The power of uninterrupted compounding

Share this article

The power of “compound interest” is a concept that has been around for a long time, and its benefits can be applied to a number of strategies designed to help accumulate wealth over time. The secret is to start early, and let time work its magic. In this article, we share some ideas that leverage the power of uninterrupted compounding to help our clients accumulate wealth at an early age.

Example of compound interest

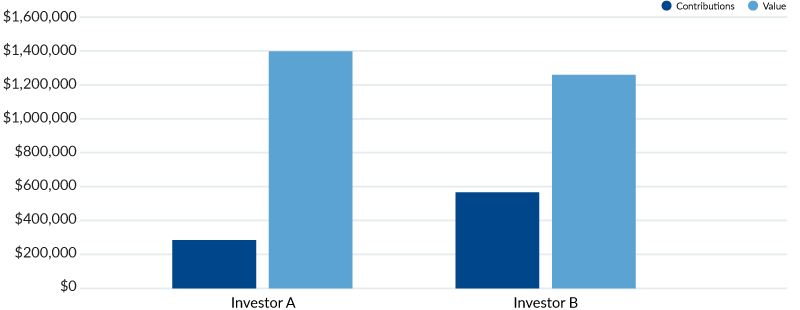

Let’s review the basics of compound interest by looking at two 25-year-old investors who make different decisions about contributing to their 401(k).

- Investor A contributes $19,000 to his 401k for the next 15 years, and then stops contributing.

- Investor B decides she can’t afford to contribute to her 401k right now and waits until she is 35 before contributing. She then contributes $19,000 for 30 years, twice as long as Investor A.

If we assume that each investor earns 5% interest per year, who will have more money at age 65?

If you guessed Investor A, you are correct. Even though Investor A contributed only half of the amount that Investor B did, Investor A ends up with $125,120 more than Investor B, thanks to having those 10 additional years of uninterrupted compounding.

It’s not always about how much you contribute...but how early

*Source - Mesirow

Ideas to leverage uninterrupted compounding

Listed below are three ideas designed to leverage the power of uninterrupted compounding to help build wealth at an early age.

1 | Fund a Roth IRA for your children and/or grandchildren

Many of our clients – regardless of their income level – use Roth IRAs or Roth 401(k)s as part of their wealth accumulation plan. In these accounts, after-tax money is contributed, growth is tax-free, there is no required minimum distribution, and when (or if) you do withdraw the money, qualified distributions are tax-free.

You can also use a Roth IRA to help your child or grandchild take advantage of uninterrupted compounding. Assuming your child or grandchild earns an income (from a summer job, for example), you can contribute to a Roth IRA in their name up to their earned income amount. The chart to the right shows how that early investment can grow over time, assuming a 5% rate of return.

Child Roth IRA

| Age | Year | Child's Income | Contribute | Return | Dollar Amount |

| 12 | 2 | $500 | $500 | 5.00% | $1,051 |

| 14 | 4 | $1,500 | $1,500 | 5.00% | $3,709 |

| 16 | 6 | $3,000 | $3,000 | 5.00% | $9,189 |

| 18 | 8 | $5,000 | $5,000 | 5.00% | $19,331 |

| 20 | 10 | $15,000 | $6,000 | 5.00% | $33,088 |

| 22 | 12 | $70,000 | $6,000 | 5.00% | $48,779 |

| 24 | 14 | $80,000 | $6,000 | 5.00% | $66,079 |

| 26 | 16 | $90,000 | $6,000 | 5.00% | $85,152 |

| 28 | 18 | $100,000 | $6,000 | 5.00% | $106,180 |

| 30 | 20 | $110,000 | $6,000 | 5.00% | $129,363 |

Assumptions:

- 5% straight-line annual returns

- $7,000 maximum contribution to Roth IRA if you’re under age 50. $8,000 if 50 or older (Tax Year 2024 IRS Law)

- Child begins full-time work at age 22 earning a salary, grown by $6,000 annually

- Assumes Modified AGI falls within income limitation for Roth Contribution

2 | Be strategic about college funding

With the average cost of a private university being upwards of $300,000 by the time a newborn is in college (in today’s dollars), uninterrupted compounding becomes extremely important. In a previous article, we discussed the benefits of 529 College Savings Plans.

In addition to starting these contributions as soon as possible, it might make sense to explore ideas to put as much money to work as soon as possible. For example, potentially using some of your “lifetime exemption” to make a 5-year lump sum contribution or overfunding your first child/grandchild’s account knowing that 529 accounts are portable.

Your Mesirow wealth advisor can help you decide which options make the most sense for you and your family.

3 | Stay invested, in good markets and in bad

Staying invested – in good markets and in bad – is vital to leverage uninterrupted compounding. Missing just a few days of good market returns can drastically affect your performance.

Staying invested goes well beyond just being able to stomach gyrations in the market (and your account balance). Asset allocation, debt management, insurance, and cash flow management all play a role in helping to ensure that your financial plan can stay on track during different market environments.

A solid financial plan can help create the infrastructure to weather the unexpected, such as a break in income due to death or illness of a family member, or a short-term increase in cash needs. By planning ahead, you can eliminate the need to draw from your investment portfolio and interrupt the compounding, potentially at an inopportune time.

In summary

The power of uninterrupted compounding is not a new concept, but it is a proven one. Applying this concept as part of a strategic wealth management plan allows our clients to help achieve the goals they wish to accomplish. We gave just three examples above. We recommend you speak with your Mesirow wealth advisor about how you can leverage these ideas as port of your financial plan.

Published March 2025

Sources:

https://www.irs.gov/retirement-plans/roth-iras

https://www.savingforcollege.com/article/how-much-can-you-contribute-to-a-529-plan

https://www.savingforcollege.com/calculators/college-savings-calculator

https://my.dimensional.com/insight/special_postings/234992/

Connect with an advisor

Mesirow does not provide legal or tax advice. Past performance is not indicative of future results. The views expressed above are as of the date given, may change as market or other conditions change, and may differ from views express by other Mesirow associates. This is not a solicitation to buy or sell the securities mentioned. Do not use this information as the sole basis for investment decisions, it is not intended as advice designed to meet the particular needs of an individual investor. Information herein has been obtained from sources which Mesirow believes to be reliable, we do not guarantee its accuracy and such information may be incomplete and/or condensed. All opinions and estimates included herein are subject to change without notice. This communication may contain privileged and/or confidential information. It is intended solely for the use of the addressee. If you are not the intended recipient, you are strictly prohibited from disclosing, copying, distributing or using any of the information. If you receive this communication in error, please contact the sender immediately and destroy the material in its entirety, whether electronic or hard copy. This material is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.

Mesirow refers to Mesirow Financial Holdings, Inc. and its divisions, subsidiaries and affiliates. The Mesirow name and logo are registered service marks of Mesirow Financial Holdings, Inc. ©2026, Mesirow Financial Holdings, Inc. All rights reserved. Any opinions expressed are subject to change without notice. Past performance is not indicative of future results. Advisory Fees are described in Mesirow Financial Investment Management, Inc.’s Form ADV Part 2A. Advisory services offered through Mesirow Financial Investment Management, Inc. an SEC registered investment advisor. Securities offered by Mesirow Financial, Inc. member FINRA and SIPC.