Taxes and charitable giving

Share this article

With the change in tax code a few years ago, many affluent individuals and families who used to itemize now qualify for the standard deduction instead, which can impact the deductibility of charitable gifts. Throughout our history, Mesirow has had a strong philanthropic culture, so charitable giving is a wealth planning area in which we are very experienced and eager to help provide some new ideas. This article outlines how you can integrate charitable giving into their financial plan and still enjoy some of the tax benefits long associated with gifting.

Here are two strategies to consider:

Strategy 1: Donor Advised Fund

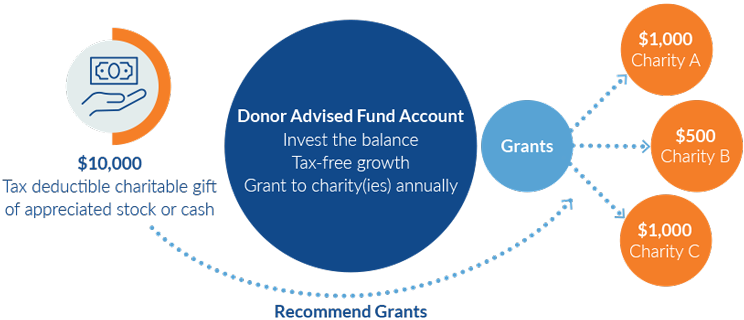

One approach taxpayers can consider is to strategically “lump together” several years’ of charitable donations into a single tax year by making a donation to a Donor Advised Fund (DAF).

A DAF is a vehicle for charitable giving that makes it easy for donors to dedicate funds to support their favorite nonprofit organization. It allows the donor to make a charitable contribution, receive an immediate tax benefit, and then recommend grants from the DAF to the donor's charities over time.

For the years in which the “lumped” contributions are made, it may be more beneficial to itemize the taxpayer's deductions to create tax savings (assuming those deductions exceed the $29,200 (for 2024) married filing jointly standard deduction threshold). In other years, the taxpayer would elect to use the increased standard deduction.

For example, let’s assume that a married couple typically makes annual charitable donations of $12,000. In addition, their only other itemized deductions are state income taxes and local property taxes, which are now limited to a combined maximum deduction of $10,000. Due to these new limitations, their total itemized deductions would be $22,000. Since this is below the $29,200 standard deduction threshold, the taxpayer would elect the standard deduction and would not receive any direct tax benefit from the charitable donations, state income taxes, or local property taxes.

To produce tax savings, the couple could instead combine four years’ worth of donations together and contribute to a DAF. As a result, they would receive an immediate tax deduction for the combined $48,000 donation to the DAF and would have itemized deductions well in excess of the standard deduction amount for that particular year. They could then make $12,000 grants from the DAF to their preferred charities each year for the next four years.

In addition to providing a taxpayer with the opportunity to maximize their tax benefit from these charitable donations, DAFs offer the following benefits:

- When you gift appreciated stock to the DAF, you receive a charitable deduction for the full value of the stock and the full value of the stock goes into the DAF. None of the entities (you, the DAF, or the charity) will pay capital gains on the stock’s past appreciation

- Once the funds are in the DAF, you can invest that money (with the support of your advisor) and any future growth will be tax free

- You control your DAF account during your lifetime, with named successors to carry on your legacy

- You control which charities the DAF will provide grants to, as well as the amount of the grants made by the DAF to those charities

How a DAF works

Strategy 2: IRA Qualified Charitable Distributions (QCDs)

Charitable-minded investors can take advantage of qualified charitable distributions (QCDs) where some or all their distribution is donated directly to a charity. In these situations, the amount donated can be used to satisfy the annual required minimum distribution (RMD) requirement, but is excluded from taxable income. This approach is limited to $108,000 per year.

In situations where the taxpayer is not going to itemize their deductions, the QCD strategy will likely be more advantageous than taking the RMD in cash and then contributing to charity (as the standard deduction taxpayer will have to include the RMD amount as income, but will not benefit from a charitable deduction). In order to order to take advantage of a QCD:

- You must be at least 70 1/2 years old

- The charity must be a qualified charity

- The check must be made payable to the qualified charity

- Contributions to a DAF or a private foundation do not count as a QCD

These are just a couple examples to demonstrate how we can partner with you to make minor charitable giving adjustments that will allow you to continue your gifting and still enjoy the tax benefits long associated with charitable giving. Your Mesirow wealth advisor can discuss these and other options with you and your tax advisor to help determine which approaches might work best for you.

Published February 2024

Sources:

“Timing Tax Savings With Deduction Lumping And Charitable Clumping”. Nerds Eye View Blog, www.kitces.com. January 31, 2018

https://www.irs.gov

https://www.irs.gov/charities-non-profits/charitable-organizations/donor-advised-funds

“Rules and Requirements For Doing a Qualified Charitable Distribution (QCD) From an IRA”. Nerds Eye View Blog, www.kitces.com. June 15, 2016

Connect with an advisor

Mesirow does not provide legal or tax advice. Past performance is not indicative of future results. The views expressed above are as of the date given, may change as market or other conditions change, and may differ from views express by other Mesirow associates. This is not a solicitation to buy or sell the securities mentioned. Do not use this information as the sole basis for investment decisions, it is not intended as advice designed to meet the particular needs of an individual investor. Information herein has been obtained from sources which Mesirow believes to be reliable, we do not guarantee its accuracy and such information may be incomplete and/or condensed. All opinions and estimates included herein are subject to change without notice. This communication may contain privileged and/or confidential information. It is intended solely for the use of the addressee. If you are not the intended recipient, you are strictly prohibited from disclosing, copying, distributing or using any of the information. If you receive this communication in error, please contact the sender immediately and destroy the material in its entirety, whether electronic or hard copy. This material is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.

Mesirow refers to Mesirow Financial Holdings, Inc. and its divisions, subsidiaries and affiliates. The Mesirow name and logo are registered service marks of Mesirow Financial Holdings, Inc. ©2026, Mesirow Financial Holdings, Inc. All rights reserved. Any opinions expressed are subject to change without notice. Past performance is not indicative of future results. Advisory Fees are described in Mesirow Financial Investment Management, Inc.’s Form ADV Part 2A. Advisory services offered through Mesirow Financial Investment Management, Inc. an SEC registered investment advisor. Securities offered by Mesirow Financial, Inc. member FINRA and SIPC.