Insights

Currency Outlook 2026

Share this article

January 15, 2026 | By Uto Shinohara, CFA

Introduction

The “Sell America” theme gained momentum through 2025 as the US dollar’s traditional safe-haven appeal was challenged. Unpredictable trade policy injected uncertainty into US growth prospects, rekindled inflation risks, and raised questions around Fed independence. As the Trump Administration enters its second year, the FX market outlook for 2026 will be shaped by central bank policy divergence, foreign relations, and the evolution of AI investment.

Post-Liberation Day: Breakdown in historical relationships

Liberation Day marked a clear turning point for markets, coinciding with a series of anomalies that ran counter to long-standing historical relationships.

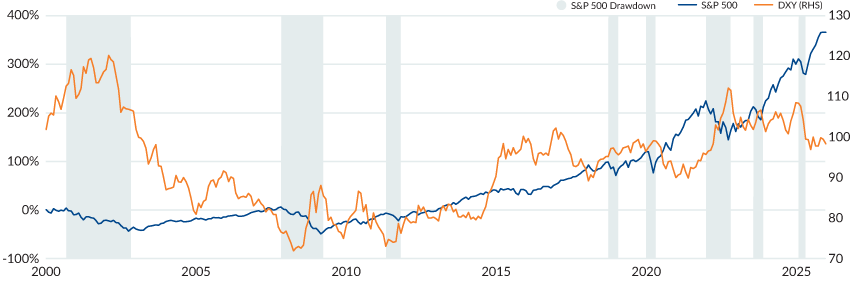

Historically, periods of US equity drawdowns have been accompanied by US dollar strength, with the dollar acting as a natural diversifier and defensive asset for global investors due to its safe-haven characteristics. Over the past quarter century, US equity weakness has typically coincided with USD appreciation. Following Liberation Day, that relationship broke down. The most recent equity sell-off saw both US equities and the dollar fall simultaneously, an outcome particularly painful for offshore investors with unhedged US exposure.

Figure 1: US DOLLAR DURING US EQUITY DRAWDOWNS

Source: Bloomberg, Mesirow

Rather than benefiting from heightened uncertainty, the dollar weakened as the US itself became the source of instability, with markets increasingly pricing negative economic shocks to the domestic economy, undermining the dollar’s role as a defensive asset.

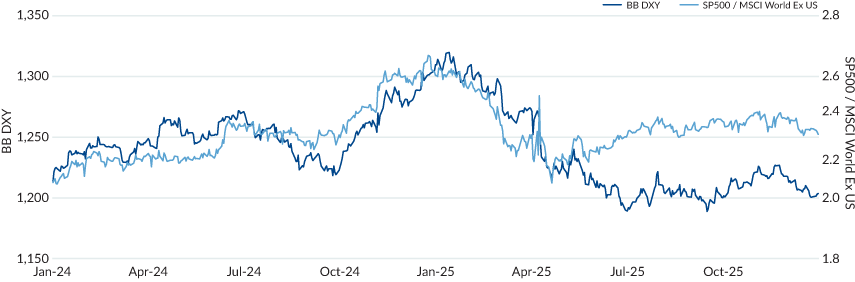

This breakdown extended beyond risk dynamics into capital flows. Traditionally, periods of US equity outperformance relative to international markets have been associated with a stronger dollar, reflecting increased demand for US assets. This relationship held into 2025 but fractured after Liberation Day.

Despite a recovery in US equities, the dollar failed to appreciate, instead weakening throughout the first half of the year, suggesting a reluctance among global investors to add incremental US exposure amid the “Sell America” backdrop.

Figure 2: US DOLLAR VS. EQUITY MARKET DIFFERENTIAL

Source: Bloomberg, Mesirow

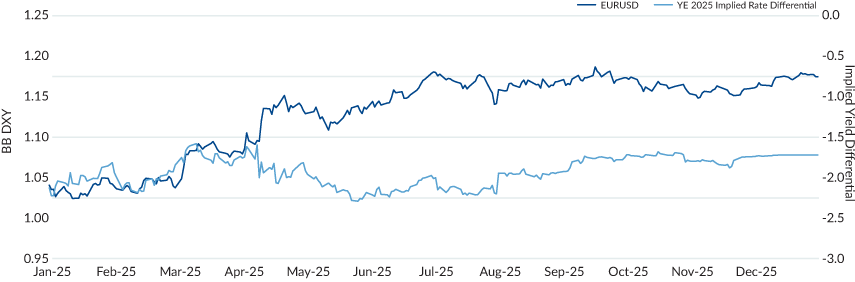

A third anomaly emerged in interest rate differentials. FX markets have historically tracked relative yield expectations, as investors seek higher returns across jurisdictions. Prior to Liberation Day, EURUSD closely followed implied year-end rate differentials between the ECB and the Fed. Post-Liberation Day, however, the relationship inverted with the Euro strengthening relative to the dollar, despite rate differentials continuing to favor the US. This divergence persisted into year-end.

FIGURE 3: FX VS. IMPLIED YEAR-END DIFFERENTIALS, EUROPE VS. US

Source: Bloomberg, Mesirow

Looking ahead to 2026

The dollar enters 2026 facing opposing forces

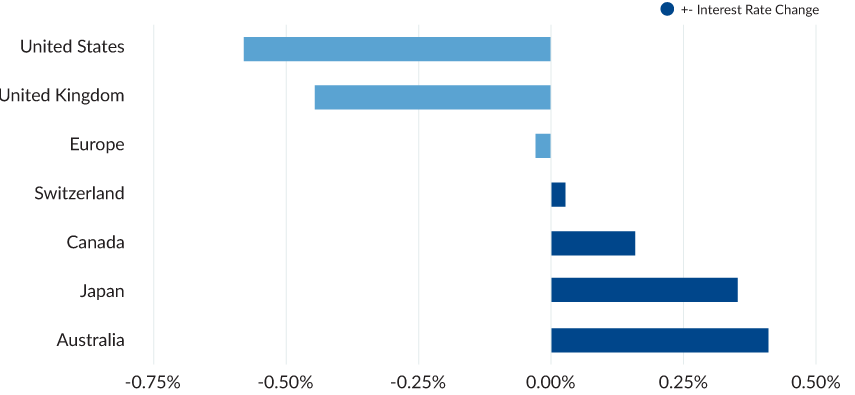

On one hand, diverging central bank policies point to continued headwinds. While the Federal Reserve remains in an easing cycle, most other major central banks are either on hold or retain a tightening bias. This divergence leaves the dollar more vulnerable relative to its peers. Although USD hedging activity increased following the dollar’s first-half decline in 2025, hedging driven by loss aversion is likely to be less reactive in 2026. With the dollar having traded largely sideways over the past six months, hedging decisions are increasingly being guided by strategic and fundamental considerations rather than short-term price moves.

Importantly, if the Fed continues to ease while other central banks remain on hold or turn more hawkish, the cost of hedging USD exposure will continue to fall. In some regions, with Australia being a notable example, investors may ultimately earn positive carry by hedging US dollar exposure.

Figure 4: IMPLIED 2026 INTEREST RATE CHANGES

Source: Bloomberg, Mesirow

Counterbalancing these pressures are capital flows linked to AI investment, which remain heavily US-centric. US firms continue to benefit from a comparatively light regulatory environment, supporting inward investment and, by extension, the dollar. However, risks remain two-sided; AI may ultimately prove more of a cost center than a productivity driver, or China could leapfrog the US with cheaper and more advanced alternatives, making the US markets less attractive and lowering demand for the dollar.

As the second year of the Trump Administration begins amid renewed geopolitical noise, most recently highlighted by developments surrounding Venezuela’s President Maduro, investors face elevated uncertainty around foreign and trade policy. In this environment, we believe it is critical for investors to have a clearly defined currency hedging framework in place, allowing currency risk to be managed proactively within international portfolios.

From all of us at Mesirow Currency Management, we wish you a healthy and prosperous New Year.

Explore more currency insights

The quiet engine of global risk

How carry trades shape and shake markets

Argentina's $40 billion lifeline

Bailout or bet—can US dollars stabilize a collapsing peso?

The information contained herein is intended for institutional clients, Qualified Eligible Persons, Eligible Contract Participants, or the equivalent classification in the recipient’s jurisdiction, and is for informational purposes only. Nothing contained herein constitutes an offer to sell an interest in any Mesirow investment vehicle. It should not be assumed that any trading strategy incorporated herein will be profitable or will equal past performance.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters