Insights

Spot and forward rates

Share this article

What they mean and why they matter

Currency traders might bemoan the lack of attention their market receives compared to equities; based on the most recent data, they trade about $7.5 trillion dollars per day compared to about $0.52 trillion daily in the global equity markets.

In building a case for why currencies should receive more attention, traders might describe how exchange rates, which describe the value of one currency in terms of another, are the lifeblood of foreign trade, investment and risk management. You knew that from reading our currency quote basics article. But did you know that currency exchange rates come in two flavors, spot and forward?

Too complex? Not at all. In fact, if you travel internationally and buy the local currency for short taxi rides and small purchases, you’ve already mastered the spot topic. Let’s review currency quotes and see how spot and forward exchange rates fit together.

Exchange rates have three components: the base currency, the quote currency, and the exchange rate (Figure 1).

FIGURE 1: COMPONENTS OF A SPOT EXCHANGE RATE

Translation: One euro can be exchanged for 1.0934 US dollars

Spot exchange rates

Spot exchange rates are used in trades that settle promptly, meaning the currencies are exchanged within two days or less; forward exchange rates are for trades that settle between a few days and years.

Spot exchange rates are influenced by supply and demand. That demand can be from central banks buying and selling currencies for monetary reasons, such as intervening to keep a country’s exchange rate stable as a reaction to an event. Or the demand might be in the form of trade: Importers and exporters need large amounts of currencies for selling and buying merchandise and services. Investment is another example - investors use currencies to trade foreign assets.

Forward exchange rates

Forwards are agreements to exchange currencies later than two days, often a month or more after the transaction. Forward exchange rates used in those agreements are based on the spot rate at the time of the trade plus forward points. Those points reflect the difference between interest rates of the two currencies. That interest rate differential is converted to points which are added to the spot rate.

FIGURE 2: CURRENCY FORWARD

Source: Mesirow

The covered interest rate parity formula says the relationship between spot and forward exchange rates and the interest rates of the currencies must be in equilibrium to avoid arbitrage. The equation is:

COVERED INTEREST RATE PARITY EQUATION

F = S * (1+ ibc) / (1+iqc) where

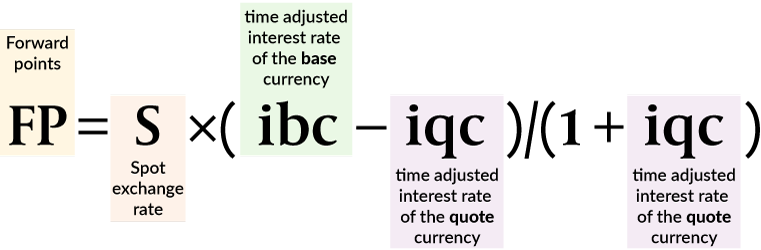

If we want to calculate just the forward points (FP), we use this equation:

FORWARD POINTS EQUATION

FP = S * (ibc – iqc) / (1+iqc)

If we add these calculated forward points to the spot rate, we’ll get the forward exchange rate we calculated using the covered interest rate parity formula. Let’s see how it works:

| EURUSD spot exchange rate | 1.0934 |

| Days to settlement | 30 |

| Interest rate time adjustment | 30 days to settle / 360 days per year = 0.08333 |

| Interest rates for euro and US dollar | Euro: 2.324% or 0.02324 USD: 4.334% or 0.04334 |

| Adjust interest rates for 30-day period | Euro (ibc): 0.02324 * 0.08333 = 0.001937 USD (iqc): 0.04334 * 0.08333 = 0.003612 |

Calculate forward rate F using covered interest rate parity equation.

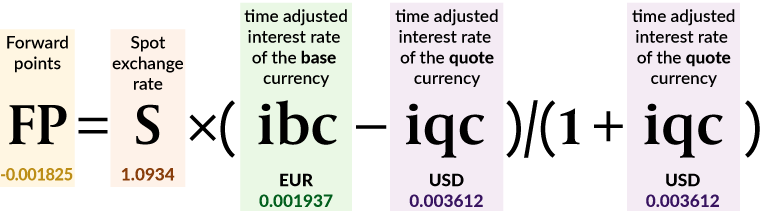

Now, let’s calculate forward points and combine them with spot rate to obtain the forward rate:

FP = S * (ibc – iqc) / (1+iqc)

For convenience, we copy data from the Forward exchange rate example:

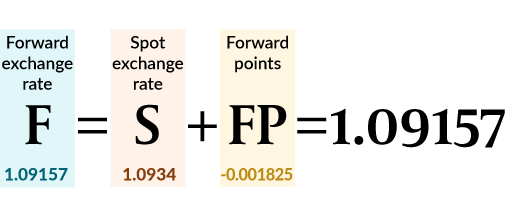

Combine the forward points with the spot rate to get the forward exchange rate, F

Using the equation for 1) covered interest rate parity and 2) forward points and then adding the points to the spot rate resulted in the same forward exchange rate.

When the currency with the lower interest rate is the base currency, the forward points are negative resulting in a forward discount. Forward points are positive when the currency with the higher interest rate is the base currency. That’s called a forward premium. In our example, EUR is the base currency and it has the lower interest rate, so we have a forward discount.

Foreign trade

Forward exchange rates are often used in hedging risk. A US wine importer, expecting a large shipment of Italian wines in three months, worries about the EUR-USD exchange rate. Fearing the euro might strengthen between now and receipt of the wine (when payment is due) making the shipment more expensive in dollar terms, the importer locks in the future price today by entering a forward exchange rate transaction.

For the importer, the downside to this agreement is that the euro might weaken before payment for the wine. A weaker euro would mean a lower dollar price for the wine shipment, a better situation for the importer. However, the importer is more worried about the risk of a higher euro price and so decides to purchase the forward.

TABLE 1: CHARACTERISTICS OF SPOT AND FORWARD EXCHANGE RATES

| Feature | Spot exchange rate | Forward exchange rate |

| Timing | Immediate | Future but agreed upon today |

| Purpose | Direct exchange | Hedging, speculation |

| Influenced by | Market demand | Interest rate differentials, exchange rate expectations |

Market upheaval, like that associated with President Trump’s tariff announcement in early April, brings currency to the forefront given its importance in foreign trade. Importers typically comfortable with long-term forward exchange rates might have switched to spot or short-term forward exchange rates, importing as much as possible before tariff rates took effect.

Knowing how spot exchange and forward exchange rates work, when they’re appropriate and their typical uses can help you make smarter financial decisions whether you’re an importer, traveler or investor.

Explore more currency insights

Are we too dependent on this FX benchmark?

FX benchmark prices are critical for global commerce, investments, and trading, but is there a hidden risk in your favorite FX rate?

Should a nation manage its currency?

Free float vs managed float currency exchange rates: which one is better?

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters