Insights

Is the US dollar Argentina’s new currency?

Share this article

October 30, 2023 | By Mesirow Currency Management

With the final round of the presidential election looming and the nation battling triple-digit inflation, Argentina’s citizens wonder what to do. The libertarian Javier Milei, a larger-than-life candidate, proposes to save the economy by dollarizing, replacing the peso with the US dollar. It’s a drastic measure from which there is no turning back. Complicating the situation, Argentina was invited to join BRICS, an association of emerging economies that seeks to blunt the importance of the US dollar in world trade. Is dollarization the best way forward?

Introduction

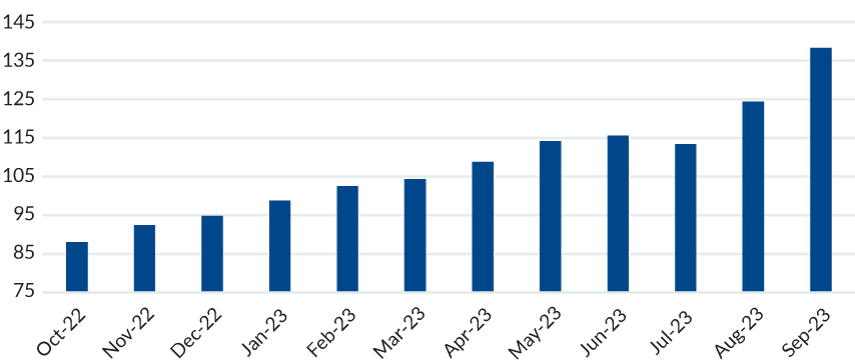

The recipient of 22 International Monetary Fund bailouts in the last 65 years, Argentina is gasping economically once more. Rocked by inflation approaching 140 percent (Figure 1), and lacking foreign reserves to support the peso – US dollar exchange rate, the Argentinian currency is worth less than three-tenths of one US cent ($0.00285) at the official rate.

Figure 1: Argentina Inflation Rate (%) October 2022 – September 2023

Source: tradingeconomics.com

Javier Milei, an economist and libertarian politician, was the Argentinian presidential front-runner until the October 22nd election when he finished second to Peronist Sergio Massa, the economic finance minister. A run-off election, scheduled for November 19th, means Argentinians will hear more about Milei’s proposals to rescue the economy by ditching the peso in favor of the US dollar as the national currency, a process called dollarization.

Argentina would not be the first South American nation to dollarize. Ecuador exchanged its sucre for the dollar in 2000. In Central America, Panama (1904) and El Salvador (2001) use the dollar, joining eight other dollar-based nations. Ecuador’s experience, given its size, has the most to offer Argentina in likely dollarization outcomes.

Beneficial outcomes – at first

Most Argentinians routinely use the dollar; switching completely to the US currency would relieve the headaches involved in managing two currencies. But adopting the US dollar would mean delegating central bank interest rates decisions and ceding control of money creation to the Federal Reserve, likely stabilizing the Argentinian economy and providing a credible and reliable monetary basis; this is what occurred in Ecuador in 2000. The Ecuadorian situation remained positive through 2008 because of beneficial conditions including high oil prices (Ecuador is an oil exporter), moderate budget discipline, an independent central bank, and a competitive exchange rate given the US’s accommodative monetary policy.

It won’t solve all the problems

Once dollarized, Argentina could have no hope of changing back to the peso; reverting to a dysfunctional currency from the world’s reserve currency would be virtually impossible. A nation without a full-fledged central bank would be a country without a lender of last resort when crises erupt. In a financial emergency, there would be no one to provide short-term liquidity to the government or to save the banks; depositors would be wiped out. With the ability to create money sharply curtailed, Argentina would have to rely on fiscal policy, external financing, and central bank foreign exchange reserve management to address calamities.

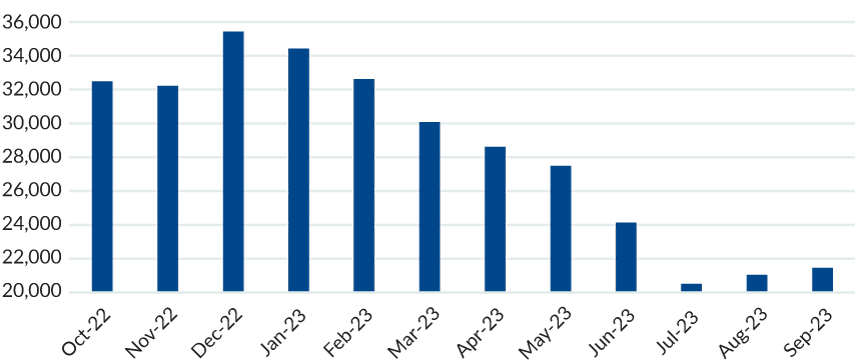

Argentina’s fiscal management record is poor, and it would be hard to imagine many lenders lining up to loan funds to a country that is endlessly at the IMF door. Moreover, Argentina would need $20 to $40 billion to switch to the dollar, but it is unclear where that money would come from. Indeed, Argentina cannot even repay the $44 billion it owes the IMF.

Figure 2: Argentina FX Reserves (USD million): October 2022 – September 2023

Source: tradingeconomics.com

Argentina could benefit from reviewing Ecuador’s dollarization experience. Initial benefits began to erode in 2009 when the central bank loaned massive amounts to the government and spending soared. Increases in public sector spending fueled greater imbalances. Oil price declines in 2014 damaged revenues, and an increasing exchange rate made exports more expensive.

Get the fiscal house in order

In Ecuador, dollarization did not lead to good fiscal management or the development of reforms to support future economic growth. Ecuador’s experience suggests that dollarization can be successful in curtailing an unconstrained money supply, but that a balanced budget, healthy banking sector, wide export base, flexible labor, and adequate foreign exchange reserves are crucial fiscal elements that dollarization by itself cannot develop or maintain.

Despite the fiscal issues, dollarization in Ecuador remains popular. The sucre is associated with sharp devaluations that ruined savings, weak monetary credibility, and hyperinflation. There is no interest in de-dollarization.

Unlevel and disjointed BRICS

Another factor for Argentinians to consider concerns BRICS. That is a group of major emerging economies – Brazil, Russia, India, China, and South Africa – formed to counter the economic power of the US and western allies, including the dominant role of the US dollar in global trade. At their August 2023 conference, BRICS welcomed six new countries for membership in 2024: Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and United Arab Emirates. BRICS, already struggling to develop a unified approach to the West, will find it difficult to craft a credible stance against the dollar and western trade if one of their newest members is a dollar-based economy. Complicating a difficult situation, Javier Milei has stated he would withdraw Argentina from BRICS.

Controversial economic actions like Milei’s BRICS proposal and a vow to slash spending that would impoverish an already poor electorate frightened voters in the first round of elections. The leading opponent, Sergio Massa, helped his cause by eliminating income taxes for 99 percent of workers and issuing cash bonuses. One politician promises pain, and another gives gifts. It’s not too difficult to see where things are likely to end up.

Explore more currency insights

The future for hedged share class investors: Futures Overlays

Hedge Share Class Investors Grapple with Shorter (T+1) Security Settlement Cycle

An armed war and a currency battle

Russia confronts the US dollar with so-so results

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters