Insights

Mesirow Currency Management | 4Q2025 Commentary

Share this article

US dollar finished in middle against G10 peers

US dollar finished in the middle of the against its G10 peers in Q4, reflecting mixed domestic fundamentals and evolving Fed guidance. Early in the quarter, the dollar showed strength, supported by hawkish Fed communication, political uncertainty abroad, and safe-haven demand. However, in November, uncertainty around the government shutdown and mixed Fed commentary left markets unsure of the trajectory for December policy. In December, a dovish rate cut, limited hawkish dissent on the Fed vote, and speculation on the next Fed chair weighed down on the dollar. Rising unemployment and softer-than-expected inflation further pressured the currency, with lingering data distortions from the shutdown and ongoing policy uncertainty limiting investor conviction for the quarter.

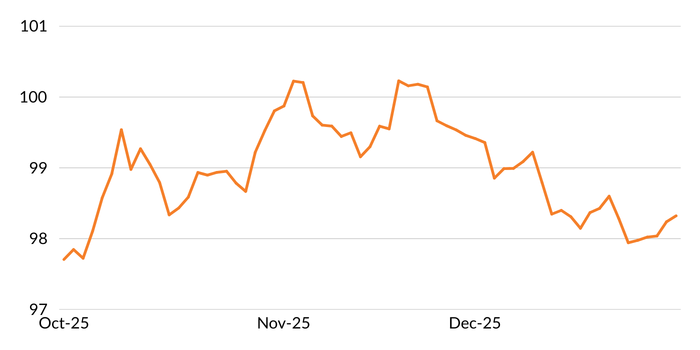

FIGURE 1: DXY – 4Q2025

The DXY rose during October and November but began to fall the last week of November and throughout all of December 2025.

Source: Bloomberg

EUR | Euro was a middling performance relative to the G10 in Q4, shaped primarily by a steady ECB policy backdrop and mixed Eurozone fundamentals. Although early-quarter political uncertainty and soft activity data weighed on sentiment, the ECB consistently reinforced an “on hold” stance, helping anchor rate expectations. In December, with inflation broadly in line with forecasts, upward revisions to growth and inflation, and a fourth consecutive rate hold at 2.0%, a less dovish tone to policy communications was apparent. Despite continued weakness in PMIs and German survey data, policy credibility helped support Euro into year-end.

GBP | Sterling landed in the lower half of the G10 in Q4, shaped by cooling inflation, a softening labor market, and a gradual shift in BoE policy. While easing price pressures and weaker employment dynamics were apparent early in the quarter, the BoE maintained a cautious stance mid-quarter, reflected in a narrow vote that signaled reluctance to ease prematurely. By December, Sterling became increasingly sensitive to domestic data with downside inflation surprises reinforcing expectations for policy easing. The BoE ultimately delivered a 25bps rate cut to 3.75% in December with a slightly tighter-than-expected 5-4 split, with subsequent weakness in retail sales validating the easing decision.

JPY | Yen was the weakest currency in G10 in Q4, weighed down by political uncertainty and a dovish policy stance. Early in the quarter, election results and ministerial appointments heightened market uncertainty. The Bank of Japan maintained a dovish stance through October and November, and although it implemented a modest 25bps rate hike in December, the Yen remained under pressure throughout the quarter due to rising global risk appetite and concerns over Japan’s economic outlook.

CAD | Canadian dollar performed well against most developed currencies in Q4. Although a rate cut, steady unemployment, and halted US trade negotiations occurred early in the quarter, higher-than-expected inflation supported tightening expectations. In November, lower unemployment, strong GDP print, and slightly higher CPI data bolstered the currency. In December, the CAD continued to perform well amid an improving labor market while the BoC left rates unchanged, noting more muted hiring intentions in the future.

AUD | Australian dollar landed in the upper half of the G10 over the quarter despite fluctuations throughout the quarter. Early in the quarter, lower consumer confidence and labor market tightness were offset by optimism around global trade and a subsequent rally in risky assets in Asia following a de-escalation of US-China trade tensions. While easing wage growth weighed on AUD mid-quarter, hawkish communication from the RBA in December supported the currency, even in the context of lower employment figures.

CHF | Swiss franc landed in the upper half of the G10 over the quarter, despite fluctuations. Starting strong in October, CHF was supported by robust exports and a stable labor market, despite low inflation. In November, the franc underperformed most G10 peers as inflation fell below expectations despite successful tariff negotiations with the US. By December, the SNB held rates steady at 0% with November CPI at the bottom of its target range, while signaling optimism for future inflation and maintaining an expansionary currency stance.

EM | Emerging Market currencies, proxied through the MSCI Emerging Markets Currency Index, appreciated 0.52% over the quarter as EM equities continued to climb into year-end, and Fed rate cuts helped support higher carry EM currencies. Regionally, the PBOC continued to guide USDCNY fixings lower over the quarter as talks between Trump and Xi focused on more trade cooperation, as Yuan gained against US Dollar.

TABLE 1: USD-BASED AS OF December 31, 2025

| FX Rate | Change 3M % | Change 1Y% | ||

| EUR-USD | 1.17445 | -0.05% | 13.42% | |

| GBP-USD | 1.34505 | 0.09% | 7.40% | |

| USD-JPY | 156.745 | -5.78% | 0.26% | |

| AUD-USD | 0.66685 | 0.62% | 7.70% | |

| USD-CAD | 1.37075 | 1.51% | 4.92% | |

| USD-CHF | 0.79225 | 0.43% | 14.39% | |

| Source: WM/Reuters | ||||

Currency for return

Currency Alpha

Mesirow Currency’s Extended Markets Currency Alpha, Asian Markets Currency Alpha, Emerging Markets Currency Alpha and Systematic Macro strategy all made gains this quarter.

Our Machine Learning suite of technical models performed the best in 4Q2025, delivering notable gains in all three alpha strategies, while our Reverting Trend model sustained the greatest losses.

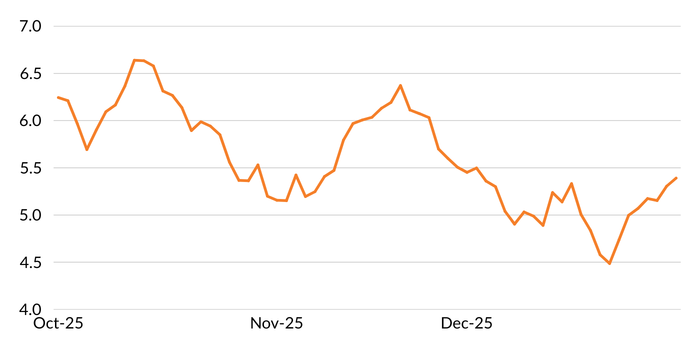

FIGURE 2: MCM'S GLOBAL VOLATILITY INDICATOR:1 4Q2025 | October – December 31, 2025

Figure 2 shows a line chart of MCM's Global Volatility Indicator for 4Q2025.

Source: Mesirow

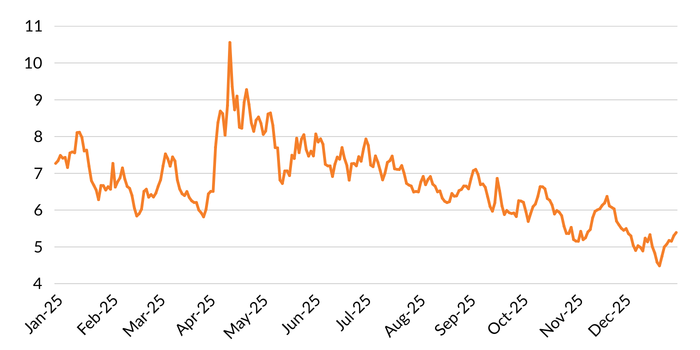

FIGURE 3: MCM'S GLOBAL VOLATILITY INDICATOR:2 1-yr | January – December 31, 2025

Figure 3 shows a line chart of MCM's Global Volatility Indicator.

Source: Mesirow

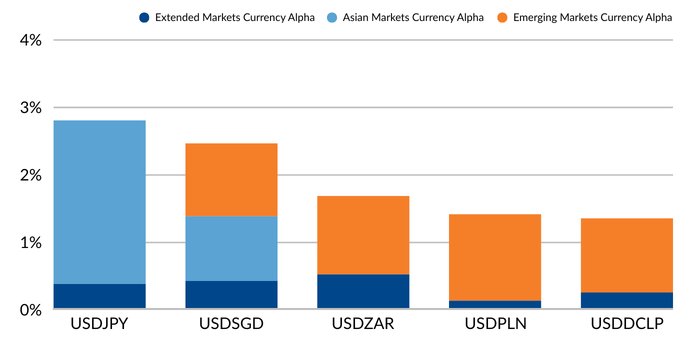

The alpha strategy’s best performers were our short US dollar positions against the Singapore dollar, the South African rand, the Colombian peso, and our long US dollar position against the Japanese yen, which was the weakest G10 currency in the fourth quarter (Figure 4).

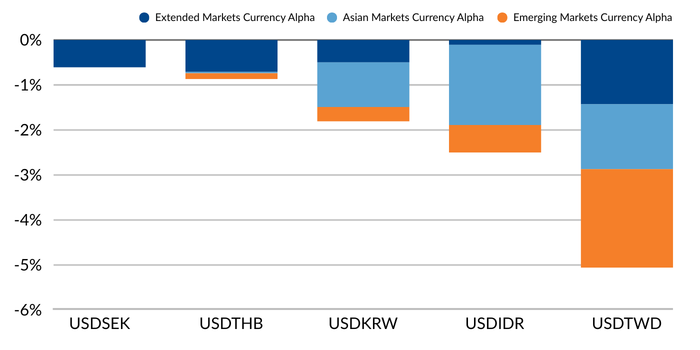

Our short US dollar positions against the South Korean won, the Indonesian Rupiah, and the Taiwan dollar were our worst performers this quarter (Figure 5).

FIGURE 4: TOP 5 PERFORMERS: October – December 31, 2025

Figure 4 shows the top five performing currency pairs for 4Q2025: USDJPY, USDSGD, USDZAR, USDPLN, USDCLP.

FIGURE 5: BOTTOM 5 PERFORMERS: October – December 31, 2025

Figure 5 shows the five worst performing currency pairs for 4Q2025: USDSEK, USDTHB, USDKRW, USDIDR, USDTWD.

Intelligent Multi-Strategy Currency Factor

Mesirow Currency’s Intelligent Currency Factor strategy gave back -0.58% (gross) over the fourth quarter as the US dollar oscillated between periods of pronounced strength and subsequent weakness. Carry continued to add value to the portfolio, benefiting from positioning against low-interest-rate currencies, with both the yen and Swiss franc tilts contributing positively towards this factor. However, Value was the primary detractor over the quarter, with Momentum also weighing on performance. While Swiss franc positioning added meaningfully, those in Sterling, Yen, and Euro detracted overall, resulting in net underperformance for the quarter.

Latest MCM Viewpoints

- The Quiet engine of global risk: How carry trades shape and shake markets.

- The new currency wars: Soros, stablecoins, and what yesterday’s currency crisis reveals about tomorrow's digital collapse.

Contact us

To learn more about Mesirow Currency Management’s custom currency solutions, please contact Joe Hoffman, CEO Currency Management at joseph.hoffman@mesirow.com.

Explore currency solutions

Passive and Dynamic Risk Management

Customized solutions to manage unrewarded currency risk in international portfolios.

Currency for Return

Strategies that aim to profit from short and medium-term moves in the currency market.

Fiduciary FX

Trading solution for asset managers and owners with focus on reducing transaction costs, improving transparency and enhancing efficiency.

1., 2. The GVI is an internal proprietary model utilizing one month at-the-money (ATM) volatility for G10 currencies, including crosses plus BIS liquidity report weightings.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters