I want my money to work for me: The power of long-term investing

Share this article

by Tiffany Irving, Senior Vice President, Wealth Advisor

I had coffee recently with a friend of mine, an attorney, who has a large base of female clientele. Our topic of discussion was centered around money, finances, investing and finding a way to help our clients get engaged in similar dialogue to ensure their own financial security both now and in the future. Inevitably these conversations lead to us asking and wondering why women, who make up over 50% of the population and who make most of the consumer spending decisions in their households, do not more frequently participate in long-term planning and investment conversations? As we sipped our lattes and solved 90% of the world’s problems, one frequent answer to our question emerged—not everyone is a finance major or is even remotely interested in money and investing. While this is completely understandable (one of my daughters finds her passion in the arts, not in finance or mathematics) I want women to know that their money can work for them and help them achieve both short-term (i.e., planning a vacation) and long-term (i.e., retiring by a certain age) financial goals.

So, how do you make your money work for you?

Most of us begin to better understand money and finances as we start managing our own checking and savings accounts, creating our own budgets, determining how much of our income we can set aside in savings. We learn that we can earn some interest in our savings accounts (albeit not much as we’ve been in a very low interest rate environment over the last several years). But then what? Invest. Ok, but how, where, when? There are a multitude of account types (i.e., individual, joint, retirement, etc.) and investment strategies (stocks, mutual funds, ETF’s, bonds, real estate, etc.) for investing which your wealth advisor can help with, but one investment concept that is important to understand as you get started is how investing your money can work for you.

The power of compounding returns

The power of long-term investing lies in the potential for compounding returns. Compounding is when the value of your original investment produces earnings and those earnings are then reinvested and have the potential to grow along with your original investment, and so on and so on each year.

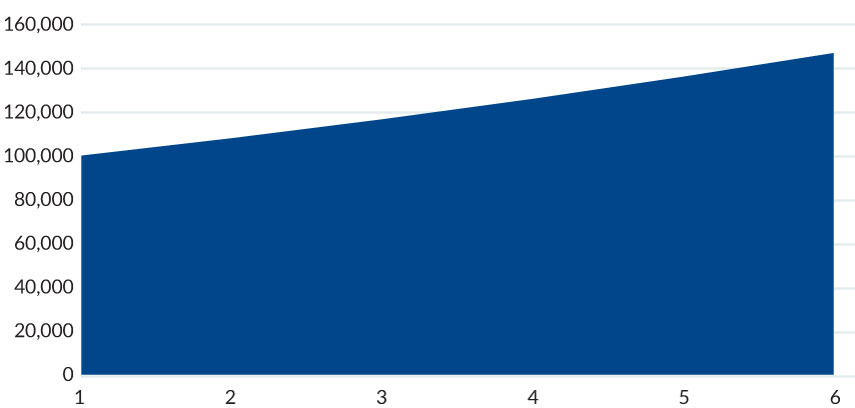

As an example, say you have $100,000 to invest and you earn a hypothetical 8% annual compound return (not accounting for taxes, fees, etc.):

Original Investment: $100,000

Year 1: $100,000 + ($100,000*8%) = $108,000; $8,000 in earnings get reinvested

Year 2: $108,000 + ($108,000*8%) = $116,640; $8,640 in earnings get reinvested

Year 3: $116,640 + ($116,640*8%) = $125,971; $9,331 in earnings get reinvested

Year 4: $125,971 + ($125,971*8%) = $136,049; $10,078 in earnings get reinvested

Year 5: $136,046 + ($136,046*8%) = $146,933; $10,884 in earnings get reinvested

Hypothetical illustration: The power of compound return

Assumptions: Hypothetical 8% annual compound return. This hypothetical rate is purely for illustration purposes.

In the example above, at the end of year 5 your $100,000 investment could now be worth $146,933. Investment returns are not guaranteed and may go up or down in any given year. Yes, down, so you need to understand the risk associated with any investment decision you make. Although investment returns are not guaranteed and they won’t be steady year over year, they can be powerful over time. According to an historical returns’ analysis at NYU, $100 invested in the S&P 500 at the start of 1928 would be worth $592,868.15 at the end of 2020.¹ We don’t all have 90+ years for our investments to grow, but the fact is the longer you let your money compound the greater your chances of success for positive returns. The power of compounding can be significant which is why investors look to the markets to help them build, grow, and preserve their wealth over time. Do you want your money to work for you? The earlier you can start your investing journey the better. The longer your time horizon the more opportunity you have for your wealth to grow and for you to experience the benefits and power of long-term investing.

Published January 2022

Connect with an advisor

Mesirow does not provide legal or tax advice. Past performance is not indicative of future results. The views expressed above are as of the date given, may change as market or other conditions change, and may differ from views express by other Mesirow associates. This is not a solicitation to buy or sell the securities mentioned. Do not use this information as the sole basis for investment decisions, it is not intended as advice designed to meet the particular needs of an individual investor. Information herein has been obtained from sources which Mesirow believes to be reliable, we do not guarantee its accuracy and such information may be incomplete and/or condensed. All opinions and estimates included herein are subject to change without notice. This communication may contain privileged and/or confidential information. It is intended solely for the use of the addressee. If you are not the intended recipient, you are strictly prohibited from disclosing, copying, distributing or using any of the information. If you receive this communication in error, please contact the sender immediately and destroy the material in its entirety, whether electronic or hard copy. This material is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.

Mesirow refers to Mesirow Financial Holdings, Inc. and its divisions, subsidiaries and affiliates. The Mesirow name and logo are registered service marks of Mesirow Financial Holdings, Inc. ©2024, Mesirow Financial Holdings, Inc. All rights reserved. Any opinions expressed are subject to change without notice. Past performance is not indicative of future results. Advisory Fees are described in Mesirow Financial Investment Management, Inc.’s Form ADV Part 2A. Advisory services offered through Mesirow Financial Investment Management, Inc. an SEC registered investment advisor. Securities offered by Mesirow Financial, Inc. member FINRA and SIPC.