The impact of changing interest rates on estate planning strategies

Share this article

Changes in the Federal Funds Rate cascade to all corners of finance, from credit card rates, auto financing, mortgages and other rate-sensitive loans, to the fixed income (bond) markets. These changes can also impact many estate planning strategies.

First, rate increases are directly reflected in the Applicable Federal Rates (AFRs), which are published monthly by the IRS. For estate planning purposes, the monthly AFRs establish the minimum rates for loans used in various estate planning strategies.

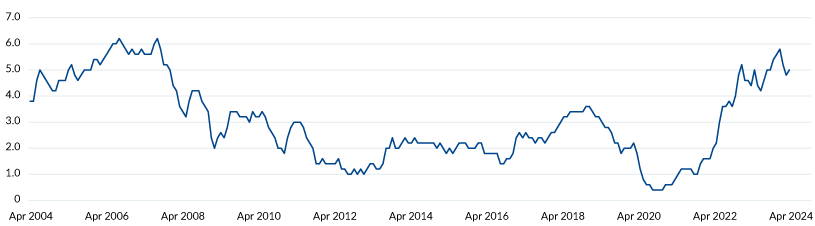

Changes in the AFRs also affect the “7520 rate,” which is defined as 120% of the mid-term AFR rate (compounded annually) for that month. The 7520 rate is used to determine present value of an annuity, an interest for life or a term of years, or a remainder or reversionary interest. Thus, the 7520 rate has a significant impact on estate planning strategies. The chart below shows the 7520 rates over 20 years, from 2004 to 2024.

Percentage changes in the 7520 rate over time

*Source: https://leimberg.com/Free-Resources/Key-Rates-Valuation/Section-7520-Rate-History

Estate planning strategies that benefit from higher interest rates

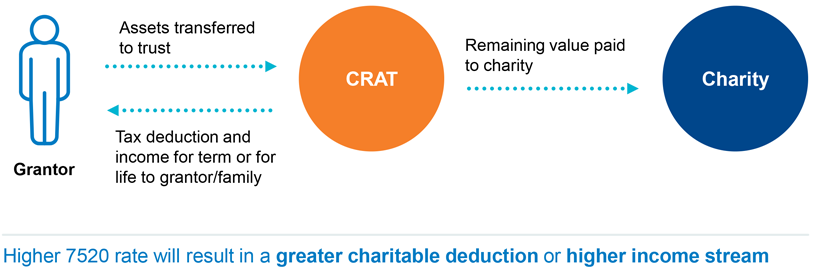

Charitable Remainder Annuity Trust

A Charitable Remainder Annuity trust (CRAT) is a “split-interest” trust in which the non-charitable beneficiary receives an annuity for a term of years or for life (or two people can have a joint and survivor annuity for life), and the remainder goes to a named charity. In this case, higher 7520 rates will result in a greater charitable deduction, assuming the same annuity payment to the family. Alternatively, lower 7520 rates can result in a greater annuity payment to the family, assuming the same charitable deduction. The only caveat is that Treasury regulations require a minimum of 10% of the initial trust value must go to the charity for a CRAT to be valid. The IRS has also ruled that a CRAT is not valid if there is a greater than 5% chance that the trust fund will be exhausted before the trust ends. So, there is an upper limit as to how much a CRAT can pay out to the non-charitable beneficiaries. As long as you meet these requirements, higher 7520 rates make CRATs more attractive as an estate planning strategy.

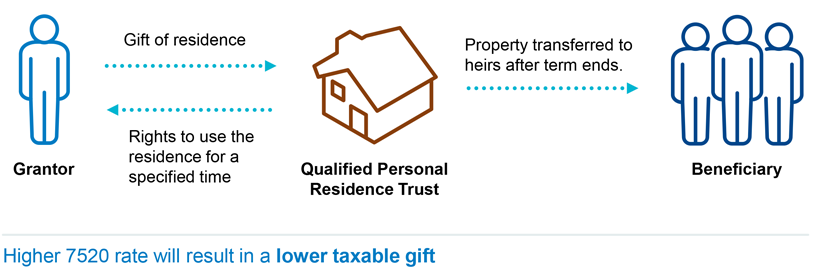

Qualified Personal Residence Trust

The other strategy that benefits from higher interest rates is the Qualified Personal Residence Trust (QPRT). The QPRT is a split-interest trust used to transfer a residence or vacation home to children or other family members at a discounted value for gift tax purposes. The grantor(s) transfer the home to the trust and retain the right to use/occupy the home for a period of years. At the end of the term, the home is retained in trust or transferred to the children or others. As above, higher 7520 rates increase the value of the retained interest, and they decrease the value of the remainder interest — the amount subject to gift tax. This means the greater the 7520 rate, the lesser the taxable gift. This is why a QPRT is an extremely popular estate planning technique while interest rates are high.

Estate planning strategies that benefit from lower interest rates

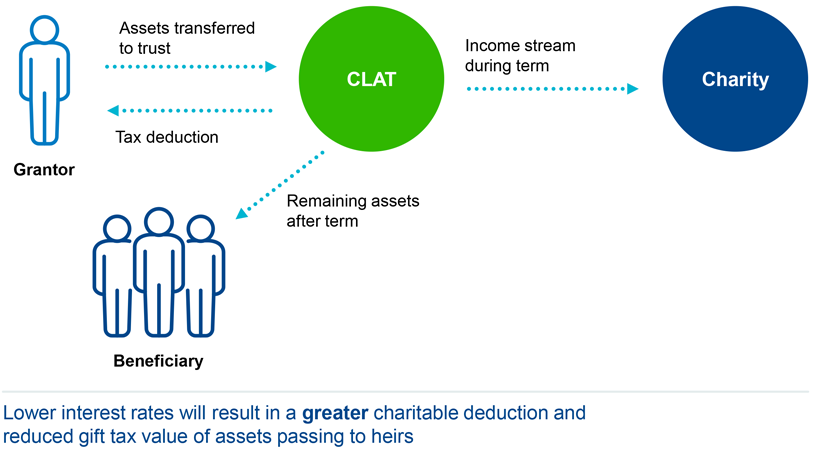

Charitable Lead Annuity Trust

A Charitable Lead Annuity Trust (CLAT) is split-interest trust that works in the opposite manner of the CRAT described above. With this strategy, the annuity payments for a term of years are made to a charity, and the remainder is usually paid to family members. The grantor is entitled to a charitable deduction for the present value of the future annuity payments to charity. When the 7520 rate is low, it results in a higher charitable deduction. A lower 7520 rate also means the value passing to family members at the end of the term (the amount subject to gift or estate tax) is lower.

Intra-family loans

Intra-family loans work best in a lower interest rate environment. The AFR rate determines the minimum amount of interest that must be charged on such loans. This technique includes loans to family members to finance major purchases, to start a business, or meet other financial obligations. These loans can also be used to shift assets tax-free from a senior family member to a junior family member. The senior family member loans a sum to a junior family member, and the funds are used to invest in assets expected to have a return greater than the interest rate on the loan. When the loan is paid back, the junior family member keeps the difference between the return on the investment and the interest paid on the loan, effectively transferring the difference from the senior family member without any gift tax consequence. The lower the interest rate, the more assets that can be shifted to the junior family member.

Installment sales

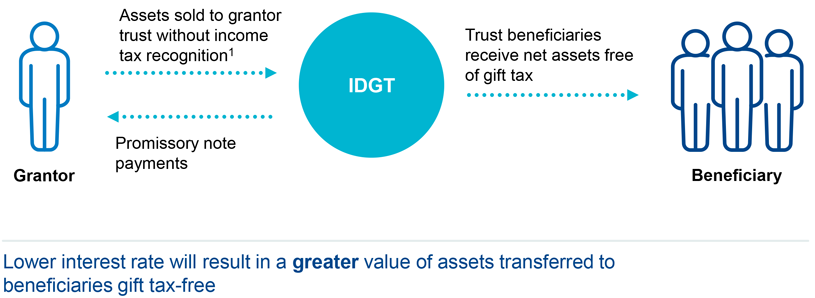

An installment sale to an Intentionally Defective Grantor Trust (IDGT) also works best when interest rates are low. This strategy involves an individual (the grantor) who “sells” property to a grantor trust created by her in exchange for a promissory note. The goal is that the property sold to the trust will have a total return greater than the interest rate on the loan, so that the net return after interest is retained in the trust, with no gift or estate tax consequence. Since the sale is to a grantor trust, the grantor does not recognize any capital gain (or loss) on this “sale,” and she will not recognize interest income from the promissory note payments from the trust. As with intra-family loans, a lower interest rate will result in more assets retained by the IDGT. The hurdle to clear in order for this strategy to make economic sense also gets lower as interest rates get lower.

1. Grantor is considered the income tax owner of trust assets, resulting in no tax recognition on initial sale to trust. Grantor subsequently pays income tax on trust income, which results in a gift tax-free benefit for the trust.

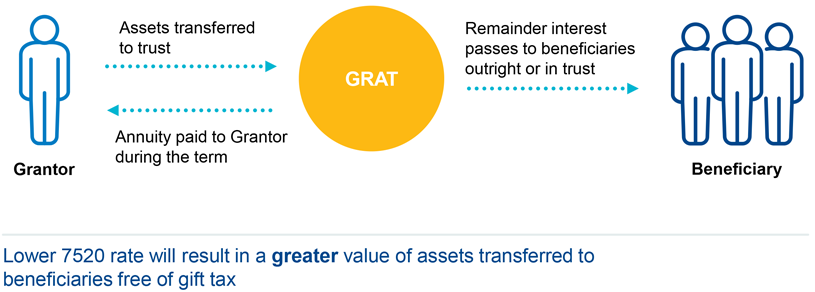

Grantor Retained Annuity Trust

Similar to the sale to an IDGT strategy, a Grantor Retained Annuity Trust (GRAT) will also perform better when interest rates are low. The GRAT is another type of split-interest trust, in which the trust’s grantor transfers assets to the GRAT, and the GRAT pays back to the grantor a fixed annuity for a term of years. After that term is up, the remainder interest then stays in trust or is paid out to the remainder beneficiaries. Since the 7520 rate determines the value of the annuity retained by the grantor, a lower 7520 rate results in a smaller annuity payment back to the grantor and more assets transferred to the remainder beneficiary tax-free.

Final thoughts

If you have a choice of strategy, consider the benefits of a CRAT or a QPRT now while rates are still relatively high (as of the date of this publication). When rates eventually trend down, you can maximize your tax savings using intra-family loans, a sale to an IDGT, or a transfer to a GRAT or CLAT. That said, one should be careful not to let the “interest tail” wag the dog. Waiting for rates to change in order to implement the most suitable estate planning strategy may not be wise. As long as that strategy still yields a tax savings, it is often better to lock in some tax savings now than none at all. We understand that these concepts can be complex, and that is why Mesirow is committed to helping you make the best informed decisions. Your Wealth Advisor, and our in-house estate planning specialist, can help guide you through the process of deciding which strategy is best for you given your unique circumstances and financial plan.

Published February 2026

Connect with an advisor

Mesirow does not provide legal or tax advice. Past performance is not indicative of future results. The views expressed above are as of the date given, may change as market or other conditions change, and may differ from views express by other Mesirow associates. This is not a solicitation to buy or sell the securities mentioned. Do not use this information as the sole basis for investment decisions, it is not intended as advice designed to meet the particular needs of an individual investor. Information herein has been obtained from sources which Mesirow believes to be reliable, we do not guarantee its accuracy and such information may be incomplete and/or condensed. All opinions and estimates included herein are subject to change without notice. This communication may contain privileged and/or confidential information. It is intended solely for the use of the addressee. If you are not the intended recipient, you are strictly prohibited from disclosing, copying, distributing or using any of the information. If you receive this communication in error, please contact the sender immediately and destroy the material in its entirety, whether electronic or hard copy. This material is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.

Mesirow refers to Mesirow Financial Holdings, Inc. and its divisions, subsidiaries and affiliates. The Mesirow name and logo are registered service marks of Mesirow Financial Holdings, Inc. ©2026, Mesirow Financial Holdings, Inc. All rights reserved. Any opinions expressed are subject to change without notice. Past performance is not indicative of future results. Advisory Fees are described in Mesirow Financial Investment Management, Inc.’s Form ADV Part 2A. Advisory services offered through Mesirow Financial Investment Management, Inc. an SEC registered investment advisor. Securities offered by Mesirow Financial, Inc. member FINRA and SIPC.