Insights

The quiet engine of global risk

Share this article

How carry trades shape and shake markets

Carry trade: Simple, steady and seductive

The currency carry trade is one of global finance’s most enduring strategies. Its appeal lies in its simplicity: borrow in a low-interest-rate currency (the funding currency) and invest in a higher-yielding one (the target currency), profiting from the interest rate differential. For decades, this strategy has quietly powered capital flows across borders, often with little fanfare—until it suddenly, unexpectedly and dramatically collapses.

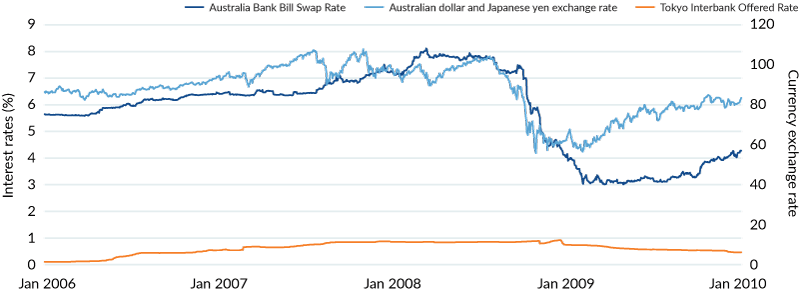

A classic example involved borrowing Japanese yen, whose interest rates hovered near zero from the late 1990s through the mid-2000s, and investing in Australian dollars, which offered significantly higher yields. The trade was straightforward: sell yen, buy Aussie dollars, and collect the spread. As long as volatility remained low and interest rate differentials stable, the carry trade delivered steady returns.

Between 2004 and 2007, yen-funded carry trades expanded rapidly as Japan’s near‑zero interest rates encouraged investors to borrow in yen and invest in higher‑yielding currencies. This wave of activity contributed to a persistent depreciation of the yen and buoyed assets in markets offering higher returns. Analyses by the Bank for International Settlements and the Federal Reserve highlight how wide interest rate differentials and subdued volatility created fertile ground for leveraged positioning, amplifying gains for institutional investors.

When the carry trade cracks

The 2008 global financial crisis marked a dramatic reversal. As risk appetite evaporated, investors rushed to unwind their carry positions. High-yielding assets were sold off, and the yen was repurchased en masse to repay borrowings. The result: a sharp appreciation of the yen and devastating losses for carry trade participants (FIGURE 1).

FIGURE 1: AUSTRALIA AND JAPANESE INTEREST RATES (%) AND CURRENCY EXCHANGE RATE

Source: Bloomberg

This unwind wasn’t just a currency event—it rippled across global markets. Liquidity dried up, borrowing costs rose, and the narrowing of interest rate spreads rendered the carry trade unattractive. The forced liquidation of positions exacerbated volatility in equities, commodities, and emerging markets.

Similar episodes followed: the Swiss National Bank’s removal of its euro peg in 2015 triggered a flash rally in the franc, wiping out years of carry trade gains. In August 2024, an unexpected policy signal from the Bank of Japan caused a brief but severe yen rally, leading to a rapid unwind of yen-funded trades. And carry trades aren’t limited to currencies. A collapse of the Terra stablecoin, a cryptocurrency pegged to the US dollar, sent shockwaves through the cryptocurrency markets in 2022.

TABLE 1: CARRY TRADE DISASTERS

| Year | Event | Currency impact | Asset class impact |

| 1997 | Asian fiancial crisis | THB -50% KRW -53% | EM equities -30% |

| 1998 | Russian ruble default | RUB -70% | Oil -55% Russian bond yields spike up to 200% in early days of crisis |

| 2008 | Global financial crisis | AUDJPY -46% in 2008 | US and international equities about -40% |

| 2015 | Swiss franc peg removal | CHF +30% in minutes | EURCHF -18.8% at day's end |

| 2022 | Terra/Luna collapse (stablecoin) | UST -100% Luna -99% | Cryto market -70% |

Sources: *see references at document end.

Carry trades: Leverage, liquidity and the lure of calm

Carry trades are typically executed via currency forward contracts—agreements to exchange currencies at a specified rate on a future date. These contracts are negotiated with major investment banks such as JPMorgan, Citibank, and State Street. Depending on the investor’s credit profile, collateral requirements may be minimal, enabling high leverage.

Leverage is both a feature and a flaw. While it magnifies returns, it also amplifies losses during adverse market moves. A small shift in exchange rates can erase months of interest income if the position is heavily leveraged.

The strategy hinges on the stability of the interest rate differential. Investors must believe that central banks will maintain their respective policy paths. A surprise rate hike in the funding currency or a cut in the target currency can compress the spread and trigger a rush to exit.

Market sentiment plays a critical role. In calm, low-volatility environments, investors tend to increase their carry exposure, reinforcing a positive feedback loop. But when volatility spikes—due to geopolitical shocks, central bank surprises or macroeconomic stress—the loop reverses, often violently.

Global implications of the carry trade: From capital flows to contagion

Carry trades are more than speculative bets—they are engines of global capital movement. When capital floods into a target country, especially an emerging market, it can inflate asset prices, fuel credit booms and strain monetary policy.

Central banks may respond by issuing debt to absorb inflows or raising interest rates to cool overheating. Ironically, higher rates can attract even more carry trade capital, deepening the cycle. Countries with floating exchange rates may allow their currency to appreciate, which can help contain inflation but may hurt export competitiveness.

The 1997 Asian financial crisis offers a cautionary tale. Speculative attacks on the Thai baht triggered a cascade of currency devaluations across the region. Carry trades played a role in amplifying the crisis, as investors rapidly exited positions in multiple emerging markets.

Digital yield, analog risk

In recent years, the carry trade has found a new frontier in digital assets. Stablecoin-based carry strategies mimic the traditional model: borrow a low-yielding stablecoin (e.g., USDC) and invest in a high-yielding digital asset or protocol (decentralized applications or blockchain-based systems that generate yield). The goal remains the same—capture the yield differential.

TABLE 2: FEATURES OF FX CARRY TRADE AND STABLECOINS CARRY TRADE

| Feature | FX Carry Trade | Stablecoin Carry Trade |

| Asset to borrow | Low-yielding currency (e.g., JPY) | Low-yielding stablecoin (e.g., USDC) |

| Investment asset | High-yield currency (e.g., AUD) | High-yield digital asset or protocol |

| Profit mechanism | Interest rate differential | Yield from staking, lending and DeFi protocols |

| Primary risk | Exchange rate volatility | Peg risk, market collapse |

The collapse of Terra/Luna in 2022 highlighted the fragility of digital carry trades. Investors who borrowed stablecoins to invest in high-yield opportunities saw their positions wiped out as the ecosystem imploded. In contrast to traditional FX markets, where central banks stand ready to stabilize turmoil, digital markets offer no such protection.

Regulatory fragmentation adds another layer of risk. Divergent frameworks—such as the US GENIUS Act and the EU’s MiCA—create blind spots that can be exploited or overlooked, increasing systemic vulnerability.

Yield chasers beware: Reckoning awaits the carry trade

The carry trade’s allure is timeless: borrow cheap, invest dear, and profit from the spread. But history shows that the strategy is prone to sudden reversals. The 1997 Asian crisis, the 1998 Russian default, the 2008 financial meltdown and the 2015 Swiss franc shock all underscore the dangers of complacency.

Carry trades often mirror broader global imbalances. As capital flows swell, they can distort asset prices, inflate bubbles, and create systemic risk. When the imbalance breaks, the unwind is swift and brutal.

Today, with the US dollar serving as a funding currency for many emerging market trades, the risk is building again. If the current administration succeeds in lowering U.S. interest rates, the dollar-funded carry trade could expand rapidly. But a global shock—be it a pandemic resurgence, geopolitical conflict or financial crisis—could trigger a violent unwind.

In the end, carry trades are not perpetual motion machines. They are cyclical, fragile, and deeply intertwined with global risk sentiment. Investors can carry on—but they rarely carry through unscathed.

* 1997 Asian financial crisis: https://www.idc.org/system/files/attachments/per04-02.pdf; https://www.investopedia.com/terms/a/asian-financial-crisis.asp#:~:text=As%20the%20Thai%20baht%20fell,7 | 1998 Russian ruble: https://en.wikipedia.org/wiki/1998_Russian_financial_crisis#:~:text=Article,being%20worth%20over%2021%20rubles; https://blogs.cfainstitute.org/investor/2015/01/15/the-ruble-crisis-where-oil-goes-the-ruble-follows/#:~:text=When%20it%20comes%20to%20oil,Thanks%20for%20the%20warning%2C%20Boris; https://www.econcrises.org/2016/05/05/russian-bond-defaultruble-collapse/#:~:text=13%20August%201998:%20Standard%20&%20Poor's,scheduled%20payments%20to%20each%20other | 2008 Global financial crisis: https://www.slickcharts.com/sp500/returns#:~:text=The%20total%20returns%20of%20the%20S&P%20500,generated%20by%20price%20changes%20in%20the%20index; https://www.msci.com/documents/10199/8815bbf9-ec59-4f12-aa96-256bb2fa47e7#:~:text=2015,%2D19.73%25 | AUDJPY change – Bloomberg | 2015 Swiss peg removal: Bloomberg | 2022 Terra/Luna collapse: cryptocurrency https://www.bis.org/publ/bisbull69.pdf

Explore more currency insights

Argentina’s $40 billion lifeline

Bailout or bet—can US Dollars Stabilize a Collapsing Peso?

Soros, stablecoins, and the new currency wars

What yesterday’s currency crisis reveals about tomorrow's digital collapse

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters