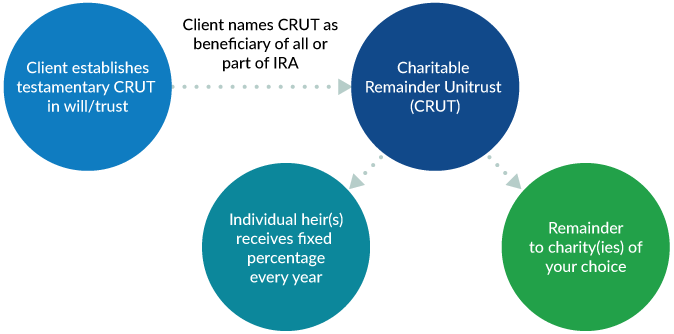

Leaving your IRA to a Charitable Remainder Unitrust can benefit your heirs and your preferred charity

Share this article

If you have substantial assets in your IRA (or other qualified plan account), leaving this asset to your children or other family members can create many headaches. First, it can create a significant tax burden under the current distribution rules. Also, giving your heir the unfettered right to withdraw all the funds and spend it as they wish may not be a good solution if they are not financially sophisticated, have creditor issues (including divorce proceedings), or are simply unable to manage the money. One solution to consider is leaving your IRA to a testamentary Charitable Remainder Unitrust (CRUT) for the benefit of your heirs and, ultimately, your preferred charity.

A testamentary CRUT is created and funded after you pass away. You can include the instructions to establish the trust and the trust terms in your Last Will and Testament or Revocable Trust. You then name one or more of your heirs as the initial Beneficiary for the CRUT. The CRUT will pay the Beneficiary a fixed percentage of the trust income, either for a set number of years (up to 20 years maximum), or for the life of the Beneficiary (or the joint lives of multiple Beneficiaries). When that period ends, the remaining assets pass to one or more charitable organizations you choose. While you determine the annual percentage paid to the Beneficiary, it must result in the charitable remainder receiving at least 10% of the initial amount. Your charity can also be your Donor Advised Fund, if you established one.

There are tax benefits to leaving your IRA to a CRUT. First, the IRA can be paid out to the CRUT without any income tax liability to the trust. In addition, interest, dividends, capital gains and other income is not taxable when earned inside the CRUT. All taxable income is suspended. When the Beneficiary receives their annual distribution, the suspended income gets carried out to the Beneficiary, up to the amount of their distribution. Any remaining suspended taxable income is eliminated once the CRUT pays out to the charitable remainder. This outcome can substantially benefit your heirs since inherited IRAs that pay out to non-spouse beneficiaries generally have to be fully distributed (and income taxes paid) within 10 years of the IRA owner’s death. If the IRA owner was already taking Required Minimum Distributions (RMDs) when they died, those RMDs must also continue to be paid to the heirs. If your heirs (such as your children) are in their prime earning years, these forced distributions can create a substantial tax burden. This is not a concern if you leave the IRA to a CRUT, which can “stretch” tax deferral over the entire distribution period to your heirs.

In addition, the present value of the charitable remainder, calculated as of the date of your death, will be deductible for state and federal estate tax purposes. The federal estate tax exemption is currently $13,990,000 per person. The exemption amounts for states with a state estate tax are typically much lower.

Let’s consider the following example. John Client wishes to leave his IRA worth $1,000,000 to his two children, ages 52 and 55. Each child currently earns substantial income and is in the top income tax bracket. John is concerned about the tax burden if each child has to continue his RMDs and then withdraw the remaining IRA balance within 10 years. John has already funded a Donor Advised Fund during his lifetime. He is favorable to leaving additional funds to the DAF at his death, but he wants to maximize the IRA payout to his children. John establishes a testamentary CRUT in his Revocable Trust and names the CRUT as the Beneficiary of his IRA. The CRUT will pay his two children the maximum annual percentage amount for their joint lifetimes, and the remainder will then pass to his DAF. Upon his death in June 2025, his estate will receive a $100,000 estate tax charitable deduction.1 The IRA can be liquidated to the CRUT and reinvested with no tax consequence. Then, the CRUT will pay 7.13102% 2 of the trust assets every year equally to John’s children (or all to the survivor when the first child dies). Income tax is thus deferred over the lifetime of each child, rather than paid within 10 years. When the last child dies, the remaining trust assets go to John’s DAF to be distributed to the family’s preferred charities.

In another example, assume Susan Client has an IRA valued at $3,000,000. She is interested in leaving her IRA to her children, but she also wishes to set aside about $1,000,000 of the IRA to help support her brother Sam (age 70), who is disabled. She is concerned about leaving this amount outright to Sam, because he has a regrettable history managing money. She believes a quarterly payment would be better to supplement his needs and ensure the rest is preserved for the future. Susan decides to establish a testamentary CRUT in her Last Will and Testament. She names the CRUT as the Beneficiary of the first $1,000,000 of her IRA, and her children as equal beneficiaries of the balance. The CRUT will pay 5% every year, in equal quarterly installments, to Sam for the rest of his life. Susan names the American Cancer Society as the charitable remainder beneficiary. When Susan dies in June 2025, her estate will receive a charitable estate tax deduction of approximately $500,000.3 The IRA will distribute $1,000,000 to the CRUT and will be reinvested with no income tax consequence. The CRUT will pay 5% every year to Sam in quarterly installments for his lifetime, and the remainder will be paid to Susan’s preferred charity.

Conclusion

While there are several benefits to leaving your IRA to a CRUT, it may not always be the best solution. Suppose your primary goal is maximizing the net after-tax benefit to your heirs and have no interest in leaving anything to charity. In that case, the tax benefits (stretching out income tax liability, estate tax charitable deduction) may not outweigh the minimum required 10% that must be left to charity when the CRUT ends. However, if your goal is to avoid leaving your heirs' unfettered control over a large sum of IRA funds, you believe a lifetime of payments makes more sense, or you would like any remaining funds to pass to one or more preferred charities, you can accomplish those goals and reap significant tax benefits with testamentary CRUT.

Your Mesirow Wealth Advisor can help determine if this strategy makes sense.

Published May 2025

1. Based on the June 2025 Section 7520 rate of 5.00%, the 5% payment to Sam, and Sam’s age 7 | 2. Based on the minimum required payout of 10% to the charitable remainder beneficiary. | 3. Based on the June 2025 Section 7520 rate of 5.00%, and lifetime payout to the individual beneficiaries aged 52 and 55.

Connect with an advisor

Mesirow does not provide legal or tax advice. Past performance is not indicative of future results. The views expressed above are as of the date given, may change as market or other conditions change, and may differ from views express by other Mesirow associates. This is not a solicitation to buy or sell the securities mentioned. Do not use this information as the sole basis for investment decisions, it is not intended as advice designed to meet the particular needs of an individual investor. Information herein has been obtained from sources which Mesirow believes to be reliable, we do not guarantee its accuracy and such information may be incomplete and/or condensed. All opinions and estimates included herein are subject to change without notice. This communication may contain privileged and/or confidential information. It is intended solely for the use of the addressee. If you are not the intended recipient, you are strictly prohibited from disclosing, copying, distributing or using any of the information. If you receive this communication in error, please contact the sender immediately and destroy the material in its entirety, whether electronic or hard copy. This material is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.

Mesirow refers to Mesirow Financial Holdings, Inc. and its divisions, subsidiaries and affiliates. The Mesirow name and logo are registered service marks of Mesirow Financial Holdings, Inc. ©2026, Mesirow Financial Holdings, Inc. All rights reserved. Any opinions expressed are subject to change without notice. Past performance is not indicative of future results. Advisory Fees are described in Mesirow Financial Investment Management, Inc.’s Form ADV Part 2A. Advisory services offered through Mesirow Financial Investment Management, Inc. an SEC registered investment advisor. Securities offered by Mesirow Financial, Inc. member FINRA and SIPC.