Insights

3Q2023 Currency Commentary

Share this article

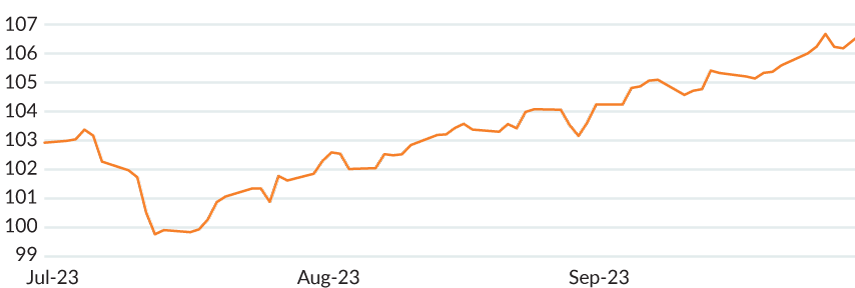

US dollar outperforms G10 currencies

US dollar strengthened broadly over Q3, outperforming the G10 currencies save a stronger Norwegian Krone. The Fed delivered their one and only hike in the beginning of the quarter, raising rates by 25bps to 5.5%. CPI numbers were as expected with the latest readings for headline at 0.6% MoM and core at 0.3% MoM. With the market anticipating another 25bps hike by year-end, soft landing hopes for the US economy are still balanced along with concerns that rates may need to stay higher for longer.

FIGURE 1: DXY – 3Q2023

Source: Bloomberg

EUR | Euro generally underperformed this quarter, outperforming only the weaker Australian dollar, Yen, and Sterling in Q3. The ECB delivered two 25bps hikes, in July and September, moving rates from 4% to 4.5%, making good on Lagarde’s Hawkish mid-quarter speech at Jackson Hole. Eurozone inflation numbers continued to fall, with September’s headline number falling to 4.3% YoY from 5.2% for August.

GBP | Sterling was broadly weaker in Q3, the largest underperformer in the G10 over the quarter. September was particularly damaging despite the BOE delivering a 25bps hike the month before while pausing during the most recent month. Weakening CPI numbers over the quarter, including an especially large drop in the core reading to 6.2% YoY from 6.9%, pushed the currency lower.

JPY | Yen was a large underperformer in Q3, trailing all other G10 currencies other than the weak Sterling over the quarter. While inflation printed at 3.2% YoY vs. 3% consensus by quarter-end, the BOJ held rates steady as Governor Ueda reiterated their dovish stance by saying that they needed to be patient. With a weakening currency, the MoF / BOJ followed its theme of threatening intervention to prevent further weakness.

AUD | Australian dollar found general weakness over the quarter, gaining only against the weaker Sterling and Yen in the G10. While the RBA did not deliver on an expected hike mid-quarter, forward guidance was kept the same, implying that some further tightening may be needed. While August inflation jumped to 5.2% YoY and employment showed resilience with a change of 64.9K vs. 25K consensus, retail sales slipped to 0.2% in August, down from 0.5% previously.

CAD | Canadian dollar landed in the middle of the G10 over the quarter as a strong September helped support CAD. The BOC started July by hiking 25bps to 5% while stating that the end of their tightening cycle could be near. While CPI in June dropped, the next two readings rebounded, registering 4.0% YoY in August along with better-than-expected net change in employment at 39.9K and a rise in hourly wages by 5.2% YoY. Rates were left unchanged for the rest of the quarter while keeping the door open to further hikes.

CHF | Swiss franc finished near the middle of the G10 over the quarter, as strength early in Q3 reversed to weakness to finish out the quarter. The SNB unexpectedly kept rates unchanged in September, noting that recent tightening has helped counter remaining inflationary pressures. Data prints for August were generally better with CPI steady at 1.6% YoY, unemployment also steady at 2.1%, and retail sales trending upwards after softening previously.

EM | MSCI EM Currency Index showed strength early in the quarter before turning down and finishing -0.44% in Q3 as stronger US dollar kept emerging market currencies under pressure. Brazil continued to cut rates in August and September while economists forecast further rate cuts into the end of the year. While the PBOC has been defending CNY in China, worsening balance of payments pressured the Renminbi.

TABLE 1: USD-BASED AS OF SEPTEMBER 30, 2023

| FX Rate | Change 3M % | Change YTD % | ||

| EUR-USD | 1.05875 | -2.96% | -0.80% | |

| GBP-USD | 1.22055 | -4.00% | 1.47% | |

| USD-JPY | 149.225 | -3.14% | -11.58% | |

| AUD-USD | 0.6454 | -3.04% | -4.83% | |

| USD-CAD | 1.352 | -2.13% | 0.22% | |

| USD-CHF | 0.9148 | -2.20% | 1.14% | |

| Source: WM/Reuters | ||||

Currency for return

Currency Alpha

Mesirow Currency Management’s (MCM) Extended Markets Currency Alpha, Emerging Markets Currency Alpha, and Systematic Macro strategies all had positive third quarter performance. MCM’s Asian Markets Currency Alpha Strategy did suffer some losses but is still in the green on a year-to-date basis.

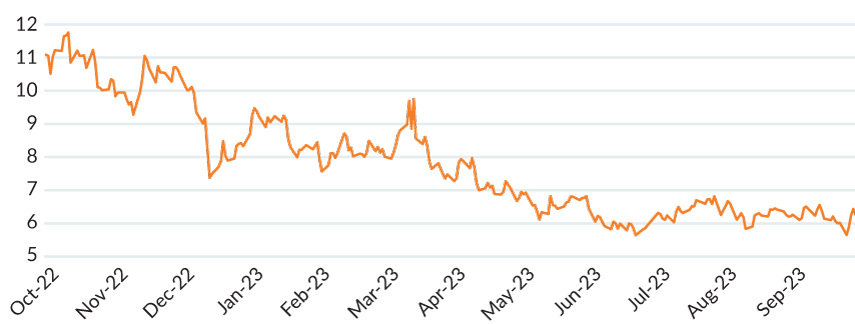

Our measure of global currency volatility, our GVI1 (Figure 2), remained stable (overall) during the third quarter and has fallen over the past year to levels last seen in March 2022. This recent increase in financial market stability has helped inform the decision-making capabilities of our machine learning models (found in the Technical component of our alpha strategies). MCM’s neural network models performed positively in this most recent quarter and are our best performing suite of models over the past year. The heightened prevalence of recurrent market behavior patterns and increased predictability of governmental interventions in this post-pandemic era has enhanced the deep neural network models' ability to capture historical data for more accurate predictions and has resulted in positive performance throughout all our alpha strategies.

FIGURE 2: MCM'S GLOBAL VOLATILITY INDICATOR: OCTOBER 2022 – SEPTEMBER 30, 2023

Source: Mesirow

MCM’s alpha strategies do, however, perform well in varying market conditions and are uncorrelated to bonds, stocks, and other market activity (Table 2).

TABLE 2: CORRELATION – STRATEGY INCEPTION TO 3Q2023

| Barclays Aggregate Global Bond Index | MSCI ACWI Index | S&P 500 Index | Consumer Price Index | |

| Extended Markets Currency Alpha | 0.06 | 0.04 | 0.04 | -0.04 |

| Asian Markets Currency Alpha | 0.00 | -0.19 | 0.03 | 0.07 |

| Emerging Markets Currency Alpha | 0.03 | -0.15 | 0.01 | -0.13 |

| Systematic Macro | 0.00 | -0.07 | 0.00 | -0.04 |

| Source: Mesirow, Bloomberg, U.S. Bureau of Labor Statistics2 | ||||

As the USD gained strength over Q3, our long US dollar positions against the New Taiwan dollar, the Chilean peso, and Chinese yuan contributed the most to positive performance. Conversely, our short USD positions against the Indonesia Rupiah and the Indian Rupee, which reached a record low in September, negated some of our gains.

Intelligent Multi-Strategy Currency Factor

MCM’s Intelligent Multi-Strategy Currency Factor recorded a slightly negative third quarter as a slow start to the period was partially offset by a positive September as US dollar strengthened over the third quarter. The Carry factor contributed positive performance on US dollar strength, while both Momentum and Value factors detracted from the program in Q3.

Latest MCM viewpoints

Hedge Share Class Investors Grapple with Shorter (T+1) Security Settlement Cycle

Russia tries to trade in other currencies with so-so results

Nations are rushing to launch CBDCs. Will the U.S. be a leader or a laggard in the digital currency race?

Contact us

To learn more about Mesirow Currency Management's custom currency solutions, please contact Joe Hoffman, CEO Currency Management at joseph.hoffman@mesirow.com.

Explore currency solutions

Passive and Dynamic Risk Management

Customized solutions to manage unrewarded currency risk in international portfolios.

Currency for Return

Strategies that aim to profit from short and medium-term moves in the currency market.

Fiduciary FX

Trading solution for asset managers and owners with focus on reducing transaction costs, improving transparency and enhancing efficiency.

1. The GVI is an internal proprietary model utilizing one month at-the-money (ATM) volatility for G10 currencies, including crosses plus BIS liquidity report weightings.

2. The above performance information is supplemental. Performance of the Extended Markets Currency Alpha Strategy, Asian Markets Currency Alpha Strategy, Emerging Markets Currency Alpha Strategy, and the Systematic Macro Strategy prior to 10.1.18, was attained at The Cambridge Strategy (TCS), an unaffiliated investment manager. On 10.1.18, a MFIM affiliate completed the purchase of a significant portion of TCS’ assets, including TCS’ intellectual property and hired a majority of TCS employees. Past performance is not an indication of future results. Actual results may be materially different from the results achieved historically. Notes on performance: The Extended Markets Currency Alpha Strategy (Extended Alpha Strategy) commenced trading in 4.1.04. The Asian Markets Currency Alpha Strategy (Asian Alpha Strategy) commenced trading in 2.1.06. The Emerging Markets Currency Alpha Strategy (EM Alpha Strategy) commenced trading in 2.1.08. Systematic Macro Performance includes performance 1.1.12 to present. Performance 1.1.12 to 2.1.18 represents hypothetical trading with backfilled data and does not represent trading on behalf of an actual client account. See the disclosure slide at the end of this presentation for information regarding hypothetical performance results. The returns for 2.1.18 are unadjusted returns for a partial month. The strategies illustrated above include accounts containing both client and Firm capital. To the extent that any account contained both client and Firm capital, assets in such account were traded in an identical manner and thus the client and Firm have identical gross returns. The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 46 country indices comprising 23 developed and 23 emerging market country indices. The Bloomberg Barclays Global Aggregate Bond Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. The S&P 500, or simply the S&P, is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters