Ground Lease Financing

Alternative long-term real estate financing solution designed to optimize overall leverage and / or return profile.

For real estate owners and developers

80+

Completed transactions*

$4.2B+

In issuance*

$1.1B

2-year average issuance**

Ground Leases

Ground Leases and GLFs have been a successful source of financing for real estate owners and developers for decades. They have become increasingly common given the current limitations of traditional real estate debt markets.

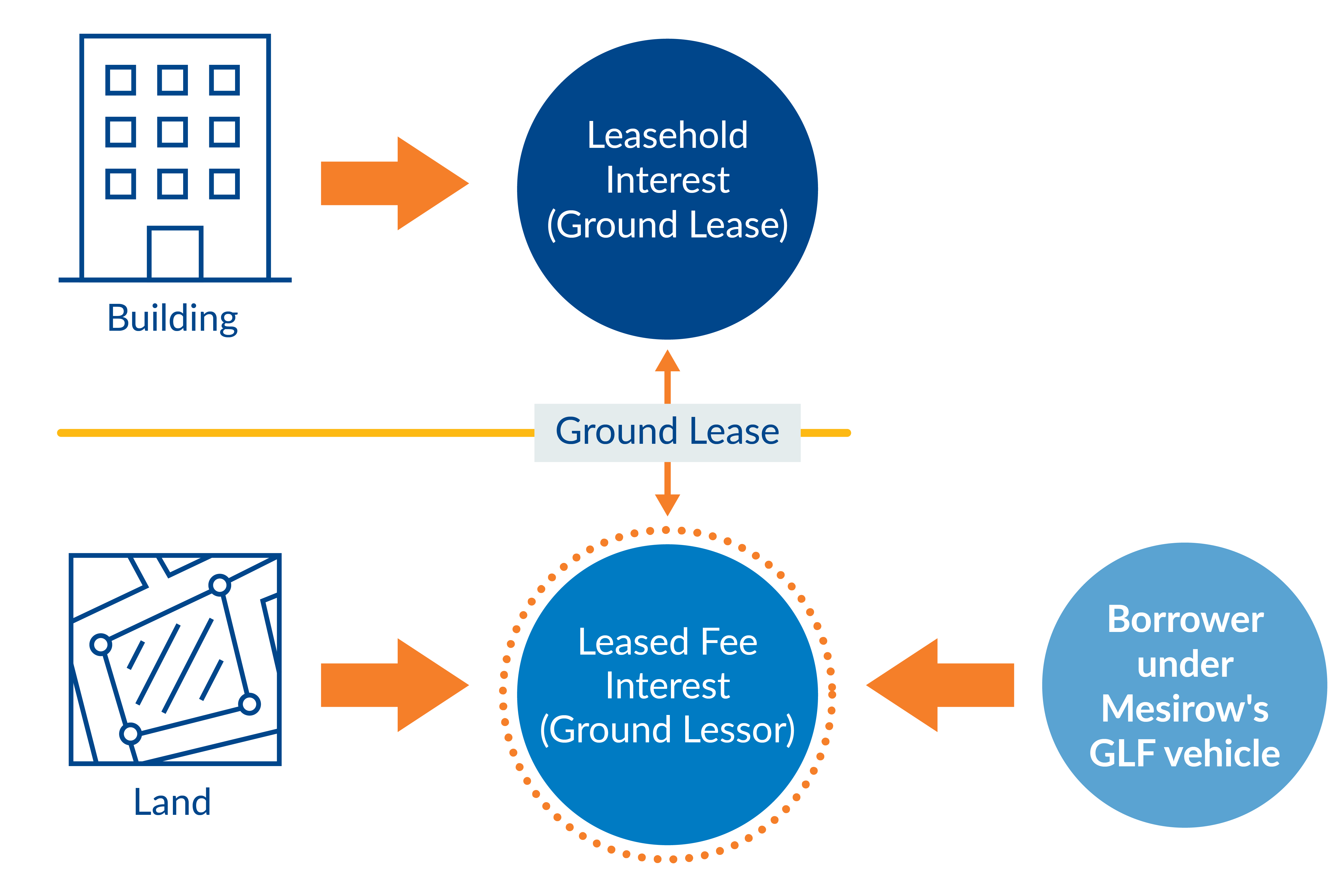

In a Ground Lease structure, the land underlying commercial real estate property is net leased on a long-term basis (typically 50-99 years) by the fee owner of the land (“Leased Fee Interest”) to the owners/operators of the real estate building (“Leasehold Interest").

Ground Lease Financing (GLF)

GLF Overview

- Structured form of commercial real estate financing

- Mortgage loan to the Ground Lessor secured by ground leased long-term to a separate building-owning entity who is the Ground Lessee.

- Defined terms

- Leased Fee Interest: owns the ground beneath the improvements

- Leasehold Interest: owns the improvements atop the ground

Synthetic ground leases

- Legal separation of a traditional fee simple property’s land from its improvements (Bifurcation)

- Each of the two bifurcated interests can be owned by affiliated entities

- Often performed in conjunction with the closing of a sponsor’s acquisition

Mesirow advises real estate clients on the following pieces which often close together in conjunction with a sponsor’s acquisition

- Bifurcation

- Mesirow’s direct loan to the Ground Lessor

- Sourcing any additional third-party leasehold debt

Property

Fee interest in ground leased to cash flowing commercial real estate across all asset classes

Size

$10 million plus

Min DSCR

1.00x ground rent. Ground rent in synthetic bifurcation sized to ~20-30% of fee-simple NOI

Leverage

Sizing largely driven by cash flow. Typically 40-55% of fee simple cost (prior to giving effect to any financing proceeds attributed to the leasehold interest

Term

5-50 year structures

Hold strategies

Debt is assignable at reasonable costs. Accommodative structures for business plans and hold strategies ranging from 5 to 50 years

Asset types

All asset types, provided sufficient in-place NOI or substantial mitigating factors

Pricing range

Dependent on various underwriting considerations

Leverage

- CRE sponsors will bifurcate a fee simple property, including at acquisition, as a means to optimize overall leverage.

- Traditional real estate transactions seek 65%-75% leverage, bifurcated transactions can produce total leverage of 80-100% between the two legal interests

Cost of Capital

- Ground Leases and Ground Lease Financings provide owners of commercial real estate properties a means of fixing a portion of the overall capital stack with fixed-rate capital in both long and short-term options.

- The overall cost of capital to sponsors is typically lower with a bifurcated Ground Lease transaction (the target is 200 bps of compression versus a Fee-Simple transaction)

Diversified capital sources

- The resultant tenor and risk profile of the Leased Fee Interest and its secured debt, provides for access to an institutional segment of fixed income investors within the debt capital markets.

- As compared to traditional Fee-Simple CMBS, these markets are generally more liquid and stable during times of market instability.

- Multiple paths to liquidity through the separate marketability of each legal interest

Large & Growing Market

The trailing 12 month market size is estimated to be approximately $3B in size (inclusive of REIT equity and financing transactions).

Mesirow represents approx. 60%-70% of the Ground Lease Financing portion of the market.

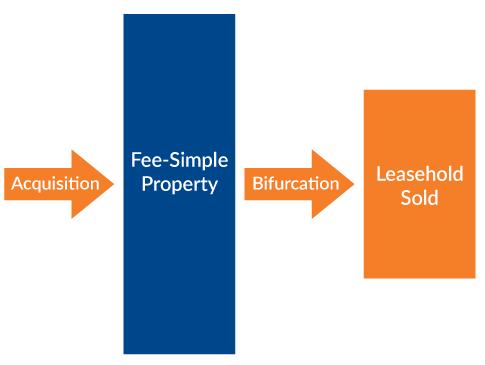

Sale of Leasehold

Process

- Property is acquired from Seller Fee-Simple

- Leasehold interest is subsequently sold subject to the terms of the Ground Lease

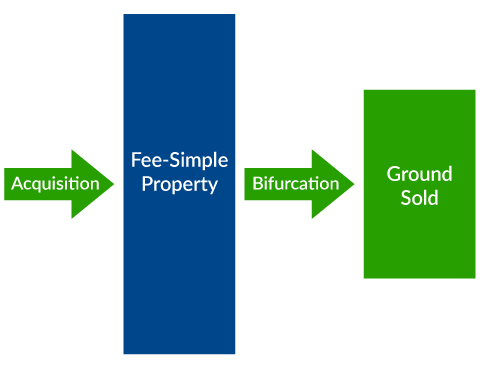

Sale of Ground

Process

- Property is acquired from Seller Fee-Simple

- Ground interest is subsequently sold subject to the terms of the Ground Lease

Upon bifurcation, can the leasehold be capitalized independently from hat of the leased fee?

Yes, the leasehold estate remains unencumbered and can be financed with a respective first mortgage lien.

Can the ground lessor and ground lessee be affiliated parties?

Yes.

Senior leaders

Insights

Explore

* As of 03.31.2025 (updated annually) | ** Data captures calendar years 2021 - 2023