Insights

Monetary futures: Stablecoins leap ahead of CBDCs

Share this article

China, India and the EU press on with CBDCs, but the US bets big on private crypto innovation

CBDCs

Central bank digital currencies – a virtual version of a nation’s currency issued by its central bank – took the early lead in the race to be the primary form of digital money. But enthusiasm for CBDCs has waned, handicapped by public and business resistance. Stablecoins, cryptocurrencies whose values are pegged to another asset, have vaulted into the lead, supercharged by the United States’ passage of supportive legislation in July 2025.

That doesn’t mean CBDCs are resigned to finishing a distant second place or worse. Three of the world’s most populous centers – China, India, and the European Union – are pushing forward with CBDCs. The stakes couldn’t be higher: domination of global payment processes, a chance to become a major currency in central banks’ reserve currency holdings and a means to defend national financial sovereignty.

Status of Central Bank Digital Currencies

Three nations – The Bahamas (CBDC: Sand Dollar), Nigeria (eNaria) and Jamaica (JAM-DEX) – have launched CBDCs. Despite government encouragement, CBDC usage is poor in all three countries – CBDCs make up less than one percent of currency in circulation (Tables 1, 2 and 3).

Table 1: CURRENCIES IN CIRCULATION – THE BAHAMAS

| Bahamian dollars B$ Sand Dollar launch: October 2020 |

| Date | Sand Dollar B$ | Total Currency B$ | Sand Dollar as % of Total Currency $B |

| 4Q2020 | 75,000 | 546,545,000 | 0.01% |

| 4Q2021 | 304,000 | 556,997,000 | 0.05% |

| 4Q2022 | 1,052,000 | 600,728,000 | 0.18% |

| 4Q2023 | 1,692,000 | 608,844,000 | 0.28% |

| June 2024 | 2,378,000 | 591,057,000 | 0.40% |

Source: Central Bank of The Bahamas

Table 2: CURRENCIES IN CIRCULATION – NIGERIA

| Nigerian Naira ₦ |

| Date | eNaira ₦ billion | Total Currency ₦ billion | eNaira as % of Total Currency |

| 4Q2021 | 0.7008 | 3,330 | 0.02% |

| 4Q2022 | 6.6026 | 3,010 | 0.22% |

| 4Q2023 | 12.5045 | 3,640 | 0.34% |

| 4Q2024 | 18.52 | 5,440 | 0.34% |

Sources: Tekedia.com; Tradingeconomics.com

Table 3: CURRENCIES IN CIRCULATION – JAMAICA

| Jamaican dollar J$ |

| Date | JAM-DEX J$ billion | Total Currency J$ billion | JAM-DEX as % of Total Currency |

| 4Q2022 | 0.046 | 238.8 | 0.02% |

| 4Q2023 | 0.257 | 279.6 | 0.09% |

| 4Q2024 | 0.258 | 286.1 | 0.09% |

Sources: Jamaica Information Service; RJR News; Jamaica Observer

What’s wrong with CBDCs?

The old ways of doing business are better

While each country has specific reasons for low CBDC usage, some problems are common: lack of clear benefits, failure to integrate with existing bank and payment systems and merchant resistance to accepting CBDC payments. Privacy – government surveillance of spending and dictates as to how the digital currency can be spent – worry everyone.

The aversion to CBDCs for these early adopters hasn’t dissuaded other nations from charging ahead with CBDC development. Forty-nine countries are piloting central bank digital currencies. The pilot programs for China and India are furthest along. Digital yuan (e-CNY) recorded world-leading transaction volume of seven trillion e-CNY ($986 billion) in June 2024, up from 1.8 trillion e-CNY ($253 billion) in June 2023. Digital rupee (e-rupee) in circulation increased from $28 million in 2024 to $122 million by March 2025.

Despite India’s impressive transaction results, FTI Consulting reported that expected progress had slowed. Concerns about data privacy and cybersecurity and insufficient public education on the benefits of CBDCs and how to use them have slowed growth.

People and businesses were reluctant to switch from the Unified Payments Interface, India’s incredibly popular payment system (83% of total payment volume in 2024). FTI noted that the UPI and central bank digital currencies are both useful for financial transactions. The UPI dominates fast and efficient transactions for smaller, retail-related payments, while CBDCs are more focused on security and tracking large monetary transactions.

While India and China have forged ahead with actual CBDC transactions, the third population center, the European Union, is proceeding cautiously. It’s working through a CBDC preparation phase that focuses on development, testing and gaining support from bureaucrats and users. Scheduled to finish in October 2025, the preparation phase will be followed by more stakeholder engagement and selection of firms with whom the EU will draft ‘framework agreements’ to develop a digital euro platform. Excessive caution, endless stakeholder consultation and slow approvals from the European Commission, European Council and European Parliament impede progress. The frustratingly feeble pace means there is no CBDC in the EU’s near-term future.

The situation is worrisome to Christine Lagarde, President of the European Central Bank. She has urged those stakeholders to grant approvals and speed development of a central bank digital euro. In a June 2025 speech, Lagarde said the digital euro was a “strategic priority” that would bolster Europe’s retail payment system. It would also address some digital currency risks such as stablecoins that break the peg with their reference asset. And a CBDC would help protect Europe’s bank-based financial and monetary system. Lagarde sees a digital euro as key to Europe’s financial autonomy.

Meanwhile, across the Atlantic

The United States’ approach to digital assets differs remarkably from the EU’s plan. The US will ban CBDCs if President Trump signs the CBDC Anti-Surveillance State Act. Passed in the House of Representatives, the Senate is considering the legislation. The anti-CBDC legislation is intended to protect individual privacy and prevent government surveillance through its monetary system.

The US is all in on stablecoins, seeing the cryptocurrency as a way to enhance the US dollar’s position as the dominant reserve currency. Most stablecoins are pegged to the dollar, and stablecoin issuers would hold US treasuries as reserves.

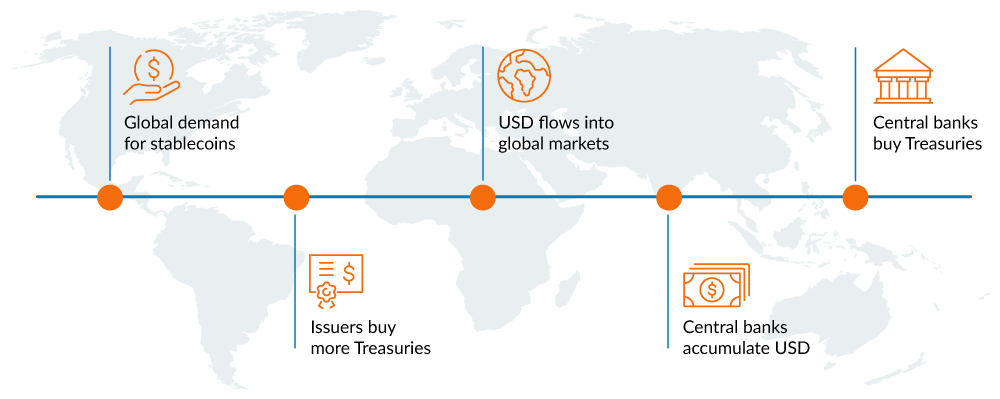

Figure 1 shows how the process will work. In the end, central banks will accumulate dollars and often convert the dollars to US treasuries, thus strengthening the US dollar’s position as the world’s dominant currency.

FIGURE 1: STABLECOINS SOLIDIFY US DOLLAR AS WORLD’S DOMINANT CURRENCY

The monetary race is a marathon, one that won’t end soon. A misstep by the US stablecoin industry - a bailout of stablecoin issuer that broke its peg, for instance - could result in a public backlash that gives China, India or the EU time to promote a CBDC that addresses privacy, integration, and usefulness concerns.

Explore more currency insights

Spot and forward rates – what they mean and why they matter

Knowing how these rates work, when they’re appropriate and their typical uses can lead to smarter financial decisions for importers, travelers or investors.

Are we too dependent on this FX benchmark?

FX benchmark prices are critical for global commerce, investments, and trading, but is there a hidden risk in your favorite FX rate?

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters