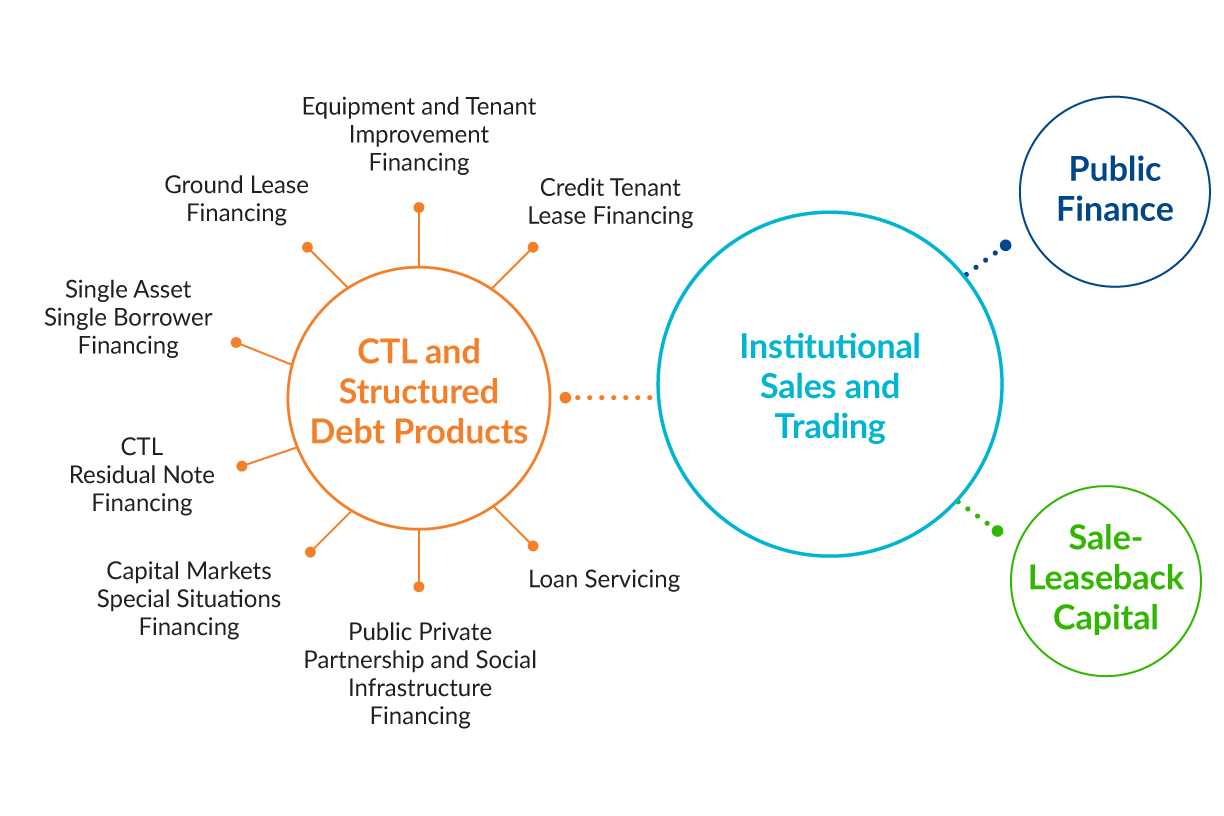

CTL and Structured Debt Products

As part of the integrated Mesirow Capital Markets platform, we deliver tailored advice and client-focused service. Long-term financing solutions at favorable fixed rates as well as advice on the structuring, placement and underwriting of alternative debt structures and real estate assets.

8

Consecutive years with a top 10 ranking in domestic private placements*

230+

Completed transactions

~$26B+

In total issuance

~$12.7B+

Servicing portfolio

Our clients access...

integrated capabilities from across Mesirow Capital Markets, in addition to potential access to the firm’s balance sheet.

We offer clients the feel of a boutique investment bank and the scale of some of the larger Wall Street banks.

Nat Sager | President & Head of Strategy, Mesirow Capital Markets

Insights

Senior Leaders

Explore

Data as of 12.31.2025. | *Private Placement Monitor League Tables 2015-2024.