Insights

Some currencies grabbed headlines last year – for all the wrong reasons

Share this article

In 2023 CBDCs struggled to find their raison d’être. Other currencies floundered too.

In 2023, Mesirow Currency reported on efforts to diminish the importance of the US dollar in international transactions and to reduce its position as the dominant central bank reserve currency. We also described the decline of three currencies – the Turkish lira, Argentine peso and Russian ruble – and the spread of central bank digital currencies. Early in the new year, what is the status of those currencies?

US dollar as reserve currency is still king

MCM Insight: Nothing lasts forever. Is the US dollar an exception?

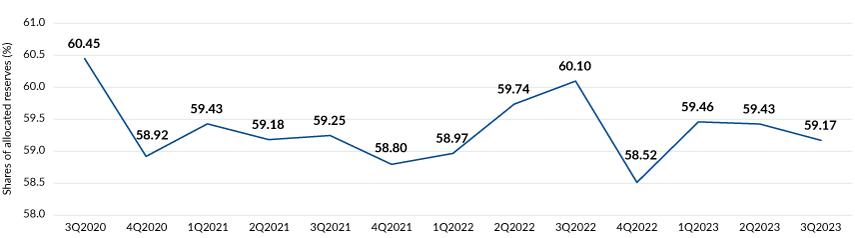

The US dollar, widely held by central banks for international investments, transactions and debt repayment, is on many nations’ most wanted list. Desperate to use anything but the dollar, some nations have met significant difficulty avoiding the US currency. In 3Q2022, the dollar made up 60.10% of central banks’ FX reserves. In 3Q2023 (the most recent data), the dollar formed 59.17% of reserves.

WORLD CURRENCY COMPOSITION, SHARES OF ALLOCATED RESERVES – US DOLLARS (%)

| 3Q2022 | Update 3Q2023 |

| 60.10% | 59.17% |

Line chart of world currency composition, percent of USD shares of allocated reserves. The chart shows a 3-year lookback. In the third quarter of 2020 the US dollar accounted for 60.45% of the world's currency reserves. In the third quarter of 2023 the US dollar accounted for 59.17% of the world's currency reserves.

Source: International Monetary Fund, imf.org

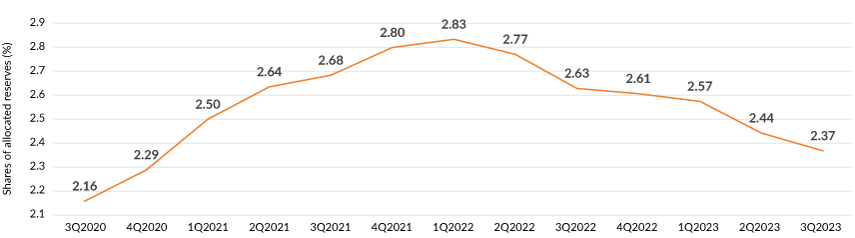

The Chinese nation, perhaps the most eager country to promote its currency, the renminbi, has seen an overall increase in the past three years in renminbi reserve holdings. Those holdings, however, slightly declined in the past year from 2.63% in 2022 to 2.37% in 2023.

WORLD CURRENCY COMPOSITION, SHARES OF ALLOCATED RESERVES – CHINESE RENMINBI (%)

| 3Q2022 | Update 3Q2023 |

| 2.63% | 2.37% |

Line chart of world currency composition, percent of Chinese renminbi shares of allocated reserves. The chart shows a 3-year lookback. In the third quarter of 2020 China's renminbi accounted for 2.16% of the world's currency reserves. In the third quarter of 2023 China's renminbi accounted for 2.37% of the world's currency reserves.

Source: International Monetary Fund, imf.org

Central bank digital currencies inch their way forward

MCM Insight: What do CBDCs mean for the US dollar?

Central bank digital currencies

| 2Q2023 | Update 1Q2024 |

| Struggling | Slight improvement |

Wars are sometimes fought on many fronts, so while the Chinese and others battle to dislodge the dollar from its reserve currency perch, there are other skirmishes to contest. Central bank digital currencies (CBDCs), a digital form of a nation’s currency issued by that country’s central bank, is one battleground that we wrote about in May 2023.

The e-CNY, the symbol for China’s central bank digital currency, gained considerable traction in 2023, with cumulative transactions reaching $250 billion by June 2023, a sharp increase from $13.9 billion reported in August 2022. Other CBDCs didn’t fare as well. Use of the eNaira, Nigeria’s CBDC, has been slow, according to the International Monetary Fund. The IMF also reported lackluster news about the sand dollar, The Bahamas’ central bank digital currency: Issued in October 2020, Bahamians continue to use more familiar payment methods instead of the digital currency.

One quasi-CBDC (quasi because the digital currency is a liability of commercial banks, not a liability of the central bank), the Cambodian bakong, introduced in October 2020, struggled at first. That changed when the Bakong quick response code reader was able to communicate with other private code-reading payment systems. In a year, bakong participants jumped from 1.5 million wallet-holders to 8.5 million at the end of 2022.

CBDCS

CBDC logos. China's e-CNY logo. Nigeria's eNaira logo. Bahamas sand dollar logo. Cambodia's bakong logo.

BRICS takes aim at the US dollar but misfires

MCM Insight: USD and the BRICS threat

Creation of BRICS* gold backed currency

| 3Q2023 | Update 1Q2024 |

| Plans announced | No official progress |

*BRICS – Brazil, Russia, India, China and South Africa

In July 2023, Russia leaked news about intentions to issue a gold-backed currency for BRICS countries – originally Brazil, Russia, India, China and South Africa but now including Egypt, Ethiopia, Saudia Arabia, Iran and the United Arab Emirates (Argentina was intending to join but its new president said it would not).

The group’s August 2023 summit had been the hoped-for setting for a joint official announcement about the currency, but the item was left off the summit agenda. Since the summit, social media reports many claims of pending announcements for the new currency, but mainstream media outlets have been quiet. That silence is not surprising.

Using another currency other than the dollar has been a BRICS policy priority for over ten years. But global commerce is still mostly dollar-denominated, and the obstacles to a common currency among the disparate BRICS economies are formidable. Despite the fervent hopes of anti-dollar advocates, the world will continue to use the dollar in trade and investments.

Poor currency performers: Lira, peso and ruble

MCM Insights: Turkey’s currency crisis, Peso today, dollar tomorrow? An armed war and a currency battle

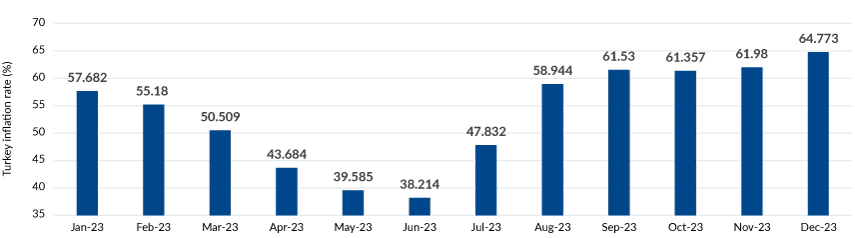

In late June 2023, one could exchange 24.9 Turkish lira for 1 US dollar. In late January 2024, the dollar strengthened (the lira weakened) to more than 30 lira per dollar. The lira was victim to Turkey’s decision to raise the minimum wage 49 percent from the July 2023 level (a 100 percent increase from the January 2023 level) in time for March 2024 municipal elections. Not surprisingly, Turkey has been beset by inflation levels that reached 64.8 percent in December 2023, contributing to the decline in the currency. Currency stability wasn't helped by the appointment of a new central bank governor on February 2nd, Turkey's sixth governor in five years.

TURKEY INFLATION RATE (%): JANUARY 2023 – DECEMBER 2023

Bar chart of Turkey's inflation rate January 2023 - December 2023. The chart shows the inflation rate is 64.773% in December 2023.

Source: tradingeconomics.com, Turkish Statistical Institute

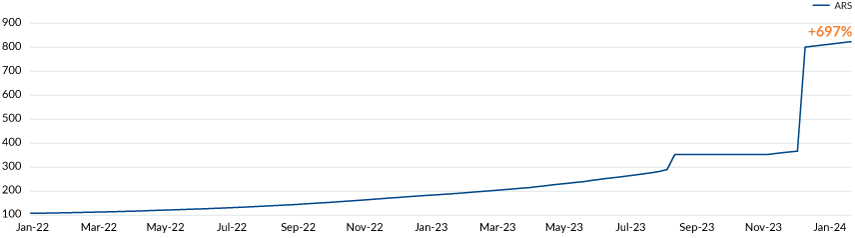

The Argentine peso was another 2023 poor performer. The South American country has been beset with financial problems including inflation of over 200 percent, government debt level of 85 percent of gross domestic product, and an out-of-control peso-printing central bank. The economic troubles are reflected in the nation’s currency exchange rate. The US dollar was worth about 350 pesos at the official rate in November 2023; the rate moved to over 800 pesos (strong dollar, weak peso) in late January 2024. Argentinians who buy dollars on the black market, which mirrors realistic supply and demand conditions compared to the official rate, must pay about 1,100 pesos for one dollar.

US DOLLAR ARGENTINEAN PESO: JANUARY 7, 2022 – JANUARY 26, 2024

Line chart of the exchange rate of the US dollar vs. the Argentinean peso from January 7, 2022 - January 26, 2024. The line shows a steep incline. The value of the Argentinean peso has dropped significantly.

Source: Bloomberg

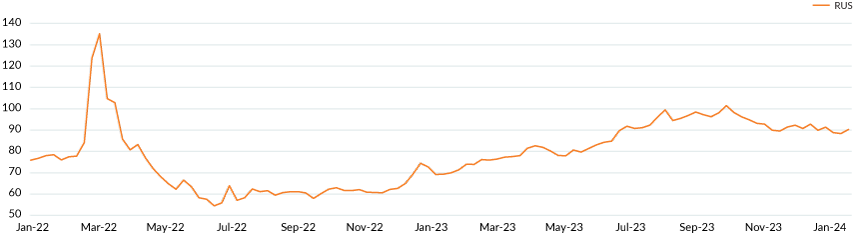

The Russian currency stumbled badly during the year, falling to over 100 rubles to the dollar before recovering to about 89 rubles in late January 2024. That recovery was due to an increase in interest rates to 16% to combat inflation resulting from a shortage of workers (off to fight in or run away from the Ukraine war) and elevated levels of lending. The currency is also supported by capital controls: Large exporters must convert foreign currency earnings to rubles, helping to support the Russian currency.

US DOLLAR RUSSIAN RUBLE: JANUARY 7, 2022 – JANUARY 26, 2024

Line chart of the exchange rate of the US dollar vs. the Russian ruble from January 7, 2022 - January 26, 2024.

Source: Bloomberg

Some of these currencies may make remarkable turnarounds and become news stories in 2024, but odds are they won’t.

If we remember the 2023 currency events at all, they’ll be for the wrong reasons.

Explore

Cryptocurrencies and Tokenization

Distributed ledger technology fosters digitization of just about everything.

Futures overlays for investors

Hedge Share Class Investors Grapple with Shorter (T+1) Security Settlement Cycle.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters