonly a financial concern among investors. HSA can be an effective long-term saving vehicle to help cover health care expenses in retirement, and it can provide important tax benefits and investment growth opportunities. Talk to your wealth advisor about how you can start taking better advantage of your HSA, or, if you do not have a Mesirow wealth advisor, we will introduce you.

Published February 2025

1. https://www.shrm.org/topics-tools/news/benefits-compensation/irs-announces-2025-hsa--hdhp-limits

2. Fidelity Benefits Consulting estimate; 2020. Estimate based on a hypothetical couple retiring in 2020, 65 years old, with life expectancies that align with Society of Actuaries' RP-2014 Healthy Annuitant rates with Mortality Improvements Scale MP-2016. Actual expenses may be more or less depending on actual health status, area of residence, and longevity. Estimate is net of taxes. The Fidelity Retiree Health Care Costs Estimate assumes individuals do not have employer-provided retiree health care coverage, but do qualify for the federal government’s insurance program, Original Medicare. The calculation takes into account cost-sharing provisions (such as deductibles and coinsurance) associated with Medicare Part A and Part B (inpatient and outpatient medical insurance). It also considers Medicare Part D (prescription drug coverage) premiums and out-of-pocket costs, as well as certain services excluded by Original Medicare. The estimate does not include other health-related expenses, such as over-the-counter medications, most dental services and long-term care.

Connect with an advisor

Mesirow does not provide legal or tax advice. Past performance is not indicative of future results. The views expressed above are as of the date given, may change as market or other conditions change, and may differ from views express by other Mesirow associates. This is not a solicitation to buy or sell the securities mentioned. Do not use this information as the sole basis for investment decisions, it is not intended as advice designed to meet the particular needs of an individual investor. Information herein has been obtained from sources which Mesirow believes to be reliable, we do not guarantee its accuracy and such information may be incomplete and/or condensed. All opinions and estimates included herein are subject to change without notice. This communication may contain privileged and/or confidential information. It is intended solely for the use of the addressee. If you are not the intended recipient, you are strictly prohibited from disclosing, copying, distributing or using any of the information. If you receive this communication in error, please contact the sender immediately and destroy the material in its entirety, whether electronic or hard copy. This material is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.

Mesirow refers to Mesirow Financial Holdings, Inc. and its divisions, subsidiaries and affiliates. The Mesirow name and logo are registered service marks of Mesirow Financial Holdings, Inc. ©2026, Mesirow Financial Holdings, Inc. All rights reserved. Any opinions expressed are subject to change without notice. Past performance is not indicative of future results. Advisory Fees are described in Mesirow Financial Investment Management, Inc.’s Form ADV Part 2A. Advisory services offered through Mesirow Financial Investment Management, Inc. an SEC registered investment advisor. Securities offered by Mesirow Financial, Inc. member FINRA and SIPC.