An introduction to “Trump Accounts”: What, when and how

Share this article

The One, Big, Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, created a new tax-advantaged savings account for children under age 18. Officially named the “Trump Account” in the legislation, this new type of account is similar to an Individual Retirement Account but has special rules that govern its establishment, funding, investment, and distribution.

How to establish a Trump Account

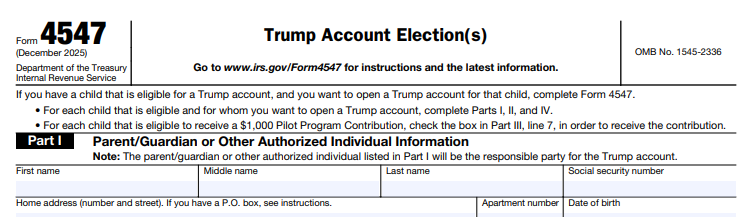

In order to initially establish a Trump Account (hereinafter “Account”) for an individual, you must make an “election” with the Department of the Treasury. There are two ways to make this election. First, you can file IRS Form 4547, which is available now and may be submitted with your 2025 Form 1040 income tax return.

The second way to make this election is through an online tool at trumpaccounts.gov. However, the IRS has indicated that the online option will not be available until mid-year 2026.

The election to establish an Account can only be made by the following persons, and only the individual who has the highest priority and is available may make the election:

- A legal guardian;

- A parent;

- An adult sibling; or

- A grandparent.

So, keep in mind that a grandparent can’t set up an account for a grandchild as long as that grandchild has a parent available to do so. Also, an individual can only have one account established at any time. So, if one parent sets up an Account, the other parent will be prohibited from establishing another Account, which may be an issue with divorced parents.

Once the IRS processes your election, the Treasury Department will send instructions with the information needed to activate the Account. This activation process must be completed for the Account to become operational.

Who is eligible

An individual qualifies for an Account if all of the following requirements are met:

- The individual has not attained age 18 by the end of the calendar year in which the election is made.

- The individual has a Social Security Number that was issued before the date of the election.

In addition, the OBBBA provides for a “Pilot Program” contribution of $1,000 to be made by the US government into the Account. To qualify for this Pilot Program contribution, an individual must meet the following requirements:

- The person was born after December 31, 2024, and before January 1, 2029;

- The person is a US citizen;

- The person is otherwise eligible to have an account; and

- An election is made to participate in the Pilot Program (this election can be made on the same IRS form used to open the Account, or using the online tool concurrent with opening an Account there).

How the Account works

Accounts operate in two distinct phases, with separate rules that apply during each phase. First, there is the "Growth Period," which applies from birth to December 31 of the year in which the individual turns 17. During this Growth Period, the following rules apply to an Account.

Rule 1: Contributions

The first type of contribution that may be made to an Account is the one-time Pilot Program contribution of $1,000 from the US government for eligible individuals. For tax purposes, the $1,000 is not included in the individual's income and it does not create basis in the Account.

Contributions may also be made by any person, such as the Account beneficiary, parents, grandparents and others. The annual limit for these contributions is $5,000 total from all sources (the $5,000 limit will be indexed for inflation starting in 2028). These contributions will generally be treated as gifts. As of now, these gifts would not qualify for the gift tax annual exclusion ($19,000 in 2026), since the funds can’t be accessed immediately. This means a donor to the Account would need to file a Form 709 federal gift tax return to report the contribution, which can be a burden, especially for such small gifts. For tax purposes, these contributions will create basis in the Account.

An employer may also make contributions to the Account of an employee or the employee’s dependent, up to $2,500 per year (per employee, not per Account). This limit will be indexed for inflation starting in 2028. Employer contributions count toward the $5,000 contribution limit from all sources. For tax purposes, these contributions are excluded from an employee’s income, and they do not create basis in the Account.

The next type of contribution is a “Qualified General Contribution,” which is funded by a state, the United States, the District of Columbia, an Indian tribal government, or a 501(c)(3) tax-exempt organization. The general funding contribution can identify a qualified class of individuals to receive the funds (e.g., by year of birth, geographic location, etc.) and they are distributed equally to every person in the class who has an Account. These contributions do not count against the $5,000 personal contribution limit. These contributions are not included in the individual’s income and do not create basis in the Account.

Rule 2: Investments

During the Growth Period, Account funds may only be invested in eligible investments, which are defined as a mutual fund or exchange traded fund that meets the following criteria:

- Tracks the returns of a qualified index;

- Does not use leverage;

- Has annual fees and expenses that do not exceed 0.1%; and

- Meets any additional criteria determined by the Treasury Department.

A qualified index includes the S&P 500 Index, or another index that is comprised primarily of equity investments in US companies. Industry-specific or sector-specific indexes, including environmental, social and governance indexes, do not qualify. Also, cash and money market funds are not permitted investments during the Growth Period, expect on a temporary basis to hold reinvestment. An Account may be invested in more than on eligible investment.

Rule 3: distributions

During the Growth Period, Accounts may not make any distributions. This includes hardship distributions, early withdrawals for education, medical expenses or first home purchase. The only allowable distributions include a direct trustee-to-trustee rollover of all funds to an Account at a different financial institution (partial rollovers not allowed), and distributions upon the death of an Account beneficiary. also, an Account may be rolled over to an ABLE account, but only in the year the beneficiary attains the age 17. This is a one-year window and can't be done in any other year.

Account rules after Growth Period

Beginning January 1 of the year the beneficiary attains age 18, the above special rules no longer apply, and the account will be governed by investment and distribution rules that are generally applicable to IRAs. For instance, distributions may be taken at any time, subject to the 10% penalty if applicable. Roth conversions are also permitted, which may be an attractive option at age 18 (or soon after) when the individual's income may be low or nonexistent.

Coordination with other investment strategies for minors

Trump Accounts may have a role to play among the various investment options for children and other minors. Section 529 education savings accounts are likely the best option for paying for college expenses, since qualified 529 distributions are tax-free, while Trump Account distributions are taxable above basis. 529 accounts can also be used for certain K-12 expenses, while Trump Account distributions are prohibited before the year the beneficiary turn 18. However, Trump Accounts may be a good way to build a foundation for future retirement savings by virtue of compounding earnings from such an early age (especially if converted to a Roth IRA soon after the Growth Period ends).

You should speak with your Mesirow Wealth Advisor about whether a Trump Account makes sense for you and the children or grandchildren in your life.

The Standard & Poor’s 500 Index, often abbreviated as S&P 500, is an American stock exchange market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ. The S&P 500 index components and their weightings are determined by S&P Dow Jones Indices.

Connect with an advisor

Mesirow does not provide legal or tax advice. Past performance is not indicative of future results. The views expressed above are as of the date given, may change as market or other conditions change, and may differ from views express by other Mesirow associates. This is not a solicitation to buy or sell the securities mentioned. Do not use this information as the sole basis for investment decisions, it is not intended as advice designed to meet the particular needs of an individual investor. Information herein has been obtained from sources which Mesirow believes to be reliable, we do not guarantee its accuracy and such information may be incomplete and/or condensed. All opinions and estimates included herein are subject to change without notice. This communication may contain privileged and/or confidential information. It is intended solely for the use of the addressee. If you are not the intended recipient, you are strictly prohibited from disclosing, copying, distributing or using any of the information. If you receive this communication in error, please contact the sender immediately and destroy the material in its entirety, whether electronic or hard copy. This material is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.

Mesirow refers to Mesirow Financial Holdings, Inc. and its divisions, subsidiaries and affiliates. The Mesirow name and logo are registered service marks of Mesirow Financial Holdings, Inc. ©2026, Mesirow Financial Holdings, Inc. All rights reserved. Any opinions expressed are subject to change without notice. Past performance is not indicative of future results. Advisory Fees are described in Mesirow Financial Investment Management, Inc.’s Form ADV Part 2A. Advisory services offered through Mesirow Financial Investment Management, Inc. an SEC registered investment advisor. Securities offered by Mesirow Financial, Inc. member FINRA and SIPC.